Knowledge exhibits that the Bitcoin Realized Volatility metric has fallen to traditionally low ranges. What typically occurs after this sample varieties?

Bitcoin Realized Volatility Has Decline To Excessive Lows Not too long ago

In a put up on X, CryptoQuant writer Axel Adler Jr has mentioned concerning the newest pattern happening within the Realized Volatility of Bitcoin. The Realized Volatility right here refers to an indicator that mainly tells us about how unstable a given asset has been based mostly on its value returns inside a specified window.

When the worth of this metric is excessive, it signifies that the asset in query has skilled a lot of fluctuations throughout the interval. However, the low indicator implies that the value motion has been stale for the commodity.

Associated Studying

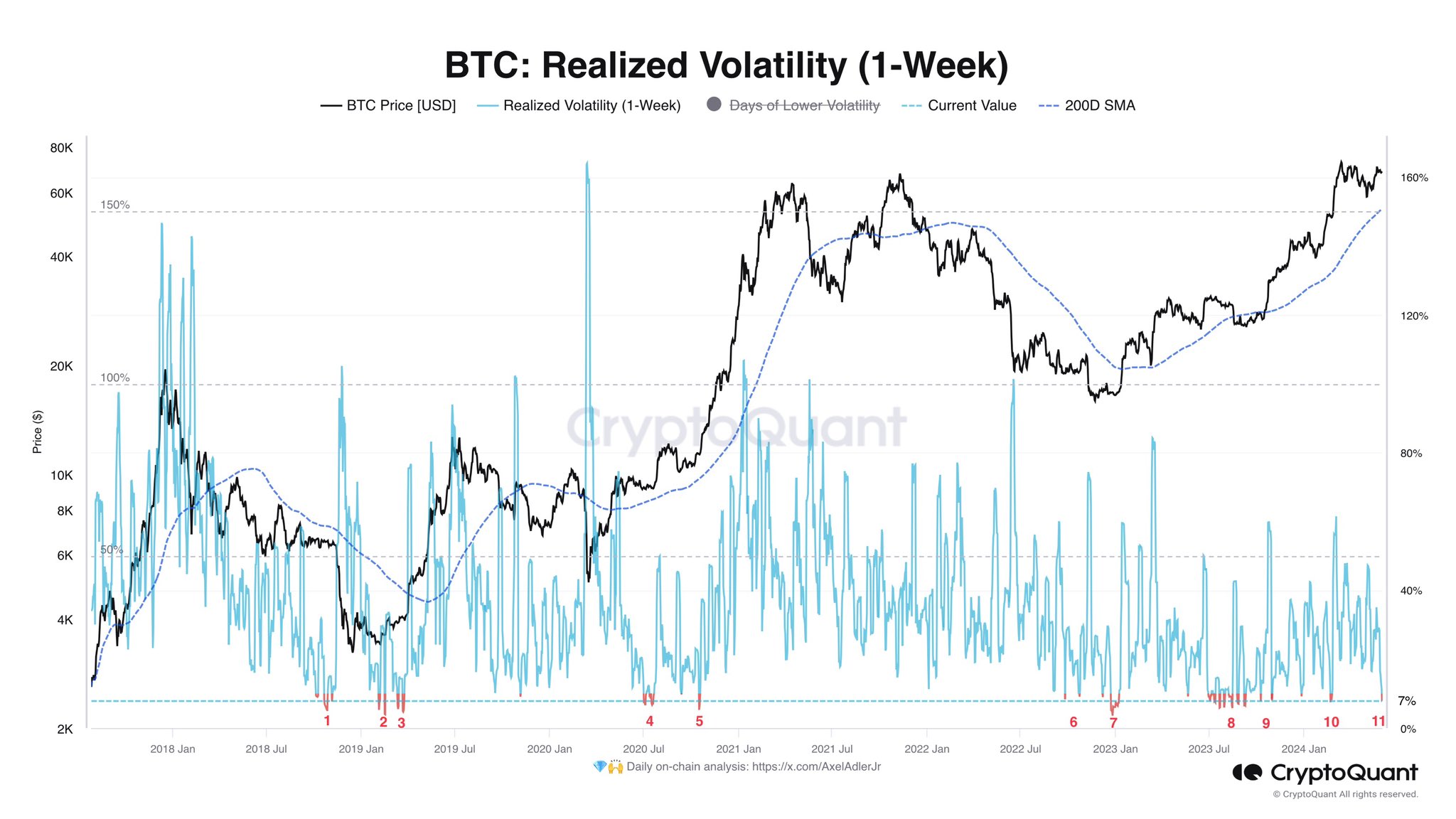

Now, here’s a chart that exhibits the pattern within the 1-week Realized Volatility for Bitcoin over the previous couple of years:

As displayed within the above graph, the 1-week Bitcoin Realized Volatility has declined to fairly low ranges of round 7% not too long ago. That is so excessive that solely ten different cases previously six years have seen the metric go equally low.

Which means the cryptocurrency’s current consolidation has been amongst the tightest in its historical past; as for what this pattern within the indicator may imply for the cryptocurrency, maybe previous patterns may present some hints.

