Billionaire enterprise capitalist Chamath Palihapitiya believes that the US economic system is already within the midst of a downturn.

In a brand new episode of the All-In Podcast, Palihapitiya explores why greater than half of Individuals imagine the economic system is in a recession though the GDP rose by 1.6% final quarter.

In keeping with Palihapitiya, the unfavourable sentiment might have one thing to do with the elements used to measure the GDP, which he notes could also be giving an inaccurate sense of the state of the US economic system.

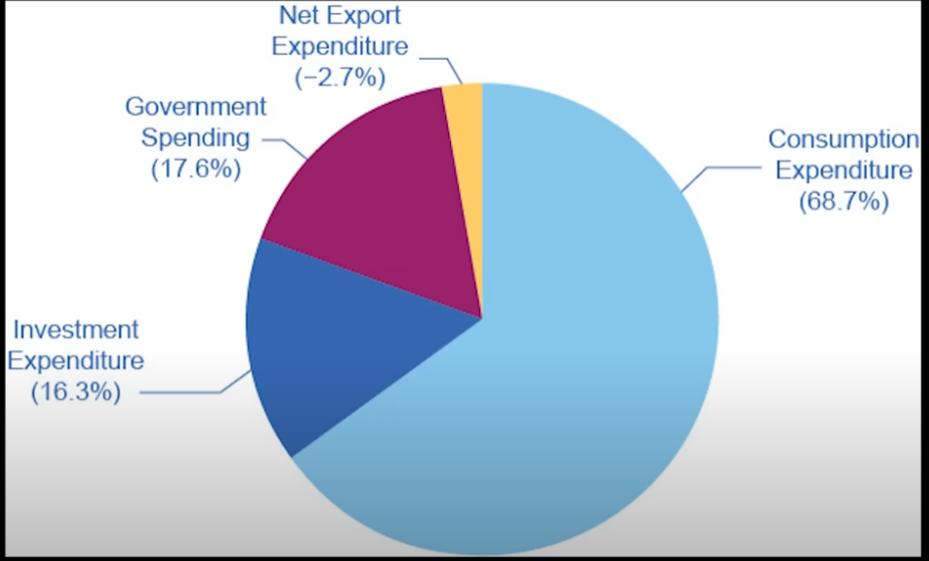

“[The GDP] is the sum of 4 issues. Most of it’s what folks spend. Then the following large chunk is what corporations and governments spend and the final is what we export to different international locations.”

The billionaire explains that buyers and corporations have a tendency to save lots of and scrimp when rates of interest are excessive. Palihapitiya says customers would moderately maintain their cash sitting in banks to generate curiosity whereas corporations restrict their investments as a result of borrowing cash is dear.

When rates of interest are low, the enterprise capitalist says customers and corporations are incentivized to spend. The price of capital is cheaper and cash sitting in banks will not be producing curiosity.

However the identical dynamic doesn’t seem to use to the federal government. In keeping with the billionaire, the federal government spends no matter prevailing charges.

“Sadly, it seems our governments in America, they simply maintain spending increasingly more. So even when internet curiosity revenue is small, even when internet curiosity revenue is excessive, they’re similar to, ‘Neglect it, the faucets are on.’

So what does this all imply? I believe what it actually means is that we do a really poor job of measuring all these dynamics collectively. So I really belief the survey knowledge of those people greater than I belief the GDP report within the sense that I believe it extra precisely captures this dynamic.

Charges are at 6%, individuals are saving extra, they’re not getting paid extra, issues are costing extra. The federal government is providing you with free cash so that you type of really feel like the whole lot is transferring in order that the GDP measurement, the way in which that it’s classically achieved, reveals that, ‘Wow we grew at 3% of 4%,’ however the common particular person American isn’t feeling that. They’re really feeling that they’ve much less cash.

I might really go along with them and truly say if we don’t revisit this factor from first rules, we’re going to get this dynamic the place we predict one factor is occurring however the precise actual reverse is occurring. On this case, I do suppose we’re in a quasi-synthetic recession.”

Palihapitiya seems to recommend that the economic system is already in a recession however GDP numbers don’t replicate that state because of sustained authorities spending.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney