Macro strategist Jim Bianco is blowing up the narrative that establishments and high-net-worth buyers are those closely accumulating shares in Bitcoin (BTC) exchange-traded funds (ETFs).

Bianco tells his 398,400 followers on the social media platform X that new necessary 13F filings with the U.S. Securities and Change Fee (SEC) reveal the breakdown of investor varieties within the spot BTC ETFs for the primary quarter of 2024.

“Anybody with over 5% useful possession or not less than $100 million in property should file a 13F inside 45 days of the top of the quarter. This was Might fifteenth. ~7,000 have been filed.

What did we study from the spot BTC ETF filings?

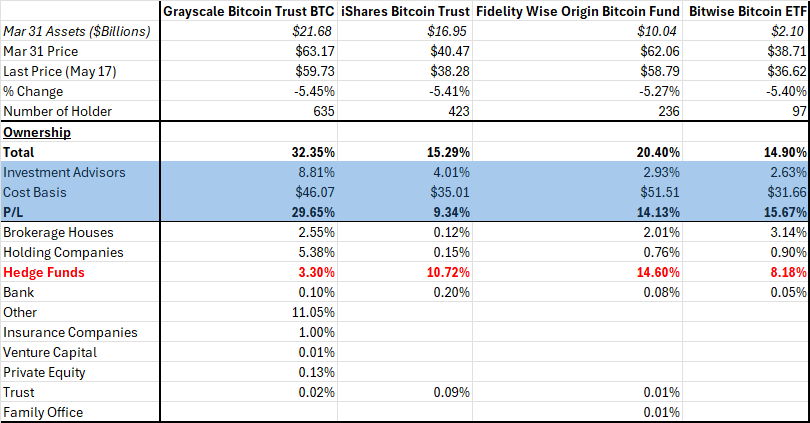

The desk beneath reveals some top-line outcomes.

The shaded blue space reveals the funding advisors’ holdings. They’re very small, between 2.5% and 4% (and eight.81% for GBTC). A latest Citi report says the typical ETF is about 35% owned by funding advisors. All through the quarter, we have been confidently instructed boomers have been calling their wealth managers and telling them to get into BTC. This isn’t the case for 95+% of the spot BTC ETF holdings.“

He says the types reveal that about 85% of buyers within the spot Bitcoin ETFs are retail buyers as of the primary three months of the 12 months.

“I feared the spot BTC ETFs have been successfully ‘orange FOMO poker chips.’ The Q1 13F filings solely additional satisfied me this was the case.

Solely ~3% of the excellent ETF market cap was held by funding advisors, utterly blowing up the narrative that ‘the Boomers are coming.’ They may over time (as in years) however didn’t in Q1. ~10% is held by hedge funds, and ~85% by non-institutional buyers (learn: retail).”

At time of writing, Bitcoin is buying and selling for $70,947, up over 7% previously day.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in affiliate marketing online.

Generated Picture: DALLE3