In his newest essay titled “The Straightforward Button,” Arthur Hayes, founding father of the crypto change BitMEX, delves into the dynamics of world financial insurance policies and their consequential ties to what he describes as the approaching ‘Crypto Valhalla.’ Hayes analyzes the coverage maneuvers of the world’s main economies, notably Japan, america, and China, and their results on the crypto panorama.

The Daybreak Of Crypto Valhalla

Hayes outlines the Federal Reserve’s potential technique in coordination with the US Treasury to interact in limitless dollar-for-yen swaps with the Financial institution of Japan (BOJ). This measure goals to govern change charges to stabilize the yen with out inflicting disruptive financial shifts.

Hayes states, “The Fed, performing on orders from the Treasury, can legally swap {dollars} for yen in limitless quantities for so long as they want with the BOJ.” This tactic, in keeping with Hayes, is designed to avert instant monetary crises by deferring laborious financial selections.

Associated Studying

The implications for Japan’s financial system are stark, with Hayes predicting extreme penalties ought to the BOJ determine to boost rates of interest: “If the BOJ raises rates of interest, it commits seppuku,” Hayes notes, utilizing the Japanese time period for ritual suicide to underscore the potential self-destructive financial influence, provided that the BOJ is the biggest holder of Japanese Authorities Bonds (JGBs) and would incur huge losses.

The devaluation of the yen has additionally important ramifications for China’s world financial competitiveness, particularly in exports. Hayes discusses how a weaker yen harms China’s export financial system by making Japanese items cheaper internationally, immediately competing with Chinese language merchandise.

He means that the Individuals’s Financial institution of China would possibly reply by devaluing the yuan to keep up aggressive steadiness. “If the yen retains weakening, China will reply by devaluing the yuan,” Hayes predicts, outlining a possible financial tit-for-tat that would destabilize world markets.

Hayes additional theorizes a couple of dramatic financial coverage shift in China involving its substantial gold reserves. He posits that China may use these reserves to peg the yuan to gold, thereby creating a brand new financial panorama.

“China is estimated to have stockpiled over 31,000 tonnes of gold […] I consider that for home and international political causes, China needs to maintain the dollar-yuan price secure.” By pegging the yuan to gold, China may probably insulate itself from foreign money fluctuations and exert better management over its financial future.

The essay additionally touches on the intersection of US politics and financial coverage, significantly in gentle of the approaching presidential election. Hayes speculates that home financial pressures, corresponding to job losses and the reshoring of producing, may considerably affect the Biden administration’s coverage selections.

Associated Studying

He argues that the administration could keep away from aggressive strikes in opposition to China to forestall a backlash in pivotal states: “Biden should win these battleground states to maintain the Orange Man at bay. Biden can not afford a yuan devaluation earlier than the election.”

Hayes means that these world foreign money maneuvers may result in a bullish state of affairs for cryptocurrencies. He advises crypto merchants and institutional buyers to watch the USDJPY change price carefully, asserting that important actions may point out shifts favorable to crypto valuations.

“Watch the USDJPY price nearer than Solana devs monitor uptime,” he advises, highlighting the potential for substantial monetary alternatives within the cryptocurrency area.On the timing of a possible “Crypto Valhalla,” Hayes speculates that the tempo of yen depreciation will speed up into the autumn. “This may put strain on the US, Japan, and China to do one thing. The US election is an important motivating issue for the Biden administration to give you some resolution.”

In line with Hayes, a USDJPY surge in the direction of 200 is “sufficient to placed on the Chemical Brothers and ‘Push the Button.’ This analogy to the Chemical Brothers’ tune underscores the urgency and drastic nature of the motion required to counter such a foreign money imbalance.

“If my idea turns into actuality, it’s trivial for any institutional investor to purchase one of many US-listed Bitcoin ETFs. Bitcoin is the best-performing asset within the face of world fiat debasement, and so they comprehend it. When one thing is finished concerning the weak yen, I’ll mathematically guestimate how flows into the Bitcoin advanced will ratchet the worth to $1 million and probably past. Keep imaginative, keep boolish, now shouldn’t be the time to be a cuck,” Hayes concludes.

