Unveiling Pattern Energy:

A Foreign exchange Dealer’s Toolkit

The attract of foreign currency trading lies in capitalizing on developments. However not all developments are created equal. A robust, sustained pattern provides way more potential for revenue than a sluggish, meandering one. That is the place pattern power indicators are available – highly effective instruments that enable you to gauge the momentum behind a value motion and establish probably the most promising buying and selling alternatives.

These technical evaluation instruments act as your compass, serving to you gauge the depth behind a value motion. Let’s delve into some standard pattern power indicators and the way they will empower your buying and selling selections:

1. Shifting Common Convergence Divergence (MACD):

The MACD is a multi-faceted indicator that gives insights into each pattern path and power. It includes two shifting averages (MAs) – a fast-moving common (EMA) and a slow-moving common (EMA). The space between these strains, the MACD line, displays pattern momentum. A widening distance signifies a strengthening pattern, whereas a narrowing distance suggests a pattern shedding steam. Moreover, divergences between the MACD line and a sign line (one other EMA) can supply early alerts of potential pattern reversals.

2. Common Directional Index (ADX):

In contrast to the MACD, the ADX focuses solely on pattern power, disregarding path. It consists of three strains: the ADX line, the +DI (constructive directional indicator), and the -DI (adverse directional indicator). A rising ADX line above a sure threshold (usually 25) signifies a robust pattern, no matter up or down. The +DI and -DI strains, in the meantime, depict the power of bulls and bears respectively, serving to you establish which aspect is dominating the pattern.

3. Relative Energy Index (RSI):

Whereas not solely a pattern power indicator, the RSI can present helpful clues. Primarily an oscillator that measures value momentum, the RSI ranges from 0 to 100. Readings above 70 recommend overbought situations, probably indicating a weakening uptrend. Conversely, readings beneath 30 recommend oversold situations, which might sign a possible reversal in a downtrend. By figuring out these potential turning factors, you possibly can place your self for pattern continuations or anticipate potential reversals.

4. Bollinger Bands:

Bollinger Bands® are a volatility indicator that may additionally supply insights into pattern power. These bands widen and contract based mostly on value volatility. In a robust pattern, value motion tends to remain confined throughout the bands, with restricted forays exterior. Conversely, in periods of weakening developments, value motion might get away of the bands extra steadily, suggesting elevated volatility and a possible pattern shift.

5. Value Motion:

Don’t underestimate the facility of pure value motion! Observing greater highs and better lows in an uptrend or decrease lows and decrease highs in a downtrend is a straightforward but efficient solution to gauge pattern power. Sharp value swings and sustained breakouts from established help/resistance ranges additional solidify a robust pattern.

6.Blended pattern methodology:

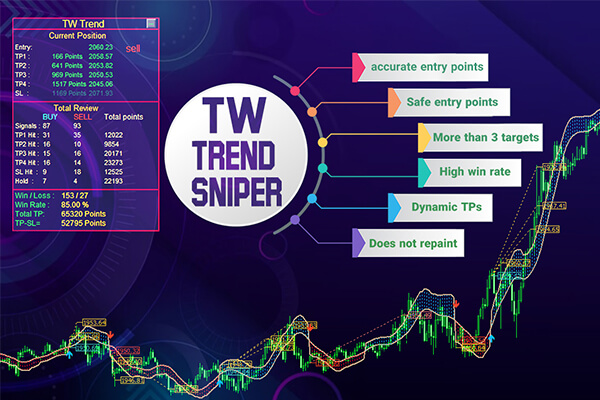

Introducing the “TW pattern sniper” Indicator, a robust indicator that’s used to establish the primary developments by utilizing the “Commerce Wizards” unique indicator components together with the usage of value motion, the detection of foreign money buying and selling classes, Fibonacci and detection features and synthetic intelligence noise removing strategies with excessive accuracy.

Bear in mind:

no single indicator is a foolproof solution to gauge pattern power. The very best strategy is to make use of a mixture of indicators alongside value motion evaluation for a extra holistic understanding of the market. Listed here are some extra suggestions:

- Contemplate the timeframe: Pattern power indicators could be utilized to totally different timeframes (short-term, long-term). Select a timeframe that aligns together with your buying and selling technique.

- Don’t rely solely on indicators: All the time think about basic evaluation and financial information occasions to get an entire image.

- Backtest your methods: Earlier than deploying these indicators with actual capital, check them on historic knowledge to see how they might have carried out.

By incorporating pattern power indicators into your foreign currency trading toolbox, you’ll be higher outfitted to establish highly effective developments, enhance your entry and exit timing, and finally, maximize your revenue potential.

Completely satisfied buying and selling

might the pips be ever in your favor!