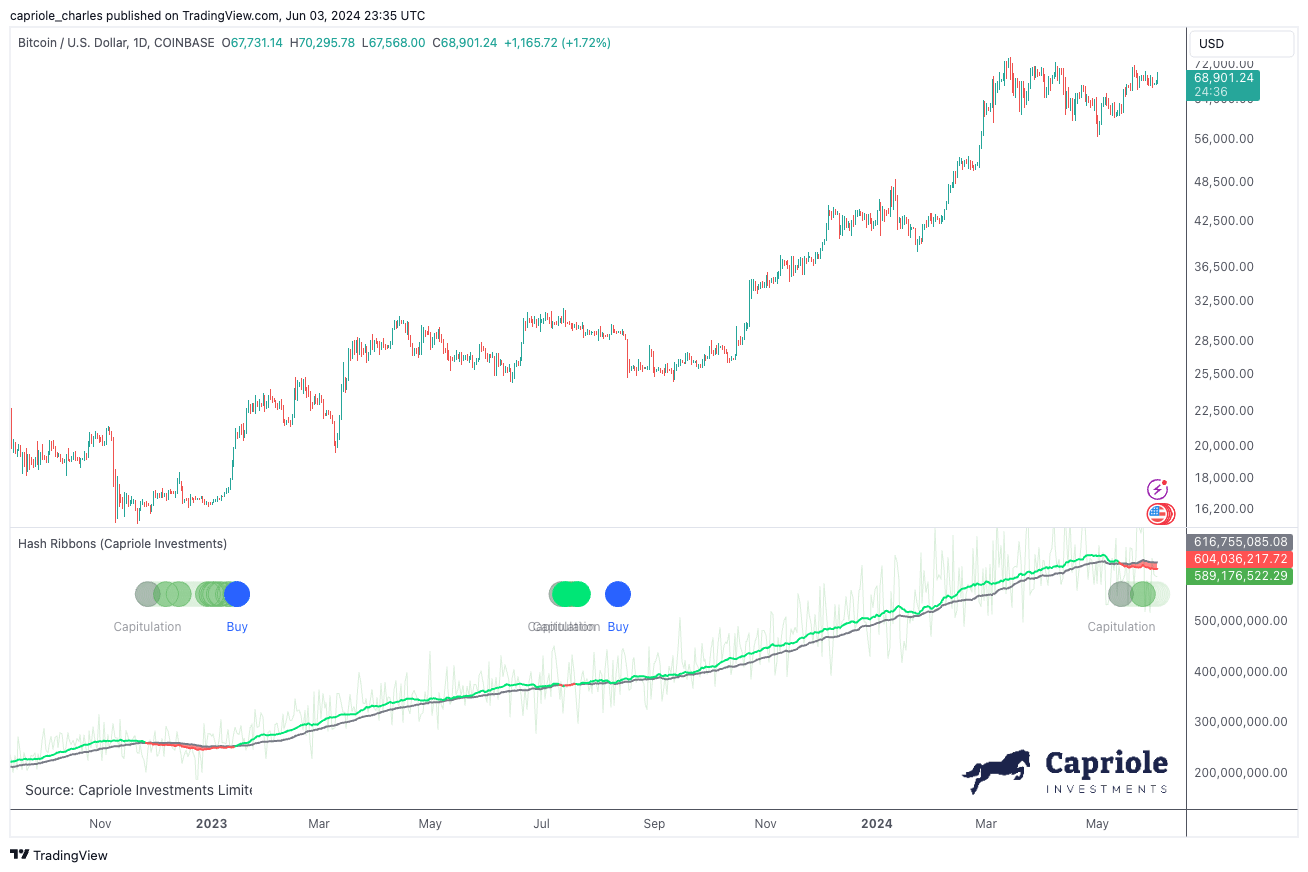

In his newest dispatch, Charles Edwards, CEO of the Bitcoin and digital asset hedge fund Capriole, has flagged a big market indicator within the newest version of the agency’s e-newsletter, Replace #51. Edwards factors to the activation of the “Hash Ribbons” purchase sign, a notable occasion that has traditionally indicated prime shopping for alternatives for Bitcoin.

