Ramp printed its quarterly spending tendencies & revealed how companies are spending on AI. There are lots of nice information factors that underscore the expansion in AI however there are necessary nuances within the patterns.

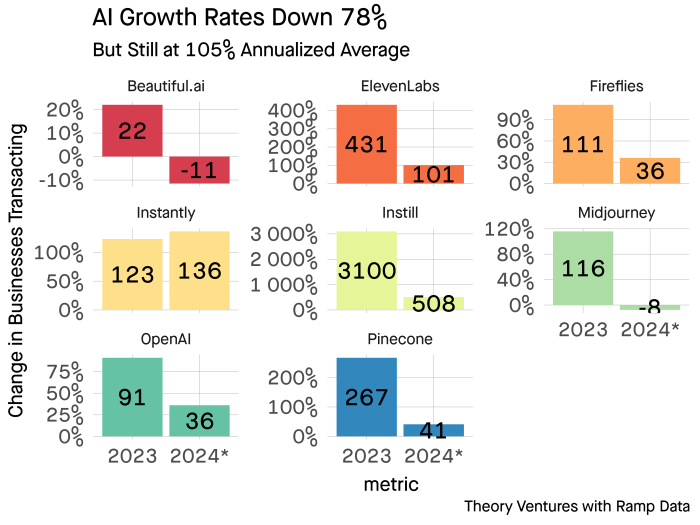

First, AI progress charges throughout the preferred distributors have fallen 78% yearly. On common, these AI companies are rising buyer counts 105% ; the median is 38%.1

Nevertheless, this isn’t a uniform pattern. Some corporations have seen contraction in buyer counts. Each the businesses with unfavorable account retention nonetheless see comparatively minor account churn : 15-25% account churn at these worth factors is frequent.

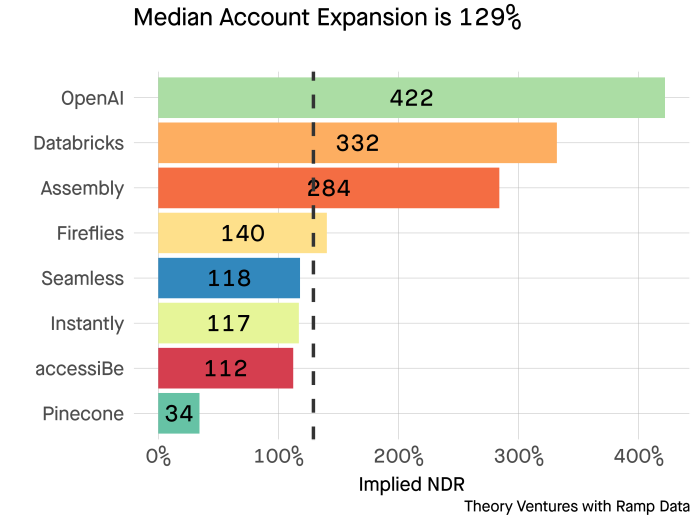

Second, the account growth stays comparatively robust. The highest quartile software program corporations round 125% right now & the businesses above are very related with a median of 129% internet greenback retention (NDR).

These information factors counsel that AI infused software program corporations’ metrics will asymptote to total software program metrics in time. NDR is nearly equal. Progress charges stay very robust, however maybe are seeing some attenuation.

In some classes, income progress is extra challenged which highlights a problem in very quick rising markets : high quality of income.

The underlying know-how shifting quickly – the bulletins from Google & OpenAI this week underscore the purpose; purchaser preferences are evolving quickly as they begin to perceive the related functions of the know-how, the prices of deployment & the worth gained from totally different functions ; vendor pricing dynamics additionally play a task. OpenAI diminished costs by 50% this week driving deflation available in the market.

The extra information throughout the report underscores AI’s progress within the final 12 months.

“Card transaction quantity for AI software program providers jumped 293% year-over-year in comparison with a rise of simply 6% in total software program transaction quantity throughout the identical interval.”

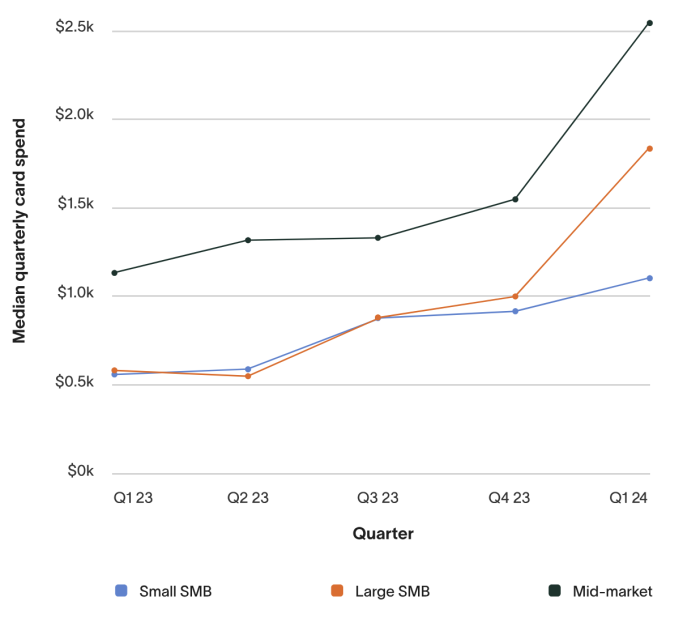

This progress is true throughout firm measurement.

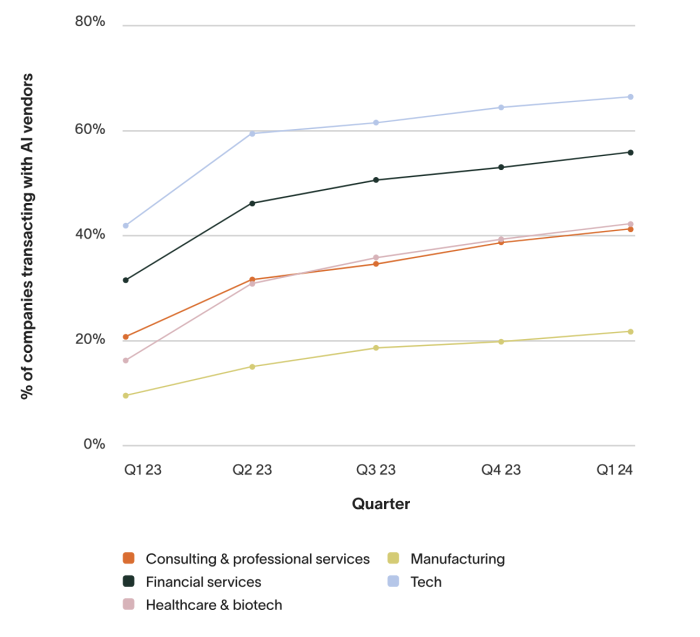

& throughout most industries.

There’s nonetheless quite a bit to be enthusiastic about. & there are indicators to be extra sanguine about long-term progress charges & valuations approaching these of total high-growth software program corporations.

1 I’m annualizing the Q1 adjustments to impute the 2024 estimated change.