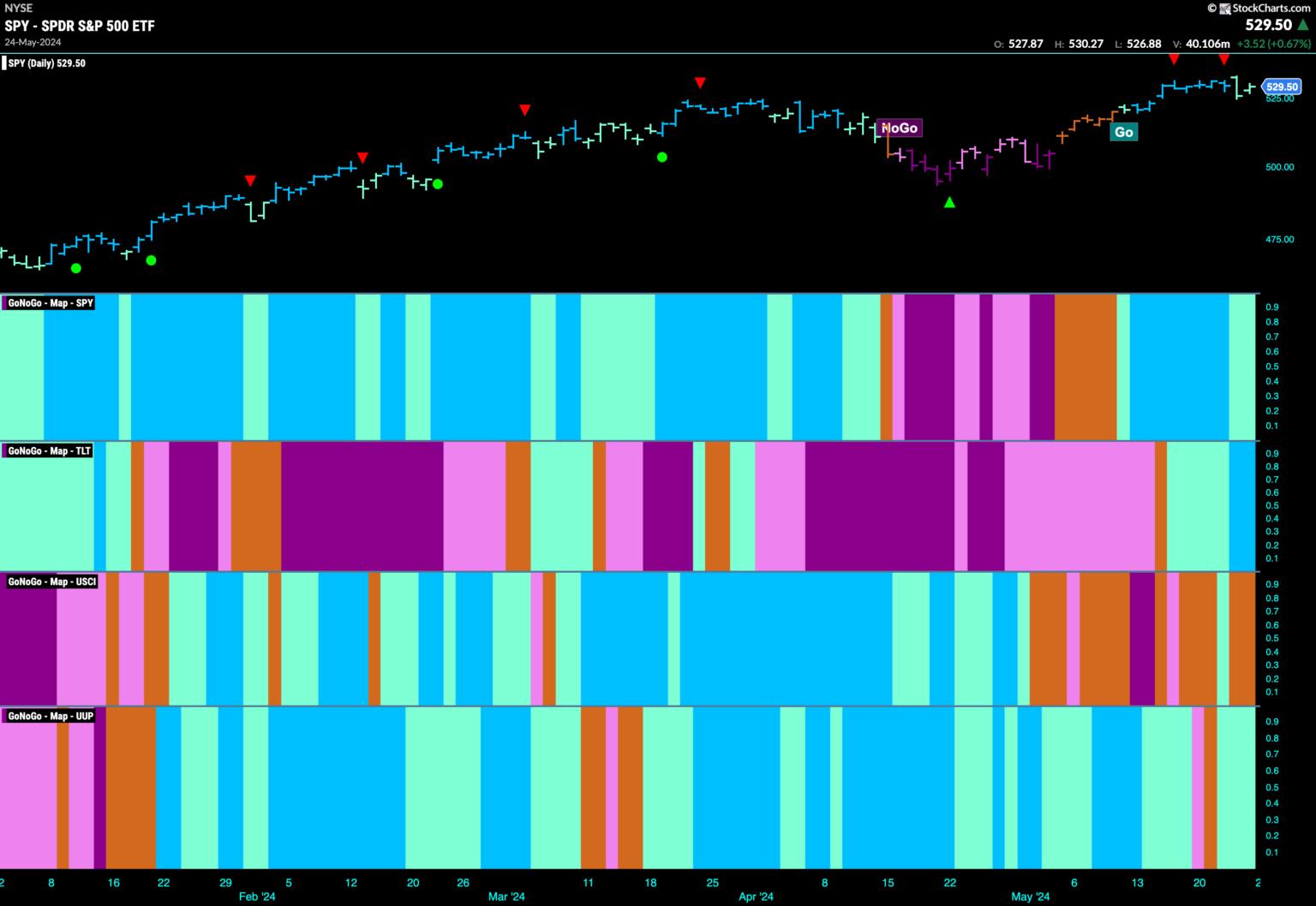

Good morning and welcome to this week’s Flight Path. We noticed some weak spot this week as value pulled again a bit of from all time highs. Momentum cooled, we noticed this within the type of Go Countertrend Correction Icons (crimson arrows) and GoNoGo Pattern painted weaker aqua bars. Treasury bond costs gained energy and painted blue bars. U.S. commodity index continued to indicate market uncertainty and the greenback regained “Go” colours albeit weaker aqua.