Bitcoin Hash Ribbons Flash Purchase Sign

The Hash Ribbons indicator, first launched in 2019, makes use of mining knowledge to foretell long-term shopping for alternatives based mostly on miners’ financial pressures. The sign arises from the convergence of short-term and long-term shifting averages of Bitcoin’s hash fee, particularly when the 30-day shifting common falls under the 60-day. In accordance with Edwards, this occasion has “within the overwhelming majority of circumstances synced with broader Bitcoin market weak point, worth volatility and considerably long-term worth alternatives.”

The present Miner Capitulation, as highlighted by Edwards, started two weeks in the past and coincides with post-halving changes within the mining sector. This era typically results in the shuttering of operations and even bankruptcies amongst much less environment friendly miners. Edwards notes, “Simply as we’re seeing right this moment, these mining rigs will usually then be phased out over a number of weeks following the Halving leading to falling hash charges.”

Regardless of the historic profitability of miners, particularly with elevated block charges from new functions akin to Ordinals and Runes, Edwards means that the market shouldn’t overlook the present alternative signaled by the newest Miner Capitulation. “Whereas this capitulation is happening when miners have broadly been worthwhile, we’d be remiss to not notice this uncommon alternative,” acknowledged Edwards.

Associated Studying

The Hash Ribbons haven’t been with out their critics, with every prevalence stirring debate in regards to the present relevance and accuracy of the sign. Edwards addressed these criticisms by referencing the earlier 12 months’s sign, which correlated with Bitcoin buying and selling within the $20,000 vary, reinforcing the indicator’s predictive energy. “Each prevalence brings some debate about their relevance right this moment, or why the present sign maybe doesn’t rely,” Edwards defined.

Edwards recommends that the most secure strategy to leveraging the Hash Ribbons is by ready for affirmation via renewed hash fee development and a constructive worth development. He concludes, “The most secure (lowest volatility alternative) to allocate to the Hash Ribbons technique is on affirmation of the Hash Ribbon Purchase which is triggered by renewed Hash Charge development (30DMA>60DMA) and a constructive worth development (as outlined by the 10DMA>20DMA of worth).”

Broader Market Context

Transitioning from the technical to the contextual, Edwards discusses the altering regulatory panorama that has lately change into extra favorable to cryptocurrencies. The SEC’s approval of an Ethereum ETF, categorizing ETH as a commodity, marks a big shift within the regulatory strategy in the direction of cryptocurrencies and displays rising institutional acceptance.

Associated Studying

“The reclassification of Ethereum and the approval of its ETF signify a pivotal shift in governmental stance on cryptocurrencies,” Edwards notes. “This might result in elevated institutional involvement and doubtlessly extra stability within the crypto markets.”

Moreover, Edwards factors to macroeconomic elements that would affect Bitcoin’s worth. The enlargement of the M2 cash provide and the Federal Reserve’s stance on rates of interest are designed to stimulate financial exercise. Nevertheless, Edwards warns of the potential long-term penalties of those insurance policies, akin to inflation, which might improve Bitcoin’s enchantment as a hedge towards financial devaluation.

“Bitcoin was conceptualized as a substitute for conventional monetary programs in instances of financial stress,” Edwards remarks. “The present financial insurance policies reinforce the basic causes for Bitcoin’s existence and will result in elevated adoption.”

On the technical entrance, Edwards gives an evaluation of Bitcoin’s worth actions, highlighting the current breakout and consolidation above important resistance ranges. He units a conditional mid-term worth goal of $100,000, contingent upon the market sustaining its present momentum and the month-to-month shut remaining above a important threshold of $58,000.

At press time, BTC traded at $69,008.

Featured picture created with DALL·E, chart from TradingView.com