Current developments within the crypto market point out a robust bullish sentiment amongst Ethereum merchants, significantly within the choices market.

Amid the rising anticipation for potential approvals of spot Ethereum exchange-traded funds (ETFs), there was a noticeable shift in choice pricing, with Ethereum name choices changing into costlier than put choices throughout all expiries.

This pricing sample suggests the market is optimistic about Ethereum’s value prospects. Notably, A name choice provides the holder the correct, however not the duty, to purchase an asset at a specified value inside a particular timeframe.

Associated Studying

This feature sort is often bought by merchants who consider the asset’s value will enhance. Conversely, a put choice gives the holder the correct to promote the asset at a predetermined value and is commonly used as safety towards a decline within the asset’s value.

Market Indicators Level To A Bullish Ethereum

Luuk Strijers, CEO of Deribit, highlighted this pattern in his communication with The Block. He famous that the “put minus name skew is unfavorable throughout all expiries and growing additional past the end-of-June expiry, a fairly bullish sign.”

Moreover, the premise, or the annualized premium of the futures value over the spot value, has elevated to round 14%, additional reinforcing the bullish outlook.

The evaluation reveals that merchants want to buy name choices at a premium in comparison with put choices, significantly for these set to run out on the finish of June and later.

This sample is an indication of a bullish market, indicating that merchants should not as interested by securing safety towards potential value drops as they’re in anticipating that Ethereum’s worth will hold climbing.

In the meantime, after the US Securities and Change Fee (SEC) unexpectedly requested for adjustments in filings, there was a resurgence in optimism concerning the potential approval of spot Ethereum ETFs.

This optimism has translated into important market exercise, with Deribit experiencing practically unprecedented buying and selling volumes. Strijers remarked, “We recorded an virtually unprecedented buying and selling quantity of $12.5 billion notional over the past 24 hours.”

This surge in buying and selling quantity and market curiosity displays how merchants and traders place themselves to capitalize on the potential approval of spot Ethereum ETFs.

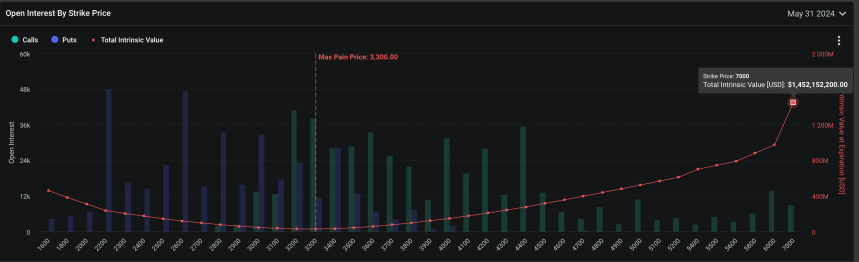

Based on information from Deribit, over $480,000 calls will expire by the tip of this month, with a notional worth of greater than $1.7 billion.

The information additional reveals that the strike value reaches as excessive as $7,000, with a complete intrinsic worth of $1.452 billion, indicating that many Ethereum choices merchants are extremely bullish on ETH.

ETH Worth Efficiency And Forecast

In the meantime, Ethereum is present process slight retracement, down by 2.4% prior to now 24 hours, with a buying and selling value of $3,690. Regardless of this pullback, the asset has maintained a robust uptrend, rising practically 25% over the previous seven days.

Because the market’s anticipation round spot ETH ETFs grows, a outstanding crypto analyst has prompt a possible value motion for Ethereum, indicating a short pullback at round $4,000 earlier than surging to new all-time highs.

Associated Studying

Based on the analyst, whereas there may be some bumps, reaching an all-time excessive of $5,000 appears “inevitable” for Ethereum.

$ETH: I feel we pullback briefly round 4k however this actually breaks all time highs if/when ETF will get authorized. This nonetheless looks like a free commerce for ETH going to ATH, which is at 5k. Could possibly be some bumps alongside the best way nevertheless it appears inevitable.

I’ve each SOL and ETH and never… pic.twitter.com/IznlJ0RAyl

— Altcoin Sherpa (@AltcoinSherpa) Might 22, 2024

Featured picture created with DALL·E, Chart from TradingView