Notice to the reader: That is the twenty-first in a sequence of articles I am publishing right here taken from my guide, “Investing with the Pattern.” Hopefully, you’ll discover this content material helpful. Market myths are typically perpetuated by repetition, deceptive symbolic connections, and the whole ignorance of details. The world of finance is filled with such tendencies, and right here, you will see some examples. Please remember the fact that not all of those examples are completely deceptive — they’re generally legitimate — however have too many holes in them to be worthwhile as funding ideas. And never all are straight associated to investing and finance. Get pleasure from! – Greg

Pullback Rally Evaluation

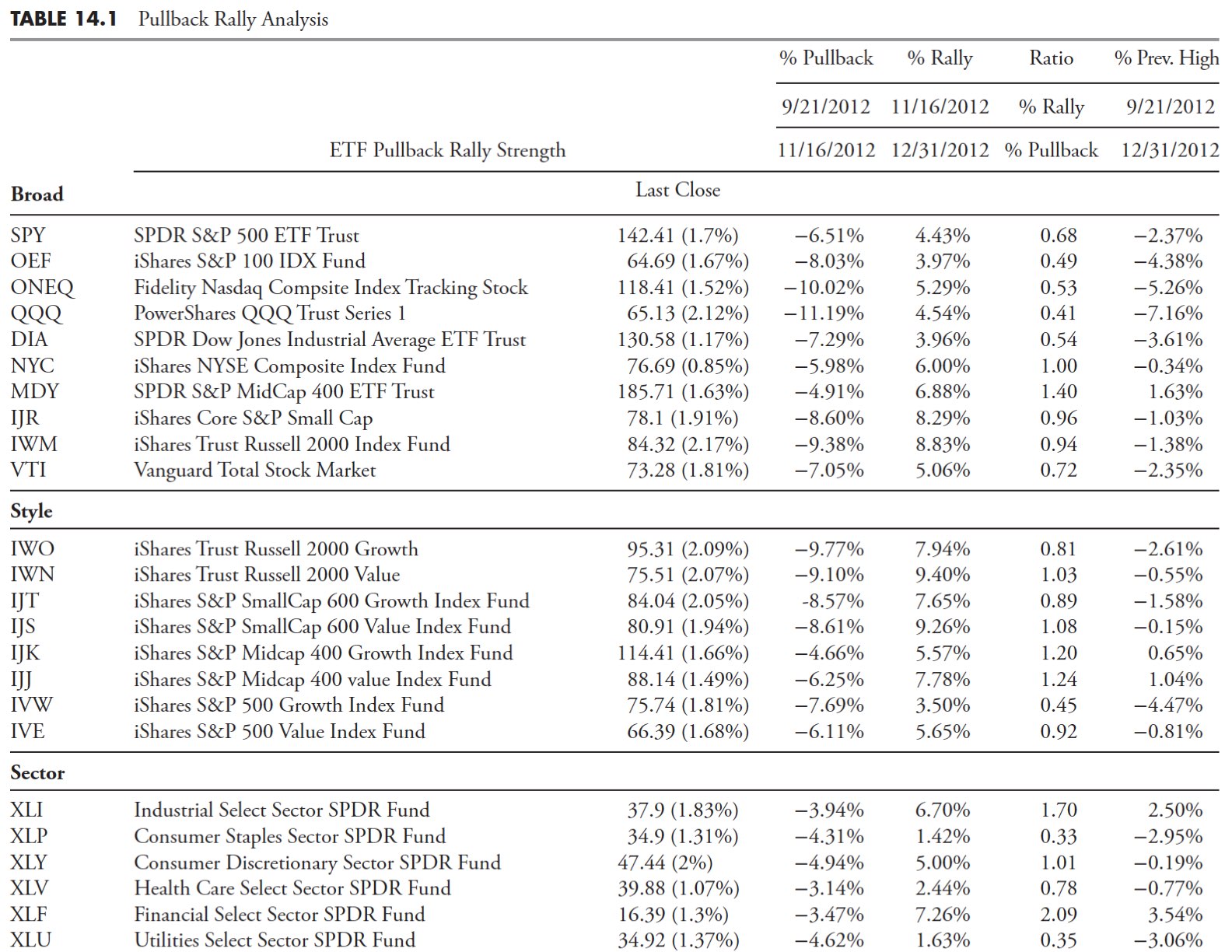

The Pullback Rally Evaluation is just not a rating measure, however a method for figuring out the relative power of points by taking a look at the latest rally from a earlier pullback. To summarize, in pullback rally evaluation, you measure the quantity of the pullback in p.c, then measure the present rally as much as the present date in p.c. The idea is pretty easy; these points that dropped the least within the pullback, will in all probability outperform within the following rally.

This idea measures the share transfer throughout the pullback, the share to this point of the present rally, and the share to this point from the start of the pullback. It is a nice methodology to see power outdoors of the snapshot of the rating measures. Determine 14.23 reveals an instance on the best way to decide the dates for the start and finish of the pullback. From the chart, you’ll be able to see a peak at level A with a pullback all the way down to level B. The rally is then measured from level B to the present date.

A ratio of the share transfer of the present rally to the share transfer of the earlier pullback is calculated. One other calculation is proportion the present value is from the start of the pullback (earlier excessive). This information, when ranked, will provide help to decide power within the rally as in comparison with the earlier pullback. Usually the stronger points in a pullback are the leaders throughout the rally.

