Joseph Lubin, co-founder of Ethereum and CEO of blockchain expertise agency Consensys, has expressed that the potential approval of spot Ethereum ETFs by the US Securities and Alternate Fee (SEC) might result in vital provide constraints for Ether. This growth is anticipated to be a “watershed” second for Ethereum.

In an unique interview with DL Information, Lubin predicted that the approval of spot Ethereum ETFs will unlock substantial institutional demand. Provided that many establishments have begun their crypto investments with spot Bitcoin ETFs, Ethereum is of course the subsequent substantial asset for diversification.

“There’s going to be a pretty big quantity of pure, pent-up strain to buy Ether” via these ETFs, Lubin commented. Nonetheless, he additionally famous that the state of affairs for Ethereum differs considerably from that of Bitcoin due to the underlying provide dynamics.

A significant factor distinguishing Ethereum from Bitcoin within the context of ETF creation is the supply of the belongings. On-chain information signifies that greater than 27% of all Ether is staked throughout varied protocols on the Ethereum community. These funds are locked in contracts and are contributing to the community’s safety and operations, thus they don’t seem to be available for market buying and selling.

“A lot of the Ether is put to work within the core protocol, DeFi techniques, or in DAOs,” Lubin defined. This structural distinction means that there’s much less Ether accessible for ETF suppliers to buy and allocate to new ETF shares.

Associated Studying

In August 2021, the Ethereum community’s EIP 1559 launched a burning mechanism the place a portion of the Ether used for transaction charges is completely faraway from circulation. This deflationary mechanism is designed to stability Ether provide progress and probably improve its shortage over time.

As community exercise will increase—probably spurred additional by new institutional curiosity in Ethereum via ETFs—this burn mechanism will regularly cut back the accessible provide, including one other layer to the potential provide crunch. “This could possibly be a fairly profound watershed second”, Lubin stated.

Ethereum Value Targets And Doubts

The market impression of an authorised Ethereum spot ETF could possibly be vital. Crypto analyst Miles Deutscher projected a potential state of affairs the place Ethereum might see a worth surge much like that skilled by Bitcoin following its personal ETF approval.

Based on Deutscher’s evaluation, “BTC rallied 75% in 63 days after the spot ETF was authorised. If ETH follows the identical development (if authorised), this may take it to $6,446 by July 23.”

$BTC rallied 75% in 63 days after the spot ETF was authorised.

If $ETH follows the identical development (if authorised), this may take it to $6,446 by July 23. pic.twitter.com/FfWg9VGUMx

— Miles Deutscher (@milesdeutscher) Could 21, 2024

Nonetheless, opinions amongst analysts fluctuate. Vetle Lunde from K33 Analysis identified the challenges in replicating Bitcoin’s success, noting that the futures-based Ethereum ETFs have solely captured a small fraction of the belongings in comparison with their Bitcoin counterparts previous to spot ETF approval. “Fut-based ETH ETFs have seen cumulative web inflows of $126m since launch ~ roughly equal to the influx to BITX over the previous 3 days. Fut-based ETH ETFs aggregated AUM is simply 7.4% of the AUM fut-based BTC ETFs had earlier than the spot approval,” he remarked.

Associated Studying

In the meantime, crypto analyst Vijay Boyapati raised considerations concerning the structural variations in ETFs, particularly the lack of ETF constructions to include staking. “It must be famous that the ETH ETFs, if authorised, will likely be a a lot worse proxy for the underlying asset than BTC ETFs as a result of the SEC remains to be extraordinarily unlikely to permit the ETF candidates to stake,” he stated.

This might consequence within the ETFs not absolutely reflecting the underlying worth progress of Ethereum worth, as additionally highlighted by Alex Thorn, Head of Analysis at crypto-focused monetary providers agency Galaxy commented: “Lack of staking in ETH ETPs could be materials for returns. If u purchased $10k ETH on Merge day in Sep ‘22 and held till at this time with out staking it, you underperformed by 8% over that interval vs somebody who purchased and staked to gather issuance, ideas, and MEV.”