An inspection of the chart reveals that such stale value motion within the asset has typically unwound with a burst of sharp volatility. The newest occasion occurred proper earlier than the rally in direction of the brand new all-time excessive (ATH).

Given this sample, it’s potential that the current BTC consolidation may additionally result in one other sharp transfer for the cryptocurrency. One thing to notice, nevertheless, is that the volatility rising out of lows within the Realized Volatility has traditionally gone both method, implying that the value transfer rising out of this tight vary may very effectively be a crash.

It stays to be seen how the Bitcoin value will develop from right here on out, given the traditionally stale motion it has witnessed over the previous week.

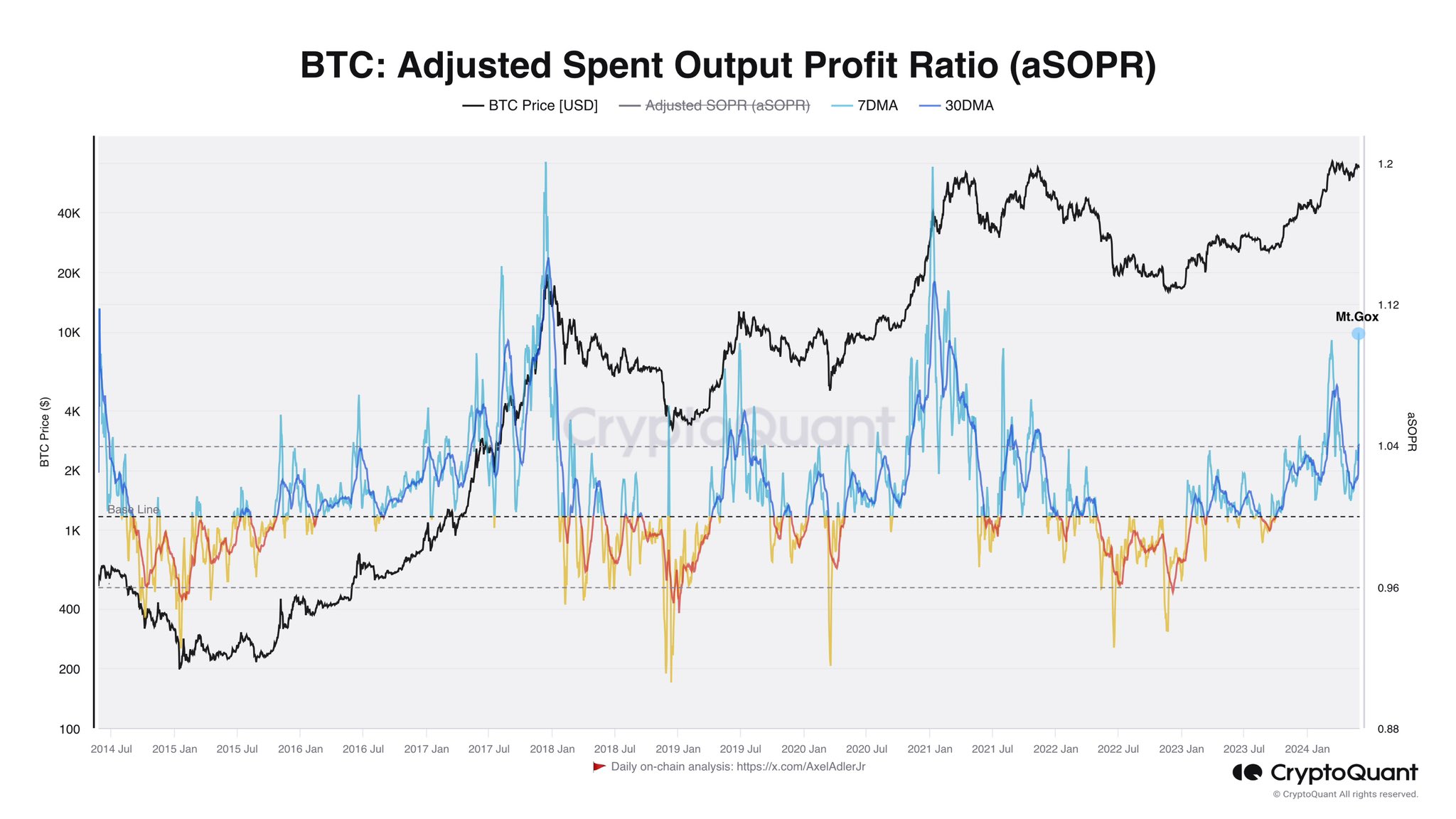

In different information, as Axel identified in one other X put up, the current motion from the bankrupt change Mt. Gox has meant that many on-chain indicators have proven false indicators.

The analyst has cited the Bitcoin Adjusted Spent Output Revenue Ratio (aSOPR) chart for instance.

The aSOPR retains observe of the web revenue or loss buyers throughout the community understand. Because the Mt. Gox BTC had been sitting nonetheless in wallets for fairly a very long time, it’s not shocking that its motion has “realized” a considerable amount of revenue.

Associated Studying

In fact, this spike within the indicator isn’t truly an indication of profit-taking, so it’s not a sign that will impression the market.

BTC Worth

Bitcoin has declined over the previous day as its value is now right down to $66,800.

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com