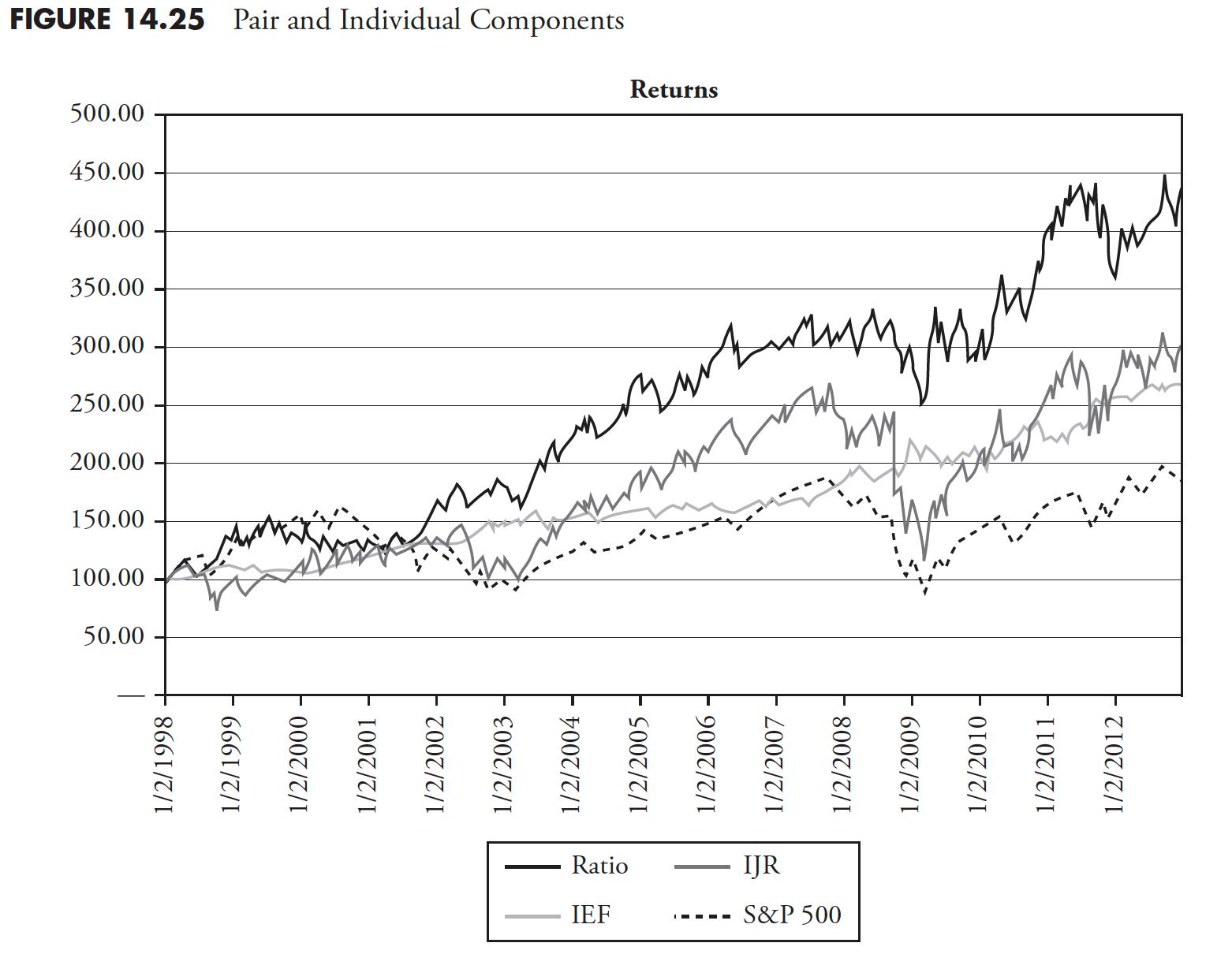

Desk 14.1 reveals the info for the Pullback Rally Evaluation. You’ll be able to see from even a fast look at Desk 14.1 that the worldwide ETFs are outperforming, not solely within the rally section (% Rally), but in addition how virtually all are actually above the place the earlier excessive (starting of pullback) started (% Prev. Excessive). The iShares FTSE China 25 Index Fund additionally carried out effectively throughout the pullback section, with the one worldwide ETF displaying a achieve for that interval of two.95%, whereas the others had been losses. The Ratio column reveals the ratio of the p.c of rally in comparison with the p.c of pullback. The pullback is accomplished, so solely the extent of the rally is unknown.

This ratio will present ETFs that carried out in a few methods. One is that, if the ETF didn’t decline a lot throughout the pullback and rises shortly within the rally, it would have a big ratio. For instance, within the Broad class, the SPDR S&P MidCap 400 ETF Belief (MDY) has a ratio of 1.40, highest in that class. It’s because it was the perfect performer (least decline) within the pullback section and ranked third in efficiency within the rally section. This may point out that MDY is a powerful performer and a candidate to contemplate for purchasing. The final column, % Earlier Excessive, may even present you which ones ETFs are making new highs from the start of the pullback. This methodology of choice reveals which points are sturdy on a relative foundation. In reality, it would additionally inform you which sectors and kinds are strongest in case you use ETFs which are tied to these methods.

Pair Evaluation

I bear in mind following Martin Zweig years in the past, and actually used one of many strategies he described in his guide, Successful on Wall Road, within the mid-Eighties. In it, he described a very easy method utilizing his unweighted index (ZUPI) and on a weekly foundation buying and selling it each time it moved 4% or extra. If it moved up 4% in per week, he purchased; if it moved down 4% in a single week, he offered. Positions had been held till the subsequent opposing sign—simply that straightforward. The issue I had again then was not solely not following it, however making an attempt to tweak it into one thing higher. Ultimately expertise instructed me that he had already been down that street and I used to be the beneficiary of the outcomes.

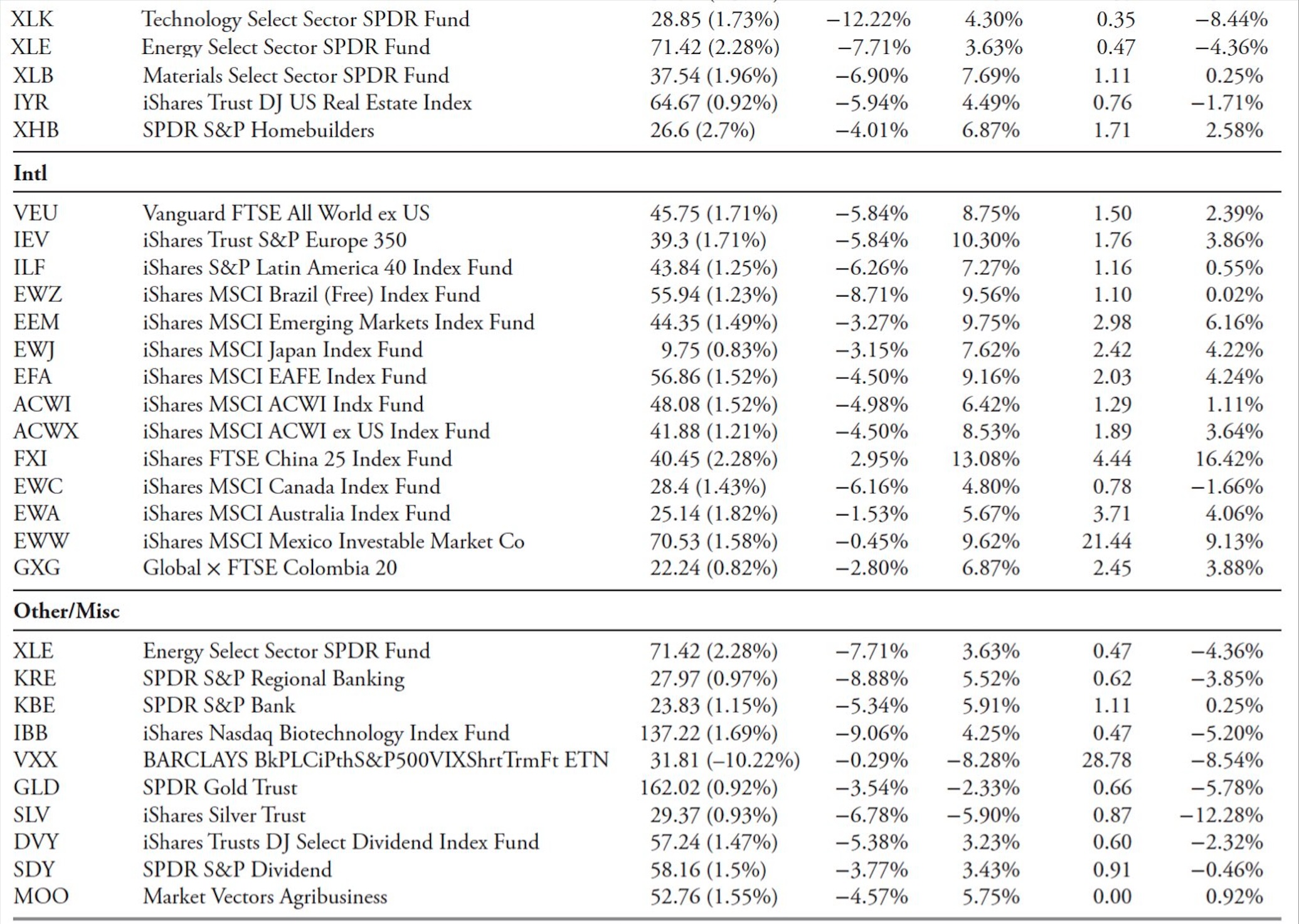

Anyway, I took this idea and used it on Index/ETF pairs, really calculating the ratio of Index/ETF pairs and utilizing the weekly motion of 4% to swap between the numerator and the denominator. It actually works effectively with asset lessons that aren’t correlated, corresponding to fairness vs. fastened earnings or fairness vs. gold, and so forth. Determine 14.24 reveals an instance of this pair technique the S&P 600 small cap index (IJR) vs. the BarCap 7-10 12 months Treasury index (IEF). The ratio line is the standard value line, with the binary sign line overlaid whereas the decrease plot is the p.c up and down strikes for every weekly information level. Bear in mind, it is a weekly chart. At any time when the ratio line strikes by 4% in per week, as proven by the decrease plot shifting above or under the horizontal strains proven as +4% and -4%, the binary line overlaid on the worth ratio adjustments course. Repeated strikes in the identical course are ignored.

