The echoes of 2021’s meme inventory saga reverberated by way of monetary markets this morning, because the obscure ROAR meme coin and online game retailer GameStop skilled a meteoric rise fueled by social media nostalgia. The catalyst? The return of a well-known face – Keith Gill, higher recognized by his on-line moniker “Roaring Kitty.”

Associated Studying

Kitty Claws Again In

Retail buyers have been despatched scrambling after Gill, a famous person among the many on-line funding group on Reddit’s WallStreetBets discussion board, posted a cryptic message hinting at a big stake in GameStop.

The publish, that includes a picture of the “Uno Reverse” card, despatched hypothesis into overdrive. Shortly after, Gill confirmed his bullish stance by revealing a large holding of 5 million GameStop shares, valued at roughly $116 million based mostly on Friday’s closing value.

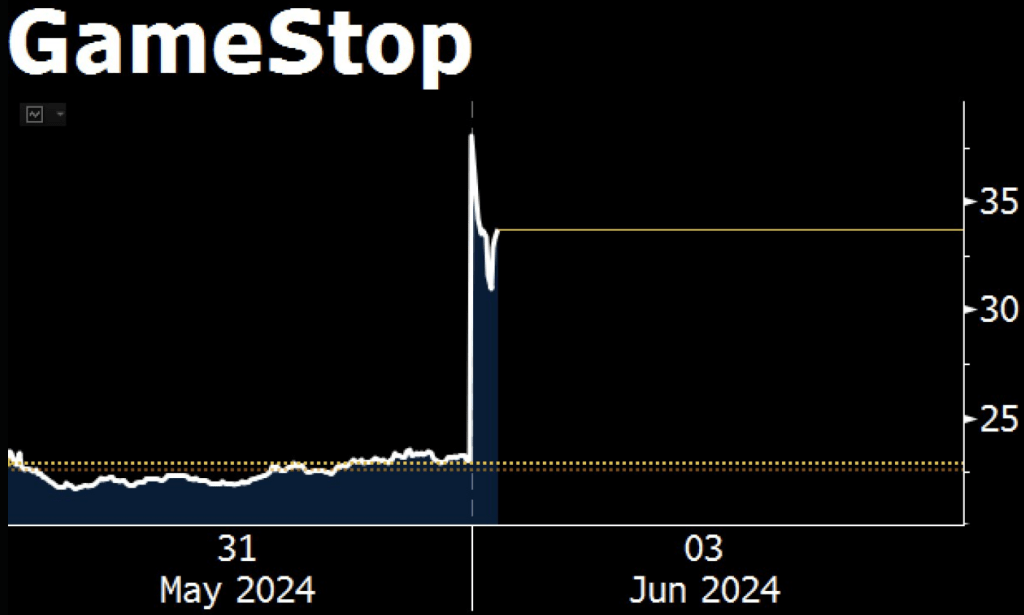

Within the 20 minutes that adopted Gill’s publish, GameStop’s inventory value on Robinhood’s in a single day markets shot up by 20% to $27.50. This enhance adopted the inventory’s Friday closing value of $23.14. This yr, the shares have elevated by virtually 40%, presumably on account of Gill’s sudden comeback.

This disclosure despatched shockwaves by way of the market. GameStop’s inventory, notorious for its volatility throughout the meme inventory frenzy of 2021, surged over 100% at its peak in pre-market buying and selling on Monday.

NOW: GameStop soars after the Reddit account that drove the meme-stock mania of 2021 posted what seemed to be a $116 million guess https://t.co/0mnyJF4lIf pic.twitter.com/rpRdA2AIWL

— Bloomberg Markets (@markets) June 3, 2024

Whereas the worth ultimately settled to a powerful 88% enhance, the roar from retail buyers was simple. The ROAR meme coin, seemingly named in homage to Gill’s on-line persona, mirrored the GameStop value surge of over 300%, reaching a excessive of $0.001643.

A Meme Inventory Revival?

The sudden rise of each ROAR and GameStop has reignited the controversy surrounding meme shares. These property, usually characterised by excessive volatility and pushed extra by on-line hype than conventional monetary metrics, captured the creativeness of retail buyers in 2021. Gill, who performed a pivotal function within the preliminary GameStop saga, seems to be a key participant on this potential revival.

Nonetheless, analysts stay cautious. GameStop itself is in a precarious place, having just lately offered a large chunk of shares to bolster its funds whereas dealing with continued web losses and projected gross sales declines. The corporate’s long-term prospects stay unsure, elevating questions on whether or not it is a real resurgence or just a nostalgic echo of 2021.

Associated Studying

Weighing Hype