Regardless of a current surge in exercise from massive traders, also known as “whales,” the worth of Toncoin (TON) seems headed for choppier waters. This comes as analysts elevate issues in regards to the cryptocurrency’s weakening technical indicators and its potential breach of a key assist degree.

Associated Studying

Whales Make A Splash, However Can They Save The Day?

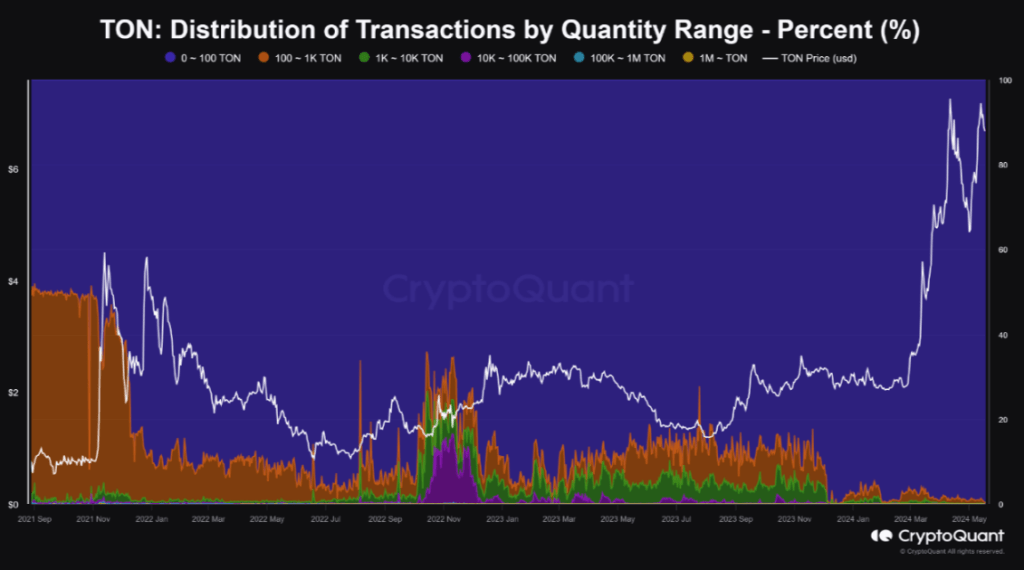

In a current report, Joao Wedson, a crypto analyst at CryptoQuant, noticed a important spike in whale exercise on the Toncoin community. Transactions exceeding 100,000 TON (roughly equal to $645,000 at present costs) surpassed a staggering $1 billion previously few weeks. This means that main holders have been actively shifting massive quantities of TON, however the goal behind these actions stays unclear.

Whereas the whales are actually making a splash, Wedson mentioned it’s not essentially translating to easy crusing for TON’s value. He identified that whereas massive transactions dominate the community’s quantity (over 50%), their influence on the worth appears negligible. Conversely, smaller transactions, though constituting the vast majority of total exercise, contribute a a lot smaller share of the full quantity.

Technical Indicators Flash Pink

Toncoin’s value has been exhibiting indicators of weak point regardless of the inflow of whale exercise. Notably, TON not too long ago dipped beneath its 20-day Exponential Transferring Common (EMA), a technical indicator used to gauge short-term developments. This implies that the typical value of TON over the previous 20 days has been on a downward slope, signifying a shift in the direction of promoting strain.

Including to the bearish sentiment is the approaching crossover of the Transferring Common Convergence Divergence (MACD) indicator. The MACD line seems poised to fall beneath its sign line, which historically signifies a lack of upward momentum and a possible value decline.

These technical indicators are flashing crimson flags for TON. If the worth breaches the decrease line of its ascending channel, which has been appearing as a assist degree, a drop to $5.70 is a definite risk.

Associated Studying

Is This A Shopping for Alternative Or A Sinking Ship?

The present state of affairs surrounding Toncoin presents a conundrum for traders. The substantial whale exercise hints at potential bullish curiosity, however the technical indicators paint a bleak image.

The important thing query stays: are the whales accumulating or distributing? In the event that they’re accumulating, this might be a shopping for alternative earlier than the worth rebounds. Nevertheless, in the event that they’re promoting off their holdings, it might be an indication of a distressed ship.

Featured picture from Vikks/Shutterstock, chart from TradingView