Mt. Gox, the defunct Bitcoin (BTC) change that suffered a significant collapse in 2014 has just lately initiated payout distribution to collectors ready for it.

The discharge of a considerable quantity of BTC, equal to $9.4 billion, on Could twenty seventh has raised considerations about potential market liquidity and value stability. In response, the on-chain market intelligence platform CryptoQuant has offered an evaluation of the potential impacts of this growth.

Potential Market Results

In response to the agency’s evaluation, 138,000 Bitcoin moved considerably from Mt. Gox in seven transactions, every value 4,000 to 32,000 Bitcoin.

Initially, these funds had been transferred to a single handle and distributed to a few separate addresses, every holding 47,400 Bitcoin.

You will need to notice that these addresses stay beneath the management of Mt. Gox’s Rehabilitation Trustee, and no repayments to collectors have been made as of but. The consolidation of those funds means that the Trustee is actively getting ready for future repayments by the Rehabilitation Plan.

Associated Studying

At current, transfers throughout the Trustee-controlled addresses haven’t impacted the market instantly. Nonetheless, the agency notes that eventual compensation to collectors, focused for completion by October 31, 2024, might affect Bitcoin’s market dynamics.

For CryptoQuant, the market affect will rely upon numerous components, together with the timing, measurement, and method of the repayments. If and when the Trustee begins repaying collectors, it might introduce a considerable quantity of Bitcoin into the market, influencing liquidity and value stability. The agency concluded by stating:

There is no such thing as a quick promoting stress for Bitcoin from these actions because the transfers have occurred throughout the addresses of the identical entity (Mt. Gox Rehabilitation Trustee) and aren’t nonetheless accessible to the open market.

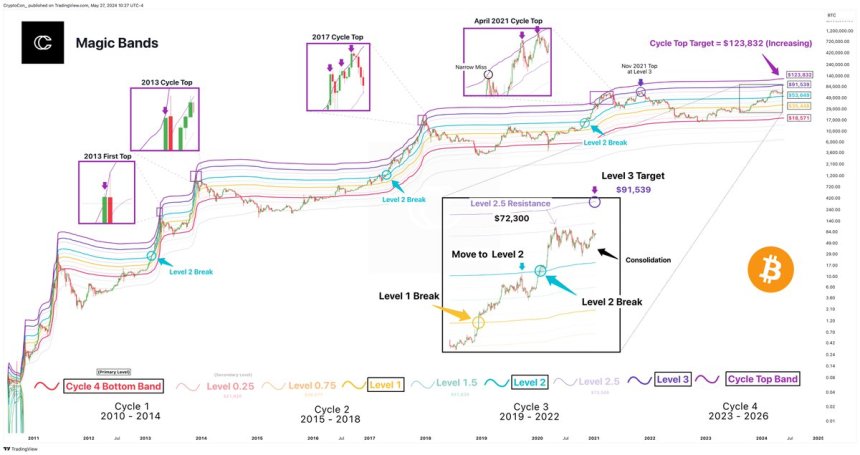

Bitcoin Worth Gravitates In the direction of ‘Stage 3’ At $91,000

As considerations develop over the potential draw back affect on Bitcoin’s value resulting from Mt. Gox’s compensation plan, analyst Crypto Con gives insights into the present state of Bitcoin value bands.

Bitcoin value bands confer with particular value ranges that analysts carefully monitor to gauge potential market actions. These bands act as magnets, attracting the worth to particular ranges.

Particularly, as seen within the chart above, “Stage 3” at $91,539 has emerged as a major value goal. Regardless of the continued consolidation at Stage 2.5, the analyst believes the market is exhibiting indicators of gravitating in the direction of Stage 3.

Moreover, Crypto Con notes that historic knowledge means that the cycle high band, priced at $123,000, will seemingly be reached with precision through the ultimate “Bitcoin parabola.”

Associated Studying

On the time of writing, the biggest cryptocurrency available in the market was buying and selling at $67,400, slowly dropping floor after continued failed makes an attempt to consolidate above the ley $70,000 stage, which is seen because the final hurdle earlier than a possible retest of its present all-time excessive of $73,700 reached on March 14.

Featured picture from Shutterstock, chart from TradingView.com