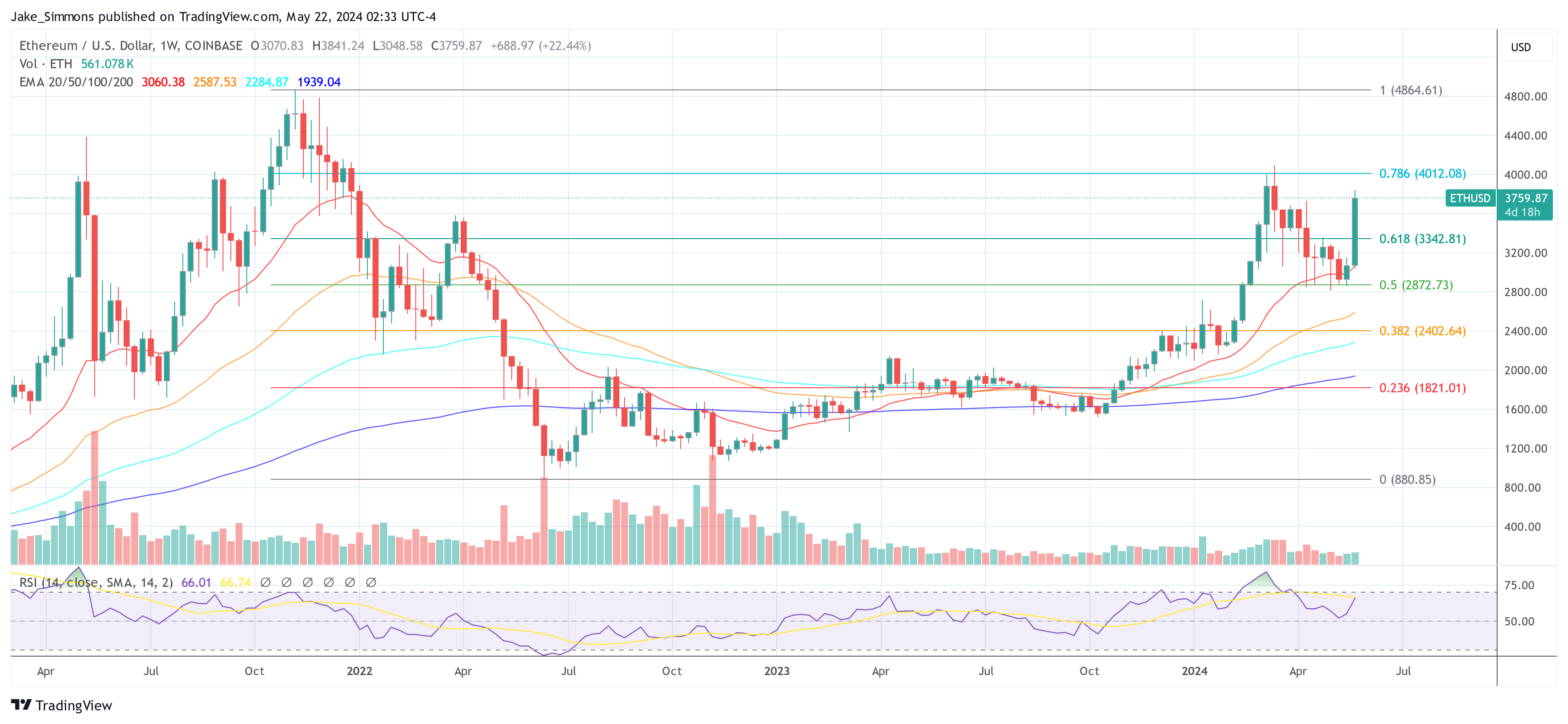

At press time, ETH traded at $3,759.

Featured picture from Consensys, chart from TradingView.com