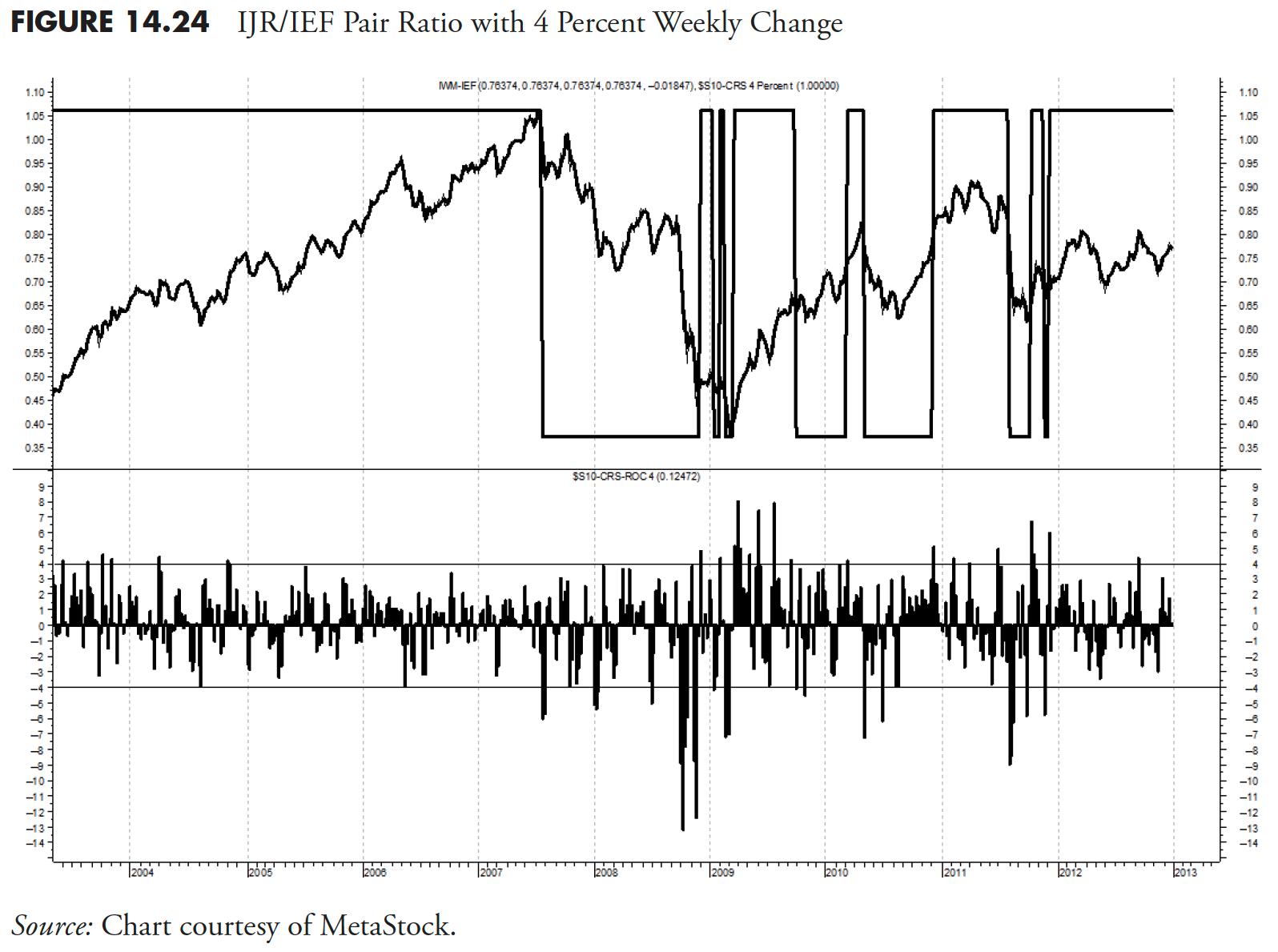

The ratio considerably outperformed every of the person parts (IJR and IEF) and the S&P 500. Determine 14.25 reveals the efficiency of the ratio (with the numerator and denominator swapped each time there was a transfer of 4% or larger), the efficiency of the person parts that make up the ratio, and the S&P 500.

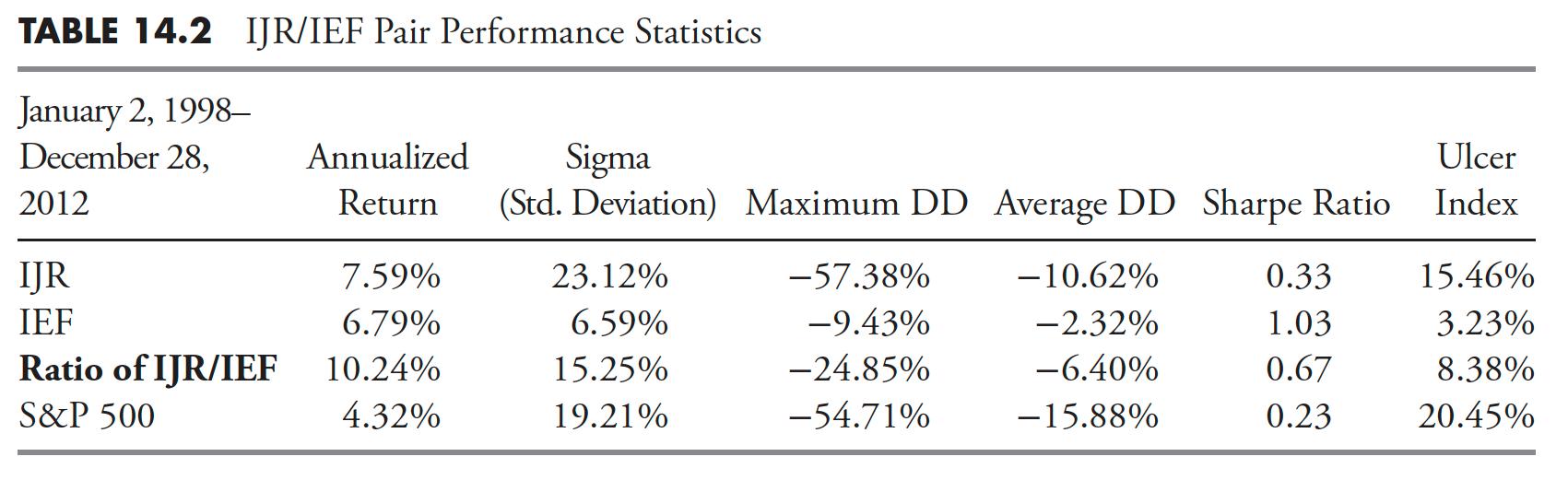

Desk 14.2 reveals the annualized efficiency statistics from 01/02/1998 till 12/28/2012 (weekly information). The Sharpe Ratio is barely modified, in that the return is used because the numerator with no discount for risk-free return. The Ratio rotation technique outperformed in annualized return, and, when in comparison with the fairness element, it lowered the Drawdown (DD) significantly, improved the Sharpe Ratio, and lowered the Ulcer Index.

