Information suggests customers on Binance responded to the Ethereum exchange-traded fund (ETF) information by aggressively longing the cryptocurrency.

Ethereum Web Taker Quantity On Binance Has Simply Seen Its Greatest Candle Ever

As defined by CryptoQuant neighborhood supervisor Maartunn in a submit on X, the Ethereum Web Taker Quantity has noticed a pointy enhance after rumors have surfaced that the ETH spot ETFs have a renewed likelihood of gaining approval.

The “Web Taker Quantity” right here refers to an indicator that retains observe of the distinction between the ETH taker purchase and taker promote volumes on any given centralized change.

Associated Studying

When the worth of this metric is constructive, it implies that the taker purchase or lengthy quantity is outpacing the taker promote or quick quantity on the platform proper now. Such a development implies a bullish sentiment is dominant among the many buyers.

Alternatively, the indicator being unfavorable suggests the presence of a majority bearish mentality among the many customers of the change because the shorts are outpacing the longs.

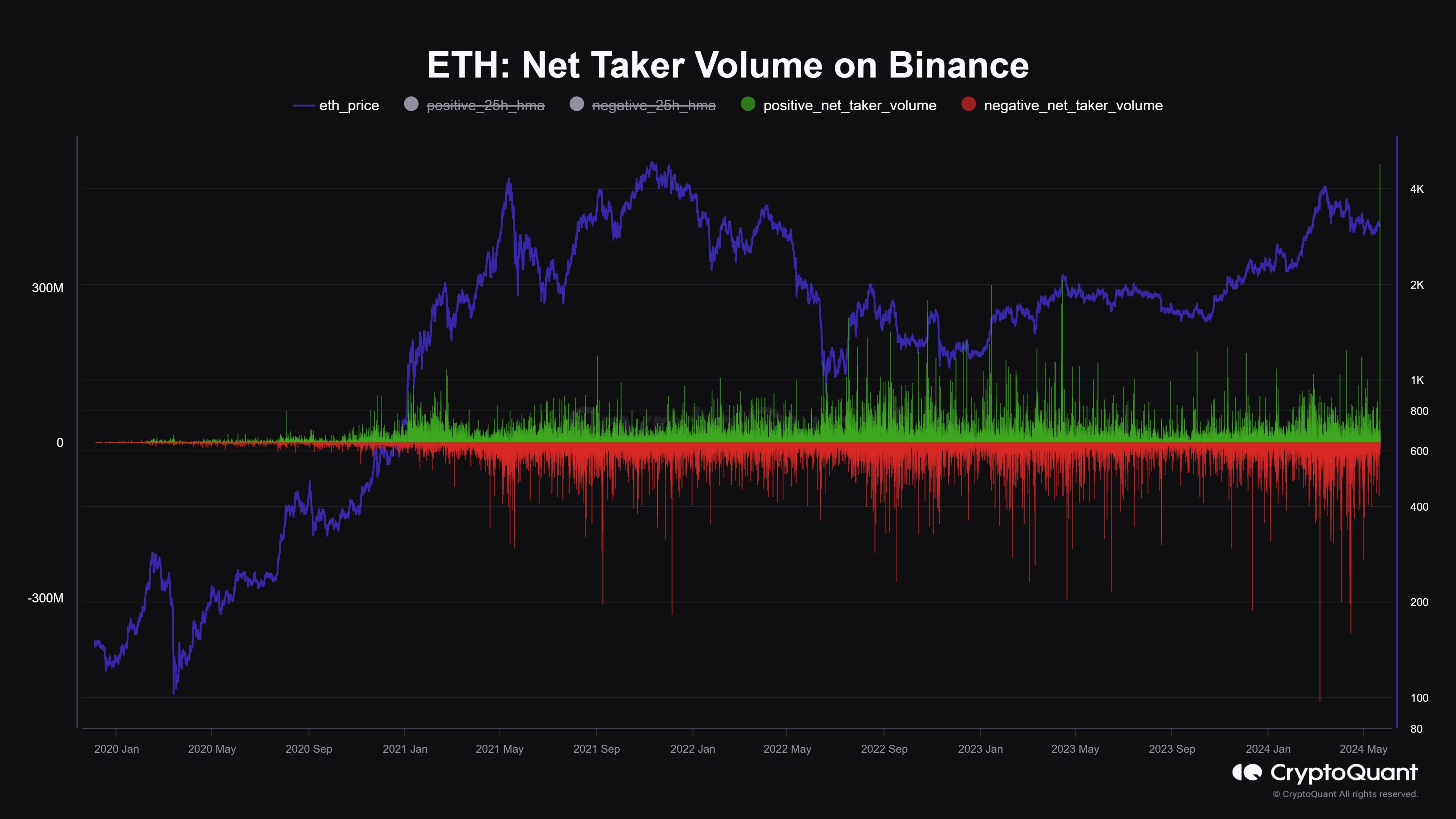

Now, here’s a chart that reveals the development within the Ethereum Web Taker Quantity on the cryptocurrency change Binance over the previous couple of years:

As displayed within the above graph, the Ethereum Web Taker Quantity on Binance has simply registered an enormous constructive spike, the implying buyers have simply opened a considerable amount of longs on the platform.

Extra particularly, the indicator’s worth throughout this spike has been $530 million, which, based on the analyst, is the only largest spike the cryptocurrency has ever seen.

