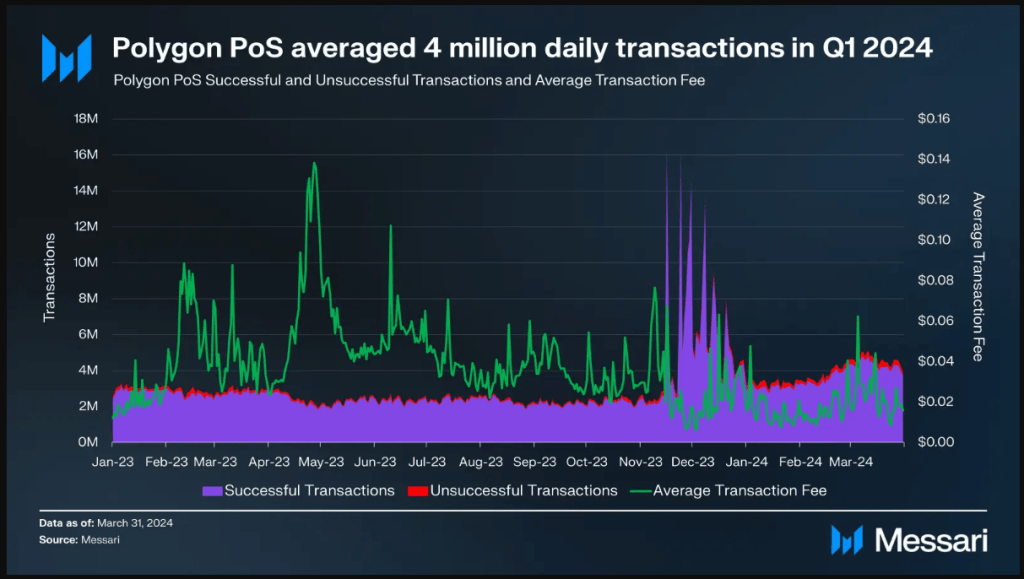

Polygon (MATIC), a Layer-2 scaling resolution for the Ethereum blockchain, finds itself in a curious place. Latest information from Messari paints an image of a community brimming with exercise – every day lively addresses surging practically 120%, new person sign-ups exploding by 70%, and every day transactions reaching a staggering 4 million. But, beneath this bustling floor lies a troubling undercurrent: a 19% drop in quarterly income in comparison with the earlier quarter, and a hefty 40% decline year-over-year.

Associated Studying

Polygon: A Community On Hearth

Polygon’s person base is clearly smitten. The primary quarter of 2024 witnessed a land rush, with new addresses flocking to the community at an unprecedented fee. This surge in person adoption translated right into a transaction frenzy, with every day interactions on the platform quadrupling.

The decentralized finance (DeFi) sector on Polygon additionally thrived, with the full worth locked (TVL) in DeFi initiatives climbing 30% in comparison with the earlier quarter. The non-fungible token (NFT) ecosystem on Polygon additionally obtained a shot within the arm, with gross sales quantity rising by practically 20%.

The Income Riddle

So, why the lengthy face amidst the celebratory confetti? The reply lies in Polygon’s dwindling income stream. Regardless of the exponential progress in exercise, the community’s coffers are taking successful.

The $7 million earned in Q1 2024 pales compared to the $10 million and $12 million raked in throughout the earlier quarter and the identical interval final 12 months, respectively. This disconnect between booming exercise and declining income is the million-dollar query that has analysts scratching their heads.

MATIC market cap at the moment at $6.8 billion. Chart: TradingView.com

Payment Fiasco Or Funding Flux?

There are two primary suspects behind this income paradox. The primary wrongdoer could possibly be Polygon’s transaction charge construction. Maybe, in a bid to draw extra customers, the community lowered its charges to an extent that, regardless of the huge enhance in transactions, the general income era suffered.

One other risk lies in a possible shift in Polygon’s income sources. Possibly there was a decline in revenue from a selected supply, resembling grants or partnerships, that wasn’t adequately compensated for by progress in different areas.

Associated Studying

What Lies Forward

Polygon faces a crucial juncture. The community’s capacity to draw customers and foster a vibrant DeFi and NFT ecosystem is plain. Nonetheless, if it fails to deal with the income conundrum, its long-term sustainability could possibly be in danger. Shifting ahead, transparency from Polygon relating to its charge construction and income streams will probably be essential in assuaging investor issues.

Moreover, exploring different income fashions, resembling providing premium companies or strategic partnerships, could possibly be the important thing to unlocking Polygon’s full monetary potential.

Featured picture from Zameen.com, chart from TradingView