I additionally discovered that smoothing the ratio with only a two-period shifting common tremendously enhanced the efficiency as a result of it lowered the variety of trades. Attempting totally different percentages aside from Zweig’s 4% labored effectively often, however, total, the 4% on weekly information yielded probably the most strong outcomes time and time once more.

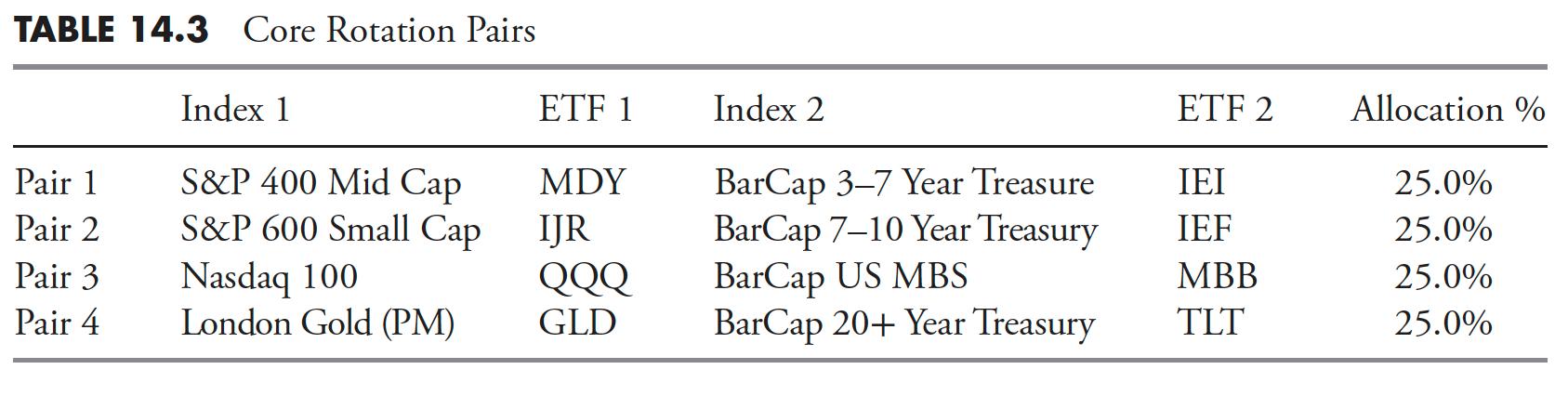

The true benefit for a pair rotation technique is when it’s used as a core holding scenario. In different phrases, if a method required a core holding proportion however that core may very well be actively managed, this is able to give an actively managed core holding that might have a lot decrease drawdowns than a buy-and-hold core, and with significantly higher returns. Desk 14.3 reveals the pairs used with an equal allocation of 25% every given to the 4 pairs. This provides as much as an allocation of 100%, however, on this instance, it means 100% of the core and the core proportion of complete allocation is set by the technique, typically 50%.

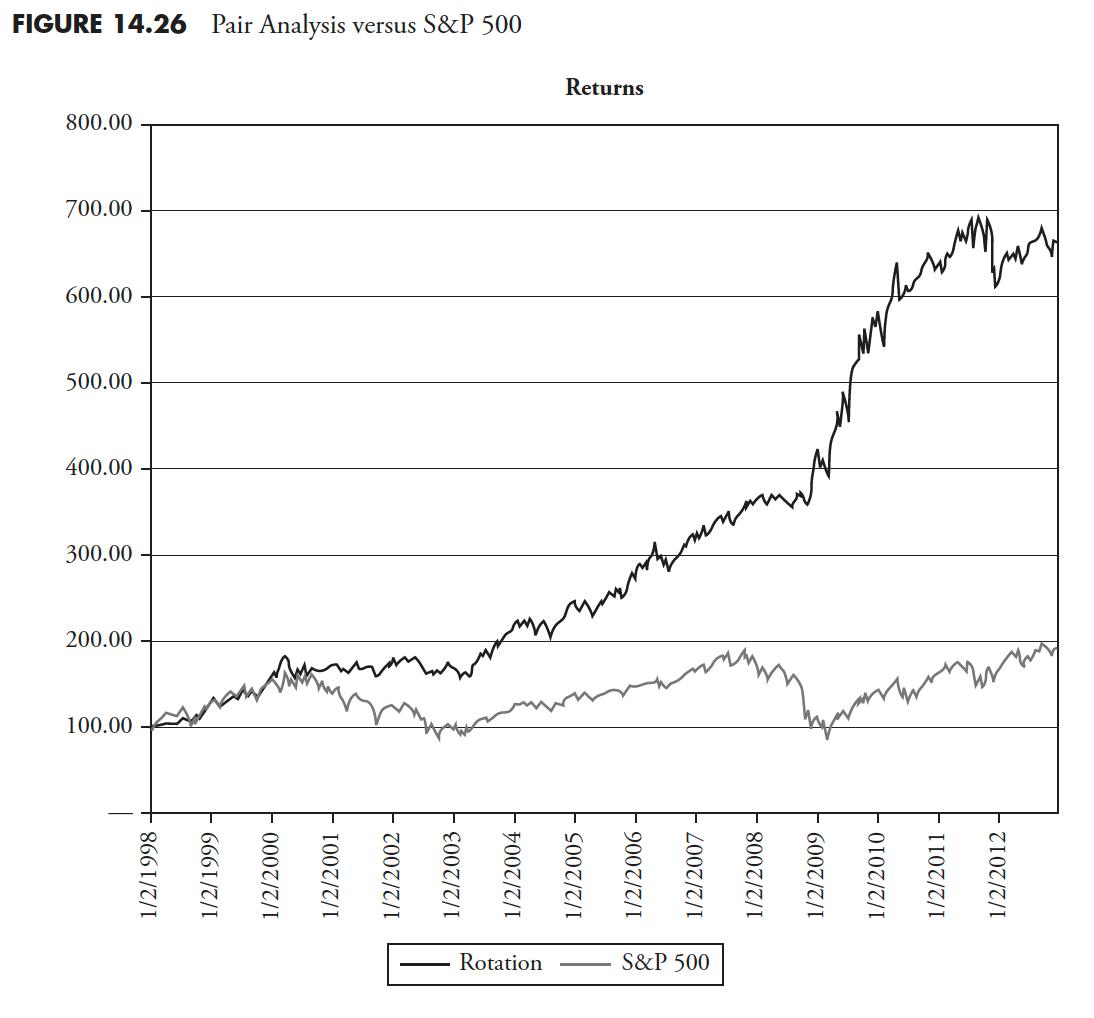

Determine 14.26 reveals the outcomes utilizing the 4 totally different pairs in a core rotation technique in comparison with buy-and-hold of the S&P 500. The drawdown in 2008 was restricted to solely 14%, and aside from that was a pleasant experience. The common drawdown (see Desk 14.4) is just 20% of the utmost drawdown. I used to be curious in regards to the lack of efficiency in 2012 and located it was the truth that within the Gold/20-12 months Treasury pair gold was the holding your entire interval.