$SPY Exhibits Buyers Digesting Features

The “Go” remained this week however costs cooled because the market absorbed the features we have seen over the previous few weeks. Because the week of buying and selling got here to a detailed, we noticed weak spot as GoNoGo Pattern painted a few aqua bars. We are going to now prove eye to the oscillator panel and watch as GoNoGo Oscillator approaches the zero line. We are going to look to see if it finds help at this degree and bounces again into optimistic territory. If it does, we are going to see Go Pattern Continuation (inexperienced circle) and may count on value to make an assault on a brand new greater excessive.

The bigger weekly chart exhibits that the bigger image stays extraordinarily bullish with one other robust blue bar painted and value in any respect time highs. GoNoGo Oscillator is in optimistic territory however not but overbought after having discovered help on the zero degree.

Treasury Charges Flash “Go Fish” Bars

GoNoGo Pattern was unable to proceed portray amber “Go Fish” bars as final week got here to an finish. As costs rallied from the latest low, the indicator rolled out of “NoGo” colours and painted a few unsure “Go Fish” bars. It is going to be vital to notice now by which path the pattern goes subsequent. If it falls again into “NoGo” bars that may very well be a optimistic for shares, if it transitions from amber to “Go” colours that might pose an issue. GoNoGo Oscillator is using the zero line the place we see the beginnings of a GoNoGo Squeeze constructing. The path of the Squeeze break will doubtless decide value’s subsequent pattern.

Greenback Recaptures “Go” Pattern

After a quick flirtation with a “NoGo” and a “Go Fish” bar, the greenback was in a position to regain “Go” colours albeit weaker aqua ones. That is an inflection level for the greenback, as we are able to see that GoNoGo Oscillator is again testing the zero line from under. The oscillator has been in destructive territory for a number of weeks now, so if the “Go” pattern is to outlive, it might want to break again into optimistic territory. If it does, we are going to doubtless see the “Go” pattern strengthen. Whether it is rejected once more on the zero degree, then we are going to count on additional struggles for value.

The weekly chart continues to indicate us how vital these ranges are. With value now attempting laborious to seek out help at prior excessive ranges from over a 12 months in the past, GoNoGo Oscillator has crashed again to the zero line. We are going to watch to see if it finds help right here. If it does, we are going to see a Go Pattern Continuation Icon (inexperienced circle) below the worth bar as an oscillator bounce again into optimistic territory will inform us that momentum is resurgent within the path of the underlying “Go” pattern.

Tyler Wooden, CMT, co-founder of GoNoGo Charts, is dedicated to increasing the usage of information visualization instruments that simplify market evaluation to take away emotional bias from funding choices.

Tyler has served as Managing Director of the CMT Affiliation for greater than a decade to raise buyers’ mastery and talent in mitigating market threat and maximizing return in capital markets. He’s a seasoned enterprise govt centered on academic expertise for the monetary providers trade. Since 2011, Tyler has introduced the instruments of technical evaluation around the globe to funding companies, regulators, exchanges, and broker-dealers.

Alex Cole, CEO and Chief Market Strategist at GoNoGo Charts, is a market analyst and software program developer. Over the previous 15 years, Alex has led technical evaluation and information visualization groups, directing each enterprise technique and product growth of analytics instruments for funding professionals.

Alex has created and applied coaching packages for big firms and personal shoppers. His instructing covers a large breadth of Technical Evaluation topics, from introductory to superior buying and selling methods.

Be taught Extra