Legendary dealer Peter Brandt says one Bitcoin (BTC) chart appears to be like fairly much like the one printed by the inventory market within the mid-Eighties earlier than an enormous breakout.

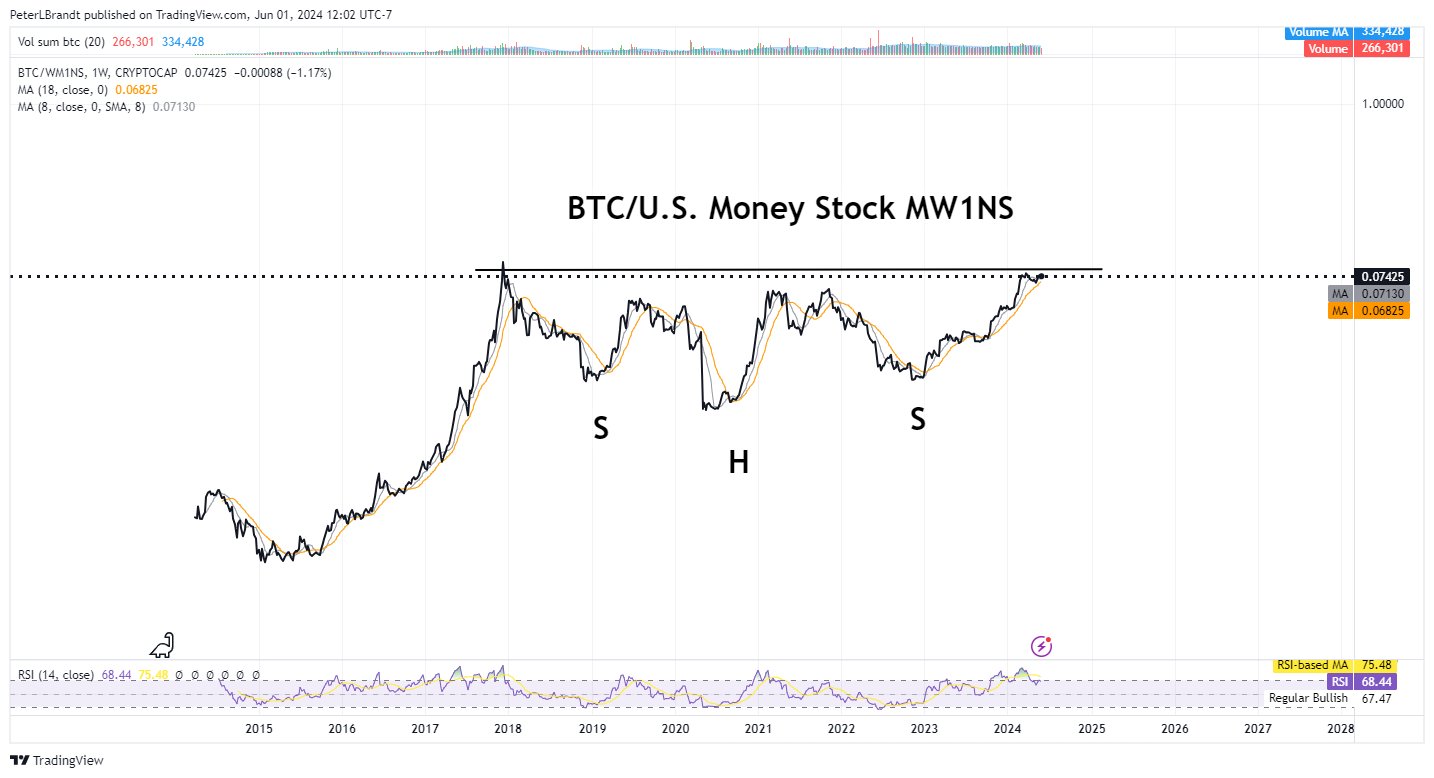

Brandt tells his followers on the social media platform X that he’s taking a look at Bitcoin versus the M1 cash provide chart (BTC/WM1NS), which compares the worth of BTC in opposition to all the cash sloshing within the US economic system.

“The argument for Bitcoin pertains to the eventual destruction of fiat foreign money items (e.g., USD) This chart… plots the worth of Bitcoin BTC in relationship to whole US cash inventory (M1). This ratio stays beneath the Dec 2017 excessive.”

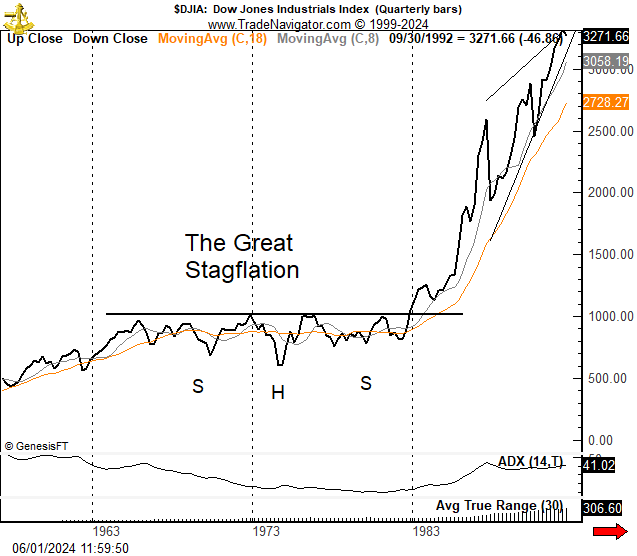

In response to Brandt, the BTC/WM1NS chart reminds him of a sample seen about 4 many years in the past when the Dow Jones Industrial Common (DJIA) index ignited a bull market to finish the stagflation of the Nineteen Seventies.

“Attention-grabbing to notice similarities in chart construction to DJIA throughout interval of Nice Stagflation of Nineteen Seventies. A few of you’ll deny the existence of continuation inverted H&S (head and shoulders) – so I’ll focus on it right here. Schabacker (1934) and Edwards and Magee (1948) acknowledge this sample by title. If the ID is nice sufficient for them, then it’s adequate for me.”

An inverted head and shoulders sample is a bullish formation indicating that consumers are now not ready for the worth to revisit lows earlier than getting into. Ought to BTC/WM1NS witness a breakout, it will counsel that Bitcoin’s worth is considerably outpacing the rising quantity of US {dollars}.

Brandt additionally predicts that Bitcoin will outperform gold within the coming months.

“Since its inception, Bitcoin BTC has gained in opposition to gold. This chart exhibits the variety of ounces of GC (gold) to purchase one BTC. The ratio ought to chop for one more 12 to 18 months – then advance to 100 ounces of GC to purchase a BTC.”

At time of writing, an oz of gold is equal to $2,329, suggesting a BTC worth of greater than $230,000 if the ratio hits Brandt’s goal.

Bitcoin is buying and selling at $69,055 at time of writing.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any losses you might incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please be aware that The Every day Hodl participates in internet affiliate marketing.

Generated Picture: DALLE-3