Determine 14.26 reveals the outcomes utilizing the 4 totally different pairs in a core rotation technique in comparison with buy-and-hold of the S&P 500. The drawdown in 2008 was restricted to solely 14%, and aside from that was a pleasant experience. The common drawdown (see Desk 14.4) is just 20% of the utmost drawdown. I used to be curious in regards to the lack of efficiency in 2012 and located it was the truth that within the Gold/20-12 months Treasury pair gold was the holding your entire interval.

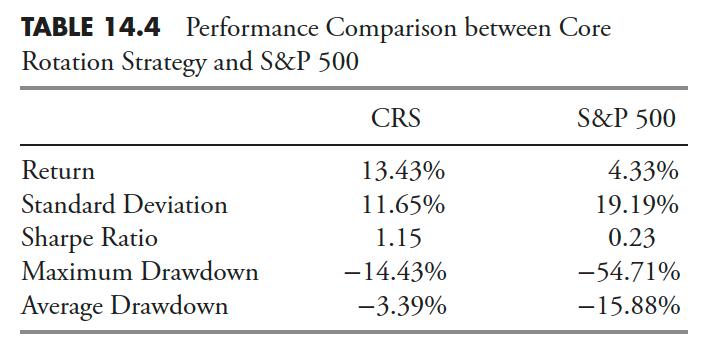

Desk 14.4 reveals the efficiency statistics for the Core Rotation Technique (CRS) in comparison with the S&P 500. On this rotation technique instance, every of the pairs had been smoothed by their two-period common previous to measuring the 4% fee of change. This course of removes most of the indicators and, whereas not affecting the outcomes that a lot, reduces the variety of trades considerably.

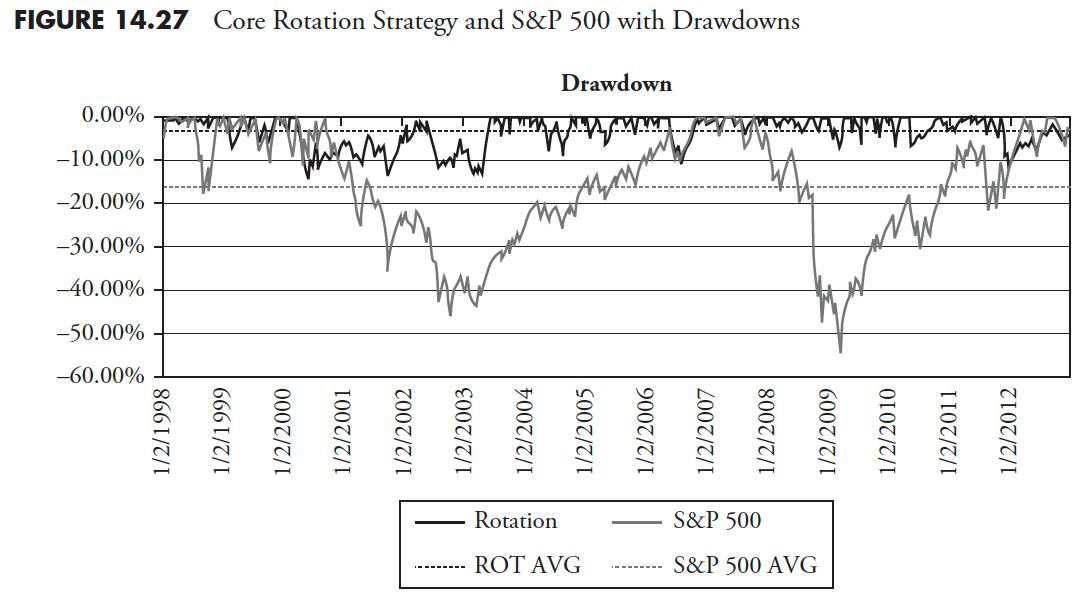

Determine 14.27 is the drawdown of the core rotation technique in comparison with the S&P 500. You’ll be able to see that the cumulative drawdown for the rotation technique is significantly lower than the drawdown of the index. The common drawdown for the rotation technique was -3.39%, whereas the common drawdown for the S&P 500 was -15.88%. This may make for a really comfy core, contemplating the distinctive returns and lowered danger statistics from simply holding the index in a buy-and-hold scenario. This core rotation technique nonetheless meets the requirement of an all the time invested core whereas actively switching between 4 pairs of fairness, gold, and glued earnings ratios.

Rating and Choice

Rating and Choice

Rating and Choice is one other crucial element to a rules-based mannequin. Upon getting measured the market, you might want to decide what to purchase. That is the technical means of figuring out securities that meet the foundations when the time to purchase arrives.

Obligatory Measures

Upon getting your assortment of rating measures, you might want to decide that are for use, together with the foundations and pointers as obligatory rating measures. Because of this you predefine the worth vary that they should be in earlier than you should purchase that ETF. That is essential to maintain the subjectivity out of the method.

Tiebreaker Measures

Upon getting decided your obligatory rating measures, the remaining rating measures are thought-about tie-breaker rating measures. These are used to assist in the choice course of, particularly when there are a whole lot of points that qualify based mostly on the obligatory measures. You’ll be able to additional cut back these into classes if desired, corresponding to frontline tie-breakers, these you employ extra typically than the others.

