In response to Ki Younger Ju, CEO of CryptoQuant, the Bitcoin present market dynamics counsel a bullish part that would lengthen properly into April 2025.

Ju’s evaluation comes amid BTC’s present uptrend, which seems to be a continuation of that seen in March, when BTC achieved a brand new all-time excessive, surging above $73,000 for the primary time.

Associated Studying

Bitcoin Market Cap Development Signifies Extended Uptrend, Says CryptoQuant CEO

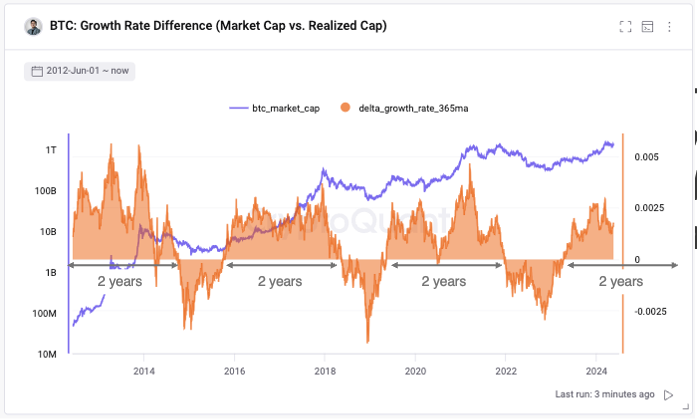

Notably, Ki Younger Ju’s prediction stems from an evaluation of Bitcoin’s market capitalization progress, which has been outpacing its realized capitalization — a measure of the market’s combination value foundation.

This pattern is a basic indicator of a powerful bullish cycle and has been a dependable harbinger of sustained upward momentum in previous market cycles.

Ju’s evaluation highlights that the market cap’s speedy progress in comparison with the realized cap suggests elevated investor confidence and market momentum.

This sample has traditionally signaled extended bullish phases. If the present developments persist, this cycle is predicted to proceed, resulting in vital beneficial properties in Bitcoin’s worth over the subsequent 12 months and a half.

#Bitcoin is in the midst of the bull cycle.

Its market cap is rising quicker than its realized cap, a pattern that sometimes lasts round two years.

If this sample continues, the bull cycle would possibly finish by April 2025. pic.twitter.com/o4k8B1Rkhv

— Ki Younger Ju (@ki_young_ju) Might 17, 2024

Bitcoin has proven a optimistic pattern, with a 1.9% improve up to now 24 hours and an over 12% rise up to now two weeks. On the time of writing, it’s buying and selling round $67,201.

Institutional Adoption And Market Sentiments Underpin Bullish Outlook

The optimistic outlook for BTC isn’t just primarily based on historic developments and market cap evaluation. Latest developments in institutional adoption present additional assist for this optimistic trajectory.

Anthony Scaramucci, the founder and managing companion of SkyBridge Capital and a notable Bitcoin advocate, lately mentioned on CNBC’s Squawk Field how US pension funds are starting to put money into BTC.

“While you do the homework on Bitcoin, you go in the direction of Bitcoin…typically if you’re early you get some bumps and scrapes, however I feel it pays to be early in Bitcoin and we’re nonetheless early in Bitcoin,” says SkyBridge Capital’s Anthony Scaramucci. pic.twitter.com/HTfbwH5VJG

— Squawk Field (@SquawkCNBC) Might 16, 2024

This transfer by institutional traders, such because the State of Wisconsin Funding Board’s roughly $100 million funding in BTC, indicators a broader acceptance and integration of BTC into conventional monetary portfolios.

Scaramucci emphasised that institutional BTC adoption is unfolding quickly, and he anticipates extra pension funds will pursue Bitcoin investments. He identified that regulatory approvals have opened the doorways for large-scale institutional participation in BTC.

This endorsement will make Bitcoin a staple in these establishments’ long-term asset allocation methods. In response to Scaramucci, understanding Bitcoin and the historical past of cash is essential to recognizing its potential.

Associated Studying

He remarked, Being early in Bitcoin is worthwhile, and “we’re nonetheless early… typically if you’re early you get some bumps and scrapes.”

Featured picture created with DALL·E, Chart from TradingView