“Binance-traders are longing the Ethereum ETF-news like there isn’t a tomorrow,” notes Maartunn. This isn’t significantly stunning, contemplating the market may be very properly conscious what a spot ETF might imply for the asset after having witnessed what went down for Bitcoin.

The ETF information pre-approval had been bullish for BTC and whereas the approval itself had initially led to bearish worth motion, it will definitely paid off for the asset as capital began quickly flowing in by means of these funding automobiles and the coin loved a rally that led to a brand new all-time excessive (ATH).

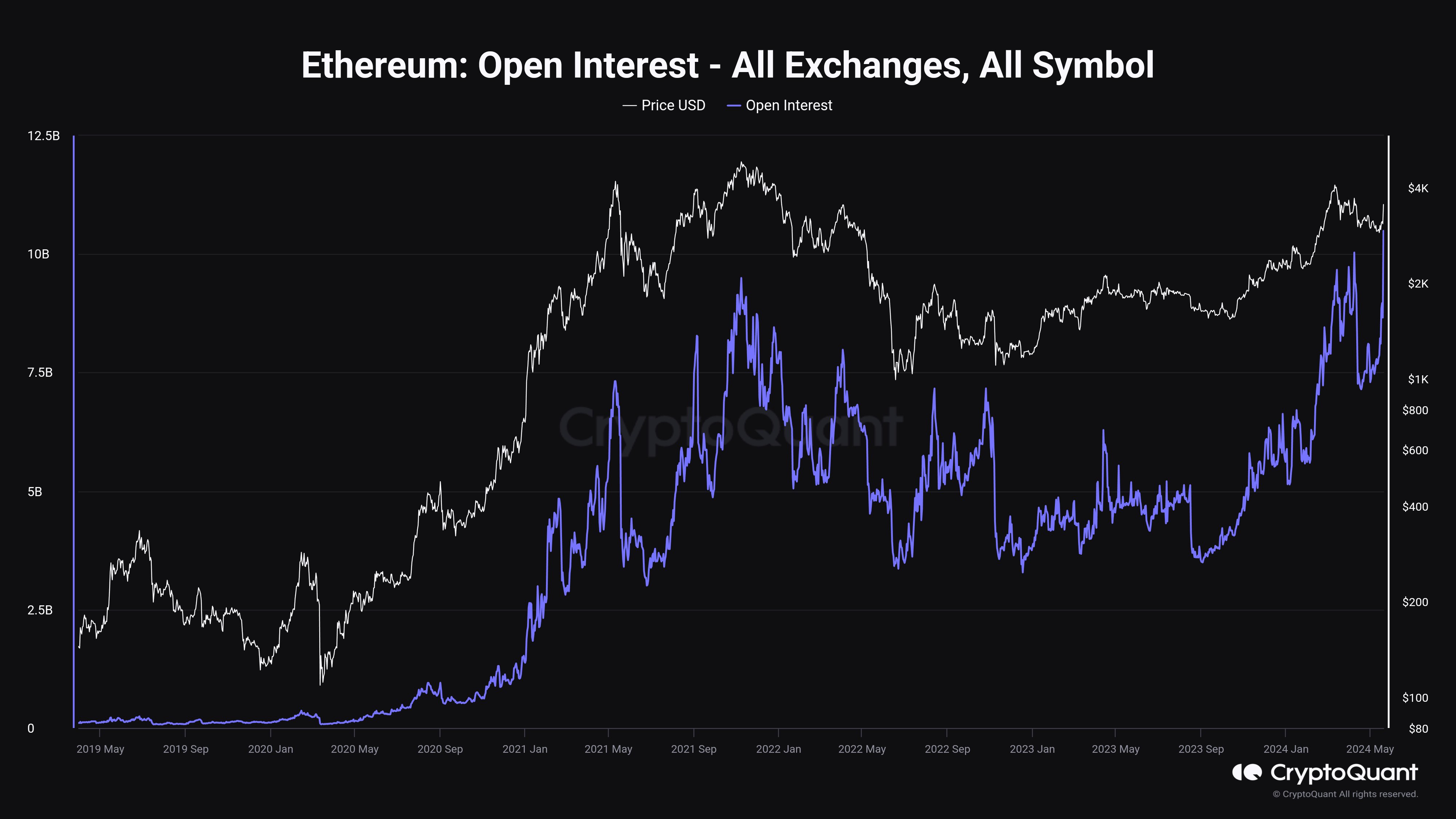

In one other X submit, the CryptoQuant analyst identified that the Ethereum Open Curiosity has shot up as properly. The “Open Curiosity” measures the overall quantity of ETH-related positions which can be at the moment open on all by-product exchanges.

This development isn’t that surprising, on condition that derivatives customers have been opening a considerable amount of longs for the asset. With this fast surge, the Ethereum Open Curiosity has managed to set a brand new ATH.

Associated Studying

Traditionally, intense hypothesis has typically led to extra volatility for the coin, as the danger of enormous liquidations occurring can develop into excessive in such durations. As such, this Open Curiosity spike might sign some turbulent occasions forward for Ethereum.

ETH Value

To this point within the rally fueled by the ETF information, Ethereum has managed to interrupt previous the $3,800 stage, which is a milestone the coin hadn’t achieved since mid-March.

Featured picture from Shutterstock.com, CryptoQuant.com, chart from TradingView.com