Rating Measures Worksheet

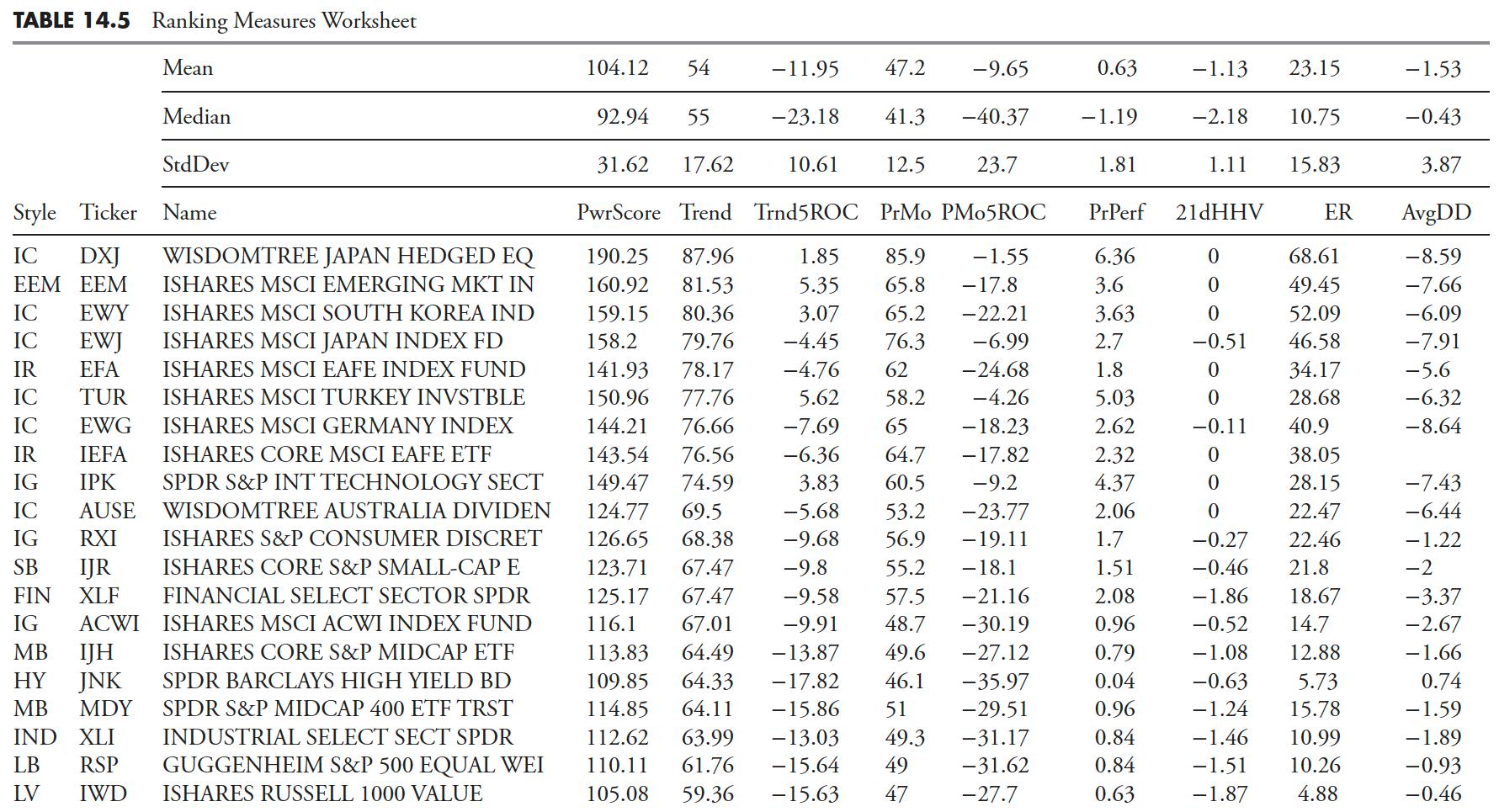

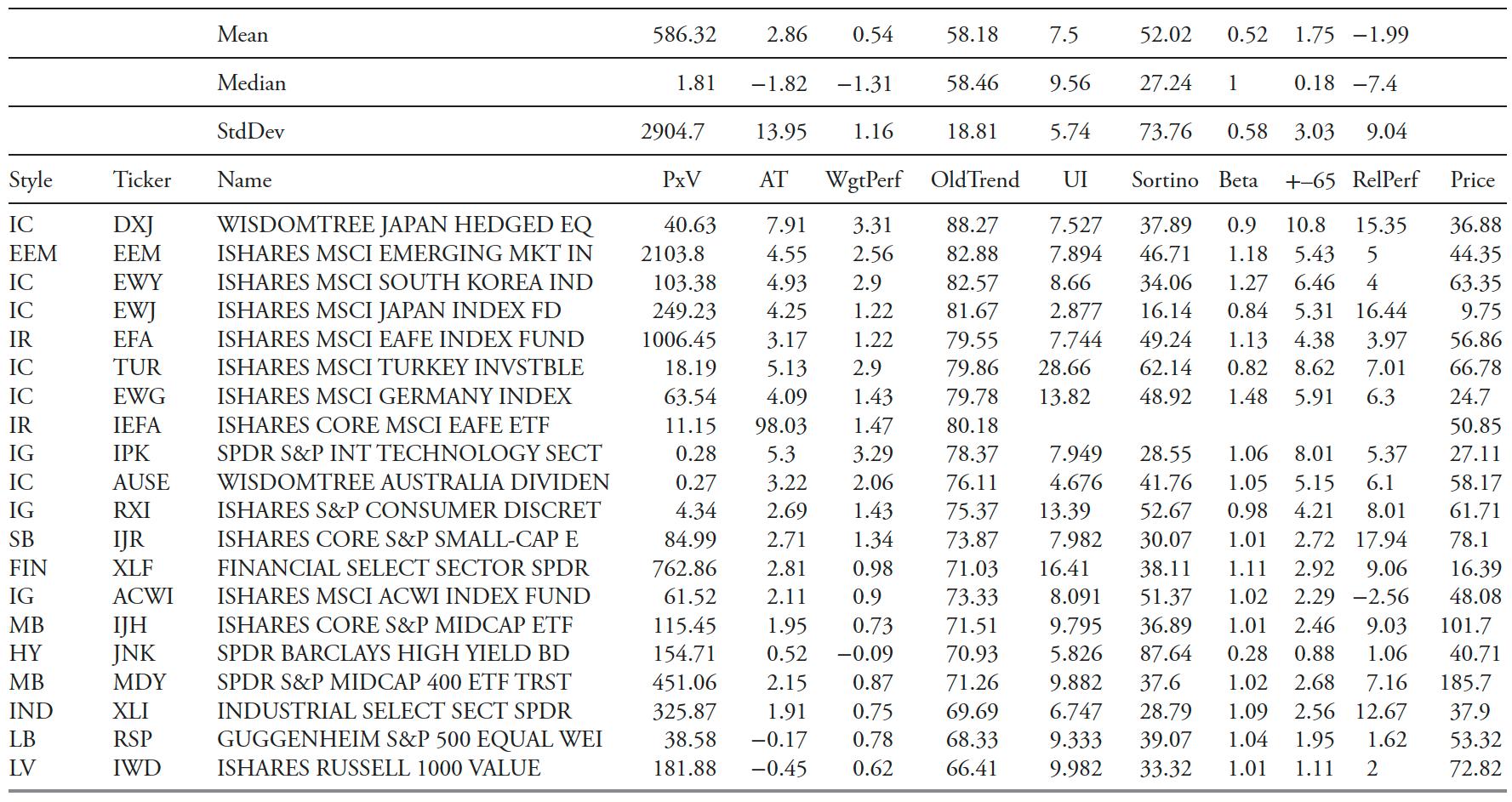

Desk 14.5 is a partial view of the rating measures worksheet. It solely reveals the highest 50 to 60 points for example, since there are greater than 1,400 ETFs within the full itemizing. One actually essential idea to understand when taking a look at technical values in a spreadsheet is that you’re solely seeing a snapshot in time. Right here is an instance: for example that the Pattern worth is of major significance and you’ve got two ETFs, one with a Pattern of 60 and one with a development of 70. Which might you select? Properly, the short reply might be 70 as that could be a stronger development measure than 60. Nevertheless, do not you additionally have to know which course the development indicator is heading? If the development that was at 60 was in an uptrend, whereas the one with the development measure at 70 was in a downtrend, a very totally different image is introduced. Because of this all the obligatory rating measures additionally present their particular person five-day fee of change, so to glean from the spreadsheet not solely absolutely the worth of the rating measure, but in addition the course it’s headed. It ought to be famous that any short-term interval for fee of change will work.

Rating Measures Are All About Momentum

All through this chapter it ought to be apparent that the rating and choice course of is centered on the idea generally known as momentum. Merely stated, I wish to purchase an ETF that reveals an upward development that’s decided by a lot of totally different technical measures.

