In a technical evaluation shared by famous crypto analyst Josh Olszewicz on the social platform X, there seems to be a big bullish sentiment constructing round Bitcoin, significantly if it surpasses the essential $72,000 mark. Olszewicz, leveraging each the Ichimoku Cloud and Fibonacci extensions, illustrates a state of affairs the place breaking this key resistance degree might catapult Bitcoin in direction of a goal of $91,500.

Right here’s How Bitcoin May Skyrocket To $91,500

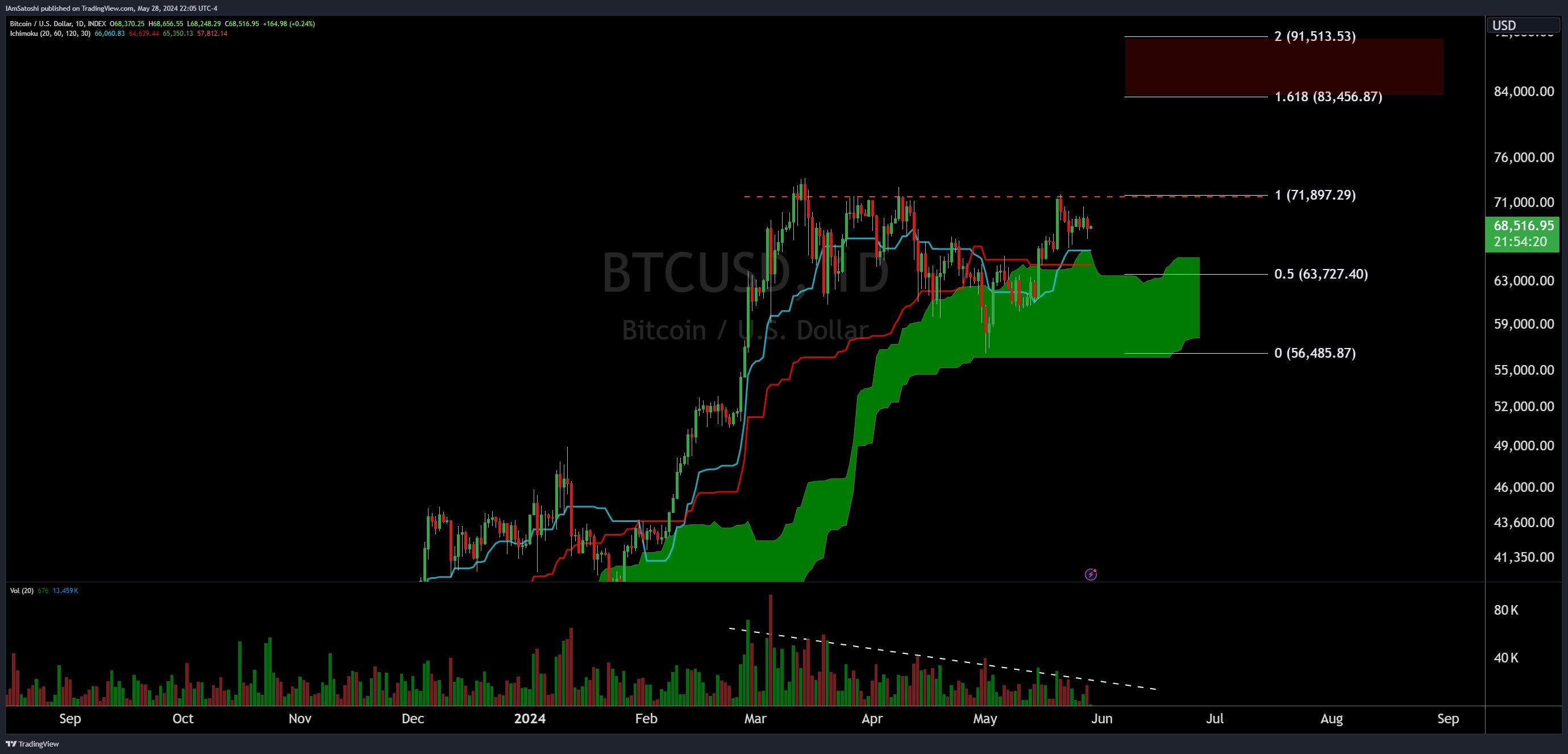

The evaluation makes use of the Ichimoku Cloud, a posh technical indicator that gives insights into the market’s momentum, development path, and potential areas of assist and resistance over completely different time frames. At present, Bitcoin’s value motion is depicted as being in a bullish part, located above the cloud. This positioning above the cloud is historically considered as a bullish sign, suggesting a powerful uptrend with sturdy assist ranges fashioned by the cloud’s decrease boundaries.

Within the Ichimoku setup, the conversion line (Tenkan-sen) and the baseline (Kijun-sen) cross sometimes, offering purchase or promote alerts based mostly on their intersection relative to the cloud. As of the most recent chart, the conversion line lately crossed above the baseline, reinforcing the bullish outlook depicted by the cloud’s positioning.

Associated Studying

Including one other layer to the technical narrative, Fibonacci extension ranges have been plotted from a big low at $56,485.87 as much as a excessive, offering potential targets and resistance ranges. The 0.5 Fibonacci extension degree is marked at $63,727.40, already surpassed by the present value trajectory.

The 1.0 extension finds itself at $71,897.29, intently aligning with the analyst’s famous pivotal degree of $72,000. Past this, the 1.618 extension at $83,456.87 represents a profitable first value goal, whereas the final word 2.0 extension looms at $91,513.53.

A key remark is the amount profile, which exhibits a declining development in buying and selling quantity. This reducing quantity can typically point out a interval of accumulation, as much less promoting stress permits costs to stabilize and doubtlessly construct a base for an upward breakout. The declining quantity development line underpins the consolidation part seen in current months, suggesting {that a} sharp motion might be imminent as soon as accumulation concludes.

Associated Studying

Olszewicz’s emphatic comment, “BTC: when this child hits $72k you’re going to see some severe shit,” underscores the excessive stakes related to this resistance degree. This isn’t merely a technical remark however a sign to the market that after $72,000 is decisively damaged, the trail to a lot larger ranges turns into more and more possible.

Such a breakout would seemingly activate a flurry of buying and selling exercise, as each retail and institutional traders would possibly see it as a affirmation of a sustained upward development, doubtlessly pushing the value in direction of the $91,500 mark indicated by the two.0 Fibonacci extension.

At press time, BTC traded at $67,783.

Featured picture created with DALL·E, chart from TradingView.com