The world’s largest cryptocurrency, Bitcoin (BTC), has been consolidating over the previous week, buying and selling between $67,000 and $70,000 after experiencing a quick 20% value correction that despatched it as little as $56,400 in early Could.

This consolidation interval comes as inflows into the US spot Bitcoin ETF market have reignited, and promoting stress seems to have cooled off, each within the ETF market and amongst Bitcoin traders extra broadly.

Bitcoin Promoting Stress Fades

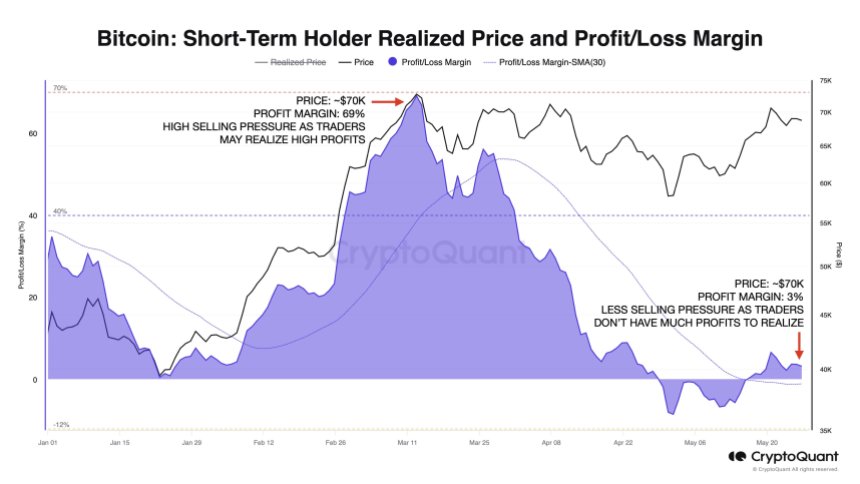

In accordance to Julio Moreno, head of analysis at on-chain market analytics agency CryptoQuant, the present Bitcoin value degree of $70,000 differs from when it final reached that mark in March.

Moreno notes that merchants at the moment are exerting a lot decrease promoting stress, as unrealized earnings are solely round 3%, in comparison with 69% in early March. This means that a lot of the “heavy promoting” has been exhausted, as seen within the chart under.

Associated Studying

Santiment knowledge additionally exhibits that Bitcoin has as soon as once more eclipsed a $70,000 market capitalization, even because the US inventory market took a hiatus for the Memorial Day vacation.

Market intelligence platform Santiment sees this as an encouraging signal, because it demonstrates BTC’s potential to carry out positively on days when it isn’t intently correlated with the first inventory market, which has been the case for a lot of 2022.

Remaining Pre-Breakout Consolidation Part

Regardless of this constructive momentum, crypto analyst Rekt Capital has famous that Bitcoin’s newest weekly candle closed under the vary excessive resistance of its ongoing “re-accumulation” section, which spans roughly $60,000 to $70,000.

This doubtless sentences the main cryptocurrency to additional consolidation inside this vary, aligned with Rekt Capital’s thesis that two phases stay within the present bull cycle: the post-halving re-accumulation section and the “parabolic rally section.”

Traditionally, Bitcoin has tended to consolidate round all-time highs earlier than embarking on essentially the most illustrative stretch of its bull cycles. In accordance with the analyst, Bitcoin has certainly been consolidating at these highs for fairly a while now, particularly by the requirements of earlier cycles.

Whereas there’s nonetheless room for additional sideways buying and selling at these elevated value ranges, the time remaining on this section is slowly working out. This results in the assumption that the long-awaited post-Halving rally, coupled with renewed investor sentiment, is poised to take the biggest cryptocurrency in the marketplace to even increased ranges than the present $73,700 reached in mid-March.

Associated Studying

As such, Bitcoin seems to be coming into a vital juncture in its present bull cycle. The consolidation and re-accumulation that has dominated the market in current months may quickly give solution to the following parabolic surge, ought to historic patterns maintain.

As of now, BTC has gained 2% prior to now 24 hours, including to its 10% constructive motion prior to now month alone. Bitcoin is presently buying and selling at $70,200.

Featured picture from Shutterstock, chart from TradingView.com