A closing thought on momentum is that day by day, in virtually each newspaper’s enterprise part, there is a superb record of shares to purchase. It’s referred to as the 52-week new excessive record, or typically shares making new highs. In case you had been to solely use this available instrument, together with a easy stop-loss technique, you’ll in all probability do a lot better at investing available in the market. Sadly, many buyers take into consideration shopping for shares like they consider shopping for one thing at Walmart, they search for bargains. Though it is a legitimate methodology also called worth investing, it is vitally troublesome to place into motion and appears higher in principle. While you purchase a inventory, you purchase it merely since you suppose you’ll be able to promote it later at the next value, I believe momentum will work a lot better in that regard.

Guidelines and Tips

Guidelines and pointers are a crucial aspect to an excellent trend-following mannequin. Upon getting the weight-of-the-evidence measure telling you what the market is at present doing, the foundations and pointers present the mandatory course of on the best way to make investments based mostly on that measure. If there was a easy reply as to why they’re vital, it’s to invoke an goal method, one which does as a lot as doable to take away the frail human aspect within the mannequin. Guidelines are obligatory, whereas pointers usually are not. That being stated, if a suggestion is to be ignored, one wants to make sure there may be ample supporting proof to permit it. Principally, the technique I exploit is one in every of a conservative purchaser and an aggressive vendor.

After many a long time in aviation and the always-increasing use of checklists, the foundations and pointers aren’t any totally different for sustaining a nondiscretionary technique than a guidelines is for a pilot. In aviation, checklists grew in size over time as a result of as accidents or incidents occurred a guidelines merchandise was created to assist stop it sooner or later. There’s an outdated axiom about checklists that stated behind each merchandise on a guidelines, there’s a story. Identical philosophy goes for guidelines and pointers in an funding technique. A guidelines (guidelines) ensures portfolio managers comply with all procedures exactly and unfailingly. This overcomes the issue with skilled managers considering they’ll accomplish the duty and don’t want any help. That perspective is dear.

Purchase Guidelines

B1—If asset dedication requires an quantity larger than 50%, then solely 50% might be dedicated, with the rest the subsequent day, guaranteeing aims stay aligned. Forty p.c could be the utmost per day if vital for Guideline G6. This rule retains the asset purchases to a most for any single day. It will not be prudent to enter the market at 100% on in the future.

B2—No Purchase Days are (1) FOMC announcement day, (2) First/Final day of calendar quarter, (3) days during which the market has lowered hours. FOMC announcement days are sometimes high-volatility days and the tip/starting of 1 / 4 entails plenty of window dressing. Depart the noise alone.

B3—No shopping for until 50 (this can be a proportion) tradable ETFs (not counting non-correlated) have:

Weight of the Proof = Weak: Pattern>60, Intermediate: Pattern>55, Sturdy: Pattern>50

I name this the “soup on the shelf” rule. If in case you have been to a big grocery retailer these days and strolled down the aisle that has soup, you in all probability observed there are millions of cans of soup with a whole lot of blends, kinds, and so forth to select from. Now think about your partner has despatched you to the shop to purchase soup. While you flip down the soup aisle, you discover they’re basically empty besides for 2 cans of rhubarb turnip barley in cream sauce. You in all probability aren’t going to purchase any soup that day. The market is analogous, particularly throughout the early phases of an uptrend, there simply is not a lot to select from. As well as, the early phases have stricter shopping for necessities, so the variety of points to choose from may very well be very small, if any. Since you by no means violate the foundations, a rule to guard you throughout this era was created, therefore rule B3.

B4—No shopping for on days when stops on present holdings are hit and belongings offered. That is normally the primary trace that the following uptrend is faltering. It simply does not make sense as a development follower to be shopping for on the identical day as you’re promoting one thing that has hit its cease. The argument that one holding won’t be correlated is weak on this instance, as, with correct buying and selling up, weak holdings ought to have been beforehand traded.

B5—No shopping for on days when the Nasdaq or S&P 500 is down larger than 1.0% (the indices used have to be tied you what you’re utilizing within the development measures). Merely put, which means that if the market as decided by the S&P 500 and/or Nasdaq Composite is down greater than 1% throughout the day, one thing is improper with the uptrend and it’s higher to not purchase that day. An argument from discount hunters or worth buyers could be that one would get a greater value on that day if the uptrend resumed. I am unable to argue with that, however I ‘m not a worth investor or a discount hunter. It appears many buyers wish to purchase shares at discount costs and I can perceive that. Nevertheless, we aren’t shopping for cleaning soap at a reduction retailer; we’re shopping for a tradable funding car whose value is set by patrons and sellers. Furthermore, you solely wish to purchase what goes up.

Promote Guidelines

S1—If stops are hit with Finish of Day information and nonetheless in place at half-hour (this time interval relies solely in your consolation stage) after the open the subsequent day, a promote is initiated; if not in place on the 30-minute level, the problem falls underneath intraday monitoring (see S2).

S2—Intraday monitoring of Worth and Pattern (between the hours of half-hour after the open till 60 minutes earlier than the shut) will invoke a Promote order despatched to brokers for execution. As soon as a difficulty hits its cease, then a 30-minute interval is allowed earlier than it’s offered. With the fixed barrage of Web and monetary media making an attempt to be first with breaking information, typically the story is introduced incorrectly, and it might probably impact a big inventory, an trade, or perhaps a sector and trigger an enormous sell-off. Often, if the story was reported in error or incorrectly, after which reported appropriately, the problem shortly recovers. Most of this occurs in a really brief time period. The 30-minute rule will assist keep away from most of those short-term sell-off with fast recoveries.

S3—In a broad-based sell-off and stops are hit, holdings hitting stops can start liquidating earlier than the 30-minute restrict.

S4—If a holding has skilled a pointy run-up in value, as soon as it reaches a 20% achieve, promote 50% of the holding and spend money on one other holding or a brand new holding. That is only a prudent means of locking in distinctive features.

S5—Any holding that’s nonetheless being held after experiencing S4, as soon as a spot open (above earlier day’s excessive) happens, can warrant an extra discount within the holding. Moreover, this may additionally anticipate a blow-off transfer or island reversal, whereas defending most features however nonetheless permitting for extra upside, though with restricted publicity. This isn’t an excellent course of when buying and selling just one difficulty, however is prudent when buying and selling many points with the flexibility to all the time discover one thing else to commerce.

Commerce Up Guidelines

T1—With Weight of the Proof sturdy: If stops are hit, however restricted to single sector/trade/fashion, substitute subsequent day so long as the Preliminary Pattern Measures are all indicating an uptrend.

T2—With Weight of the Proof sturdy: If stops are hit on multiple sector/trade/fashion, reenter when Preliminary Pattern Measures are all indicating an uptrend or Preliminary Pattern Measures are bettering, so long as there isn’t any deterioration within the weight of the proof.

T3—With Weight of the Proof at an intermediate stage: If stops are hit, however restricted to single sector/trade group, substitute subsequent day so long as Preliminary Pattern Measures are all indicating an uptrend.

T4—With Weight of the Proof at an intermediate stage: If stops are hit on greater than a single sector/trade/fashion, the traditional Purchase guidelines apply.

T5—There isn’t any buying and selling up when weight of the proof or preliminary development measures are deteriorating. Clearly, on this scenario, there’s something not good in regards to the uptrend and it isn’t a time to commerce up.

Tips

Notice: Tips are used as reminders and provide the chance to be ignored, however solely after appreciable deliberation and analyzing all different potentialities. Absolutely the most essential guideline is the primary one, G1.

