Fast Take

On Might 23, the SEC accredited the Ethereum (ETH) exchange-traded funds (ETF).

In January, business litigator Joe Carlasare recommended that approving a spot Bitcoin ETF indicated that an ETH ETF was almost sure. Carlasare’s assertion was based mostly on a number of key factors:

ETH futures have been buying and selling on the CME since 2021, establishing a regulated futures marketplace for ETH.

“ETH Futures are already Buying and selling on CME”

The SEC has accredited Ethereum futures ETFs, demonstrating regulatory consolation with Ethereum-based monetary merchandise.

“The SEC has already accredited ETH futures ETFs”

CME has the identical surveillance-sharing settlement between BTC and ETH.

“The CME has similar surveillance sharing agreements for each Bitcoin (BTC) and Ethereum futures”.

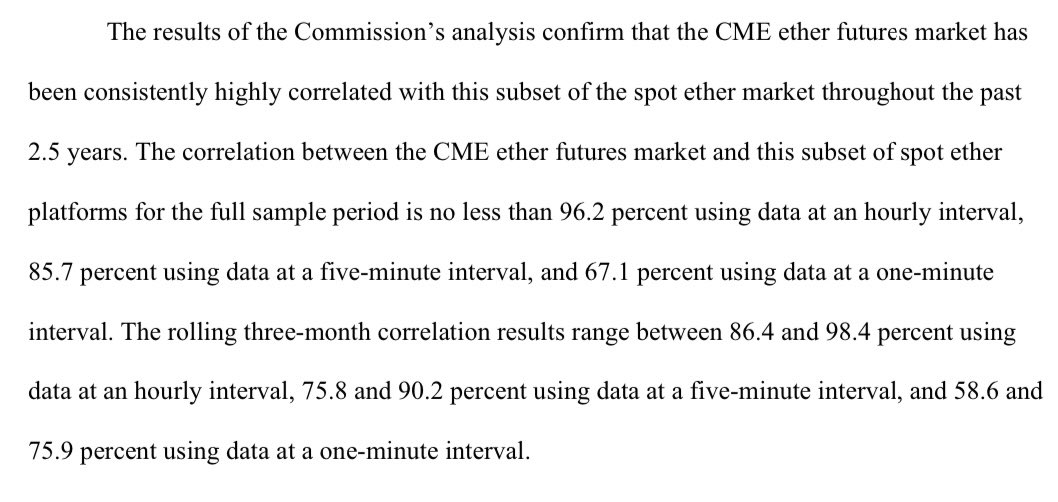

Final, a excessive correlation between futures and spot markets.

“The correlation of ETH futures to identify is over 90% (identical to BTC). That is main purpose they accredited the BTC spot etf”.

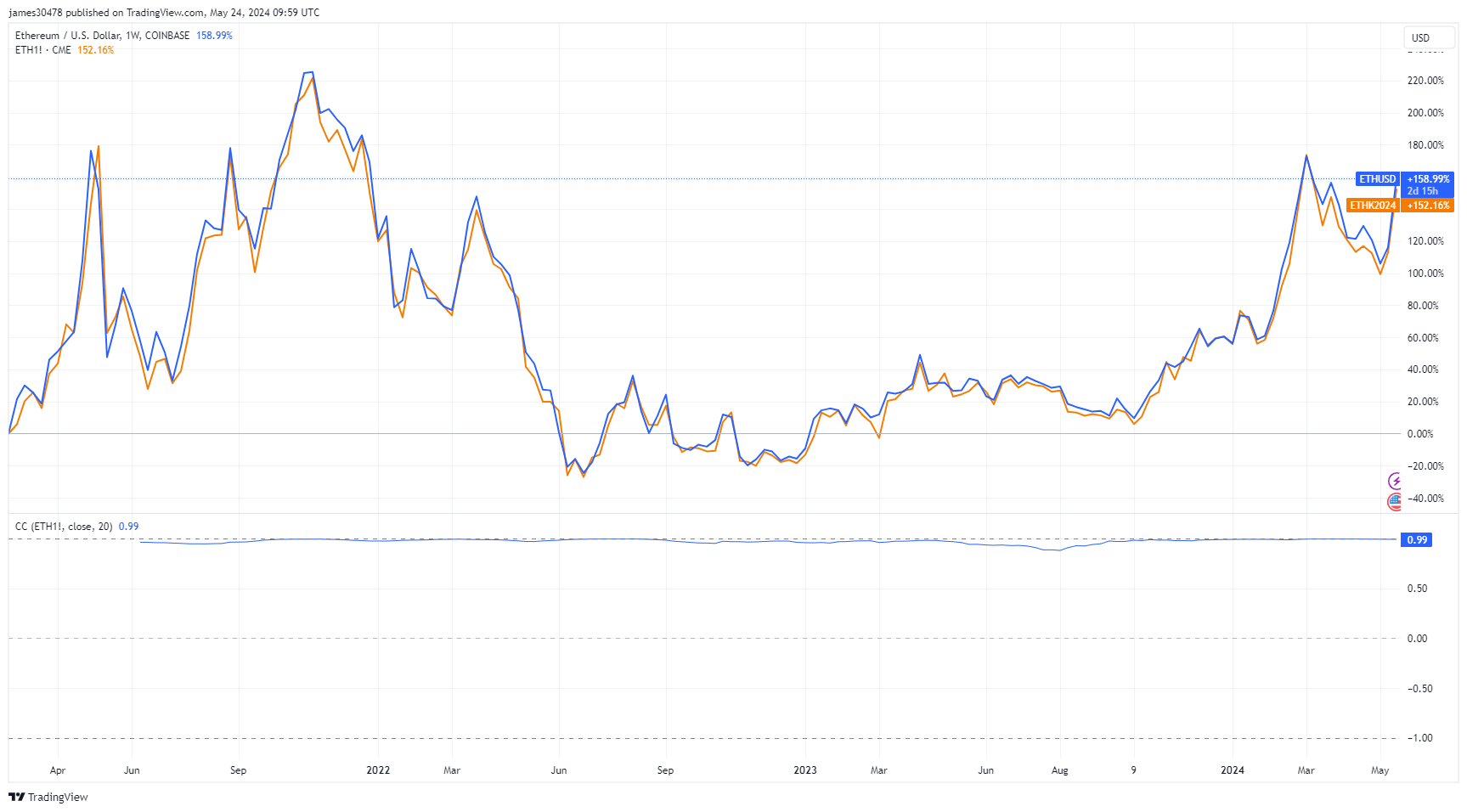

In accordance with TradingView information, the correlation between Ethereum futures and the spot market has been roughly 99% because the approval of the Ethereum futures ETF on CME in 2021.

Nate Geraci, President of The ETF Retailer, shared paperwork highlighting the shut relationship between the ETH spot and futures markets, some extent acknowledged by the SEC.

Given these elements, no different digital belongings token moreover Bitcoin and Ethereum would obtain ETF approval within the close to future with out new CME product releases. CME does supply reference charges for added digital belongings corresponding to Aave, Chainlink, Polkadot, and Uniswap however doesn’t supply them as tradeable merchandise.

The publish Bitcoin, Ethereum ETFs stand alone as SEC unlikely to approve non-CME futures listed digital belongings appeared first on CryptoSlate.