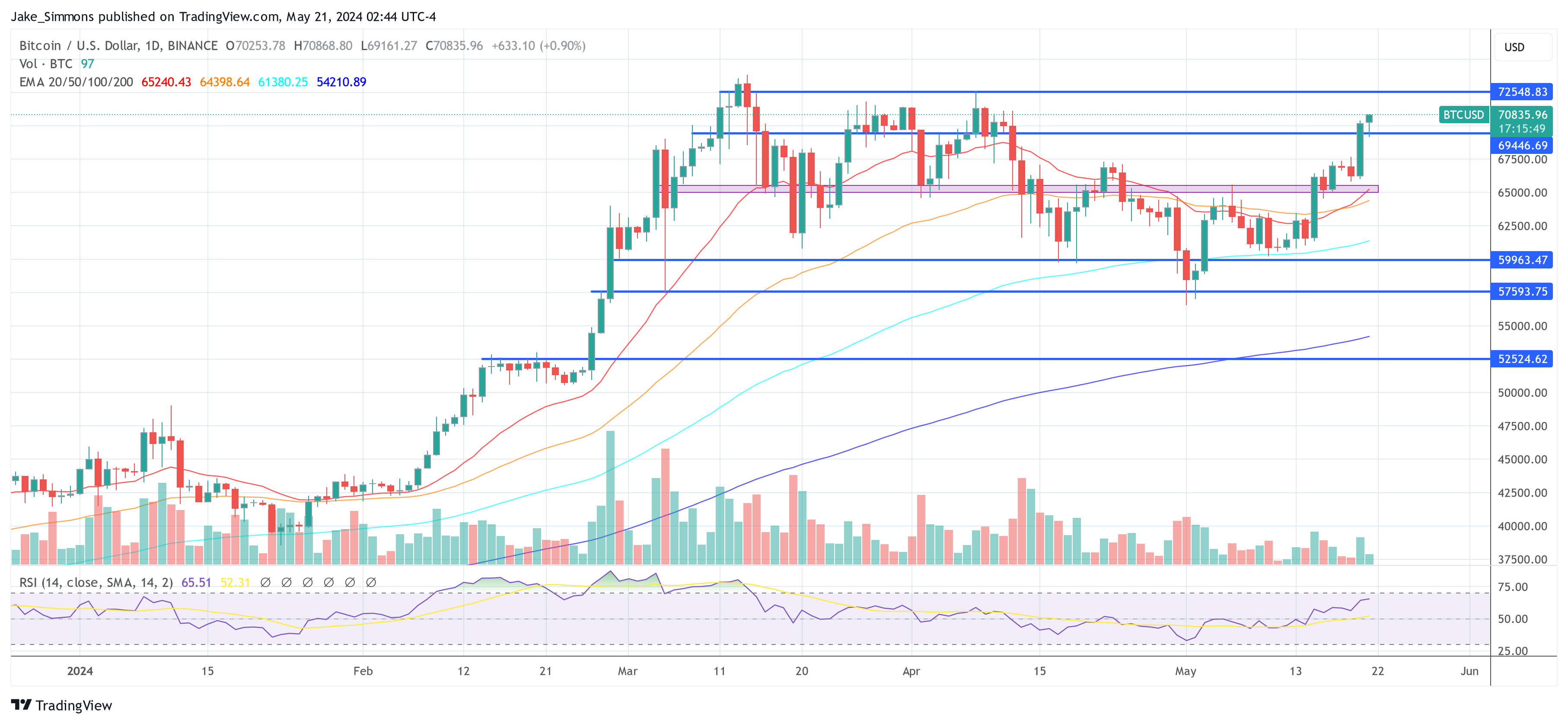

At press time, Bitcoin traded at $70,835.

Featured picture from YouTube / Tom Bilyeu, chart from TradingView.com