G1—Within the occasion a scenario arises in which there’s not a rule or guideline, a conservative resolution might be selected and carried out based mostly on speedy wants. A brand new guideline or rule might be developed solely after the occasion/battle has completely handed. It is a critically essential guideline to make sure the “warmth of the second” is just not used to create or change a rule. Absolutely the worst time to create or change a rule is when you find yourself emotionally involved about one thing that simply appears to not be working appropriately. Within the Nineteen Seventies, the Navy F-4J Phantom jet had analog devices and, in comparison with at present’s digital know-how, was antiquated. We needed to memorize what we referred to as preliminary motion objects for emergency procedures; these had been designed to deal with the short and vital steps to close down an engine due to fireplace, no oil stress, and so forth. Throughout simulator (speak about antiquated in comparison with now), many would pull the improper lever or shut off the improper change throughout the emotional surge that comes with shiny pink flashing lights and loud horns. I used to be not excluded from that group, however discovered that, when one thing occurred that required speedy motion, winding the clock (they weren’t electrical again then) for just a few seconds to rid your self of the adrenaline rush would help you carry out higher throughout the process. Beside the explanations given for S1 beforehand, this falls consistent with that considering.

G2—Attempt to adhere to this if doable: Weak Weight of the Proof: SPY, MDY, DIA (guarantee liquidity); Intermediate Weight of the Proof: Types and Sectors; Sturdy Weight of the Proof: Vast Open (a pilot time period which means full throttle). The obligatory rating measures will dominate this guideline.

G3—European ETFs have to be monitored intently after 1pm Jap Time to make sure sufficient execution time. It’s because when the Europe markets shut, liquidity in these points turns into an issue.

G4—Day-after-day when invested, buying and selling up must be evaluated. Usually, this entails promoting the poor-performing holding and shopping for further quantities of present holdings.

G5—All purchase candidates ought to be decided by A) rising obligatory rating parts utilizing a chart of the Rating Measures, and B) an consciousness of the problem’s value assist and resistance ranges.

G6—At all times pay attention to the Prudent Man idea. That is kind of a catchall to make one take into consideration an motion that has not been adequately coated with guidelines or pointers. If deciding to do one thing so far as asset dedication or ETF choice, one must be ready to face in entrance of the boss and clarify it.

There are a bunch of further guidelines and pointers that may be created. I might warning you on making an attempt to develop a rule for each inconsistency or disappointment that surfaces whereas buying and selling with a mannequin. There’s in all probability an excellent equilibrium in regards to the depth and variety of guidelines is finest. I strongly counsel including guidelines rationally and unemotionally.

Asset Dedication Tables

Along with measuring what the market is doing (weight of the proof) and a algorithm and pointers to inform you the best way to make investments based mostly on what the market is doing, you then want a set of tables for every technique to indicate you the asset dedication (fairness publicity objective) ranges to be invested to for every Weight of the Proof situation.

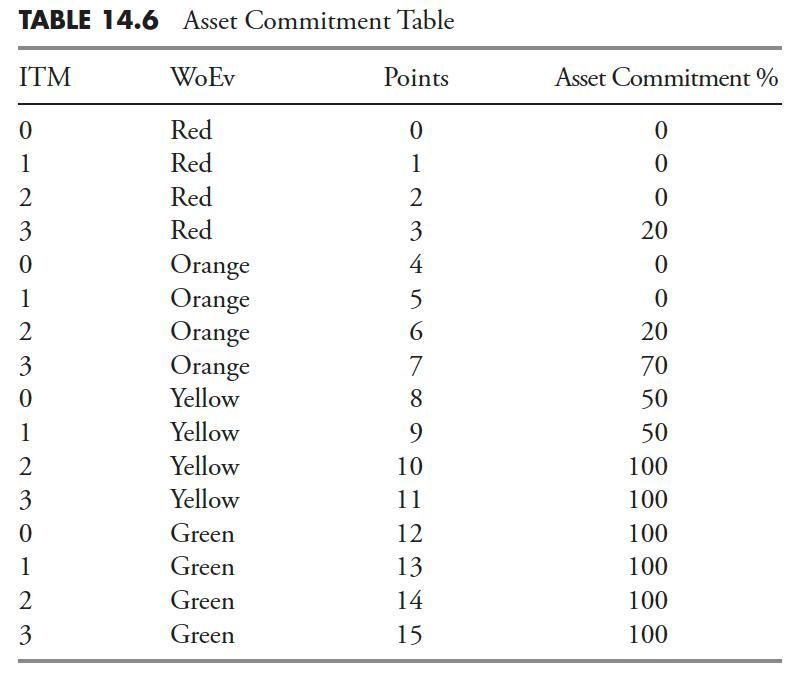

Desk 14.6 is an instance desk exhibiting the Preliminary Pattern Measure Degree (ITM), Weight of the Proof (WoEv), the Factors assigned to every stage, and the Asset Dedication Degree Share (Asset Dedication p.c). That is merely a pattern and ought to be based mostly in your danger preferences and aims. As you’ll be able to see, even with the WoEv at its lowest stage, so long as the a lot shorter-term development measures (ITM) are all saying there may be an uptrend, one can commit fairness to the market.

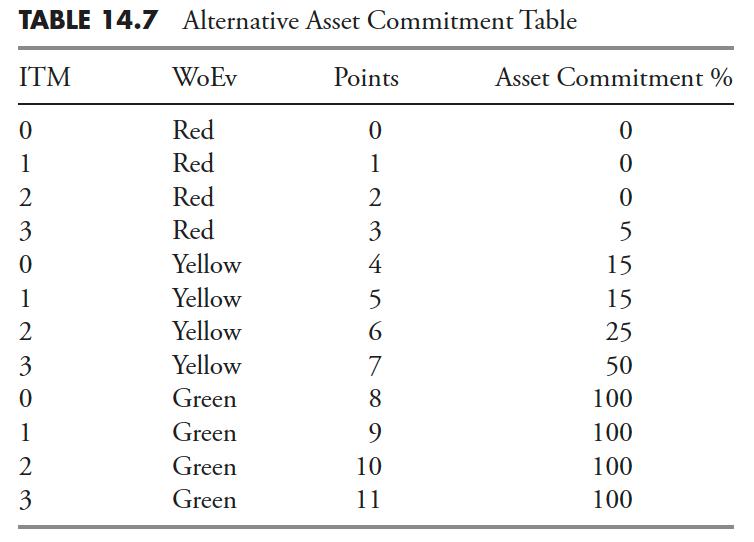

Another and extra conservative asset dedication desk is proven in Desk 14.7. It’s simpler and a extra easy course of to divide the WoEv into solely three ranges, with the center or intermediate stage being the transition zone.

The principles and pointers provide just a few exceptions to the above desk of asset dedication, however solely based mostly on pretty uncommon occasions. Following the foundations and dedication ranges will result in an goal course of, which is the final word objective.

This text accommodates many measures one can use to find out which holdings ought to be purchased. Many are solely helpful in aiding within the choice course of. In case you think about the truth that you may solely have to buy just a few holdings and there are greater than 1,400 accessible, you want a powerful set of technical measures that can assist you cut back the variety of points right into a extra manageable quantity. There are some that had been recognized as obligatory measures, which suggests these are those which have the perfect monitor file at figuring out early when a holding is in an uptrend. I’m optimistic there are a lot of momentum indicators that aren’t on this chapter, however these are those that I’ve used for a few years. Simply bear in mind what the objective of that is: to take away human enter into the choice course of.

Thanks for studying this far. I intend to publish one article on this sequence each week. Cannot wait? The guide is on the market right here.