Latest analytical insights from FireCharts 2.0 are indicating important maneuvers by main stakeholders of Bitcoin—also known as “whales”—that are impacting the cryptocurrency’s value actions. These stakeholders are altering liquidity patterns in a way that implies a strategic push in the direction of a extra tightly managed buying and selling vary.

What Bitcoin Whales Are Up To

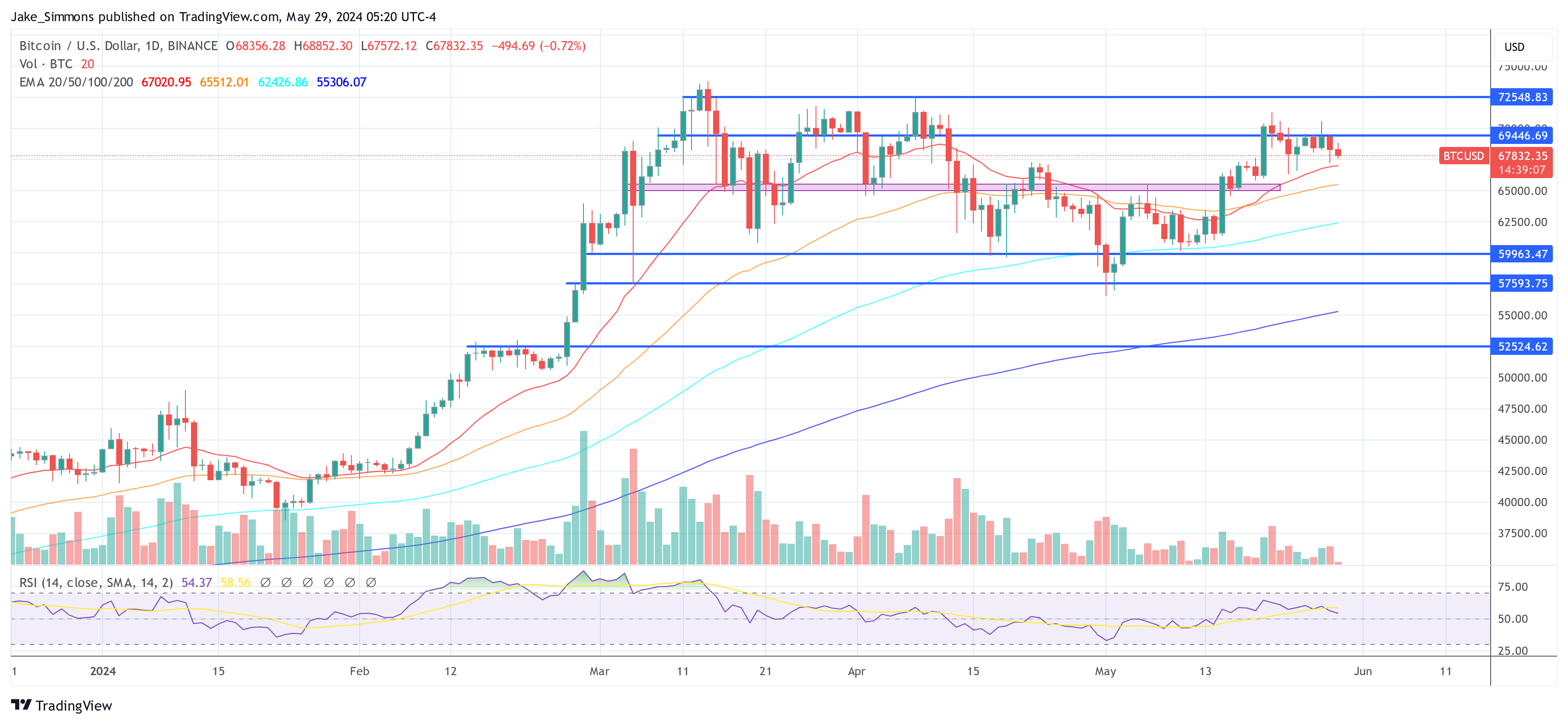

In keeping with Materials Indicators, a sophisticated buying and selling analytics, there was a noticeable adjustment within the distribution of liquidity inside Bitcoin’s order e book. Particularly, there’s a lower in ask liquidity at greater value factors, coupled with a rise in bid liquidity ranging from $60,000 to $67,000. This dynamic is ready to compress Bitcoin’s value right into a narrower vary, a situation anticipated by the platform because the digital asset escalated above $52,000.

The discussions about Bitcoin’s value trajectory have been rife with hypothesis a few potential pump to $73,000, particularly following its bounce from a low of $52,000. Regardless of a current excessive close to $70,600, which resulted in a pointy rejection, the sentiment stays cautiously optimistic. “There was quite a lot of chatter since late final week calling for a pump to $73k, and there are reputable the explanation why that may be a close to time period goal, and why it’s nonetheless potential regardless of the rejection from $70.6k we noticed on Monday,” famous Materials Indicators.

Associated Studying

From a macroeconomic perspective, Bitcoin’s prospects seem exceedingly bullish. “The outlook for Bitcoin is actually as bullish because it’s ever been,” mentioned a consultant from Materials Indicators throughout a current livestream. They kept away from reiterating the specifics, urging viewers to revisit the earlier week’s evaluation for a deeper understanding.

In distinction, the technical evaluation paints a extra nuanced image. Regardless of the favorable macro outlook, Bitcoin has constantly failed to verify a resistance/assist (R/S) flip at $69,000—a vital stage for confirming bullish momentum. This ongoing failure is emblematic of the bulls’ wrestle to take care of upward stress and safe a brand new all-time excessive (ATH). By integrating order e book information with technical indicators, analysts have noticed a progressive downward motion in blocks of ask liquidity, from preliminary placements round $75,000-$76,000 to current figures close to $70,000-$71,500.

Trying ahead, the pivotal query is: how low can Bitcoin realistically go earlier than discovering substantial assist? To deal with this, analysts at Materials Indicators flip to a mix of technical evaluation and real-time order e book information. The convergence of Bitcoin’s 21-Day, 50-Day, and 100-Day Shifting Averages round $65,000-$66,000 provides a compelling case for potential assist. The 21-Day MA, specifically, is favored for its historic reliability as each resistance and assist.

Associated Studying

Order e book information corroborates this evaluation, displaying a strengthening of ask liquidity resistance above $70,000, whereas bid liquidity is strategically positioned all the way down to as little as $58,000. The biggest concentrations of bid liquidity point out the strongest assist at $60,000 and $65,000, with considerably lesser assist round $66,000 and $67,000.

Regardless of the complicated interaction of things within the close to time period, the long-term perspective stays overwhelmingly bullish. The important question for the market is when, not if, a reputable breakout will happen. Observations from the order e book present greater than $200 million in asks stacked from $71,000 to $75,000, juxtaposed with round $90 million in bids between $65,000 and $67,000. If ask liquidity doesn’t skinny out, bid liquidity might want to strengthen considerably to set off a sustainable break into the $70s.

In keeping with Materials Indicators, probably the most favorable situation would see Bitcoin set up a agency consolidation vary above $65,000, validate an R/S Flip at $69,000, and stabilize above this stage earlier than aiming for a brand new ATH. Such a improvement wouldn’t solely verify the bullish development but in addition pave the best way for sustained upward momentum based mostly on the present order e book traits and technical analyses. This trajectory, they counsel, would offer the healthiest market development in gentle of the present circumstances.

At press time, BTC traded at $67,832.

Featured picture created with DALL·E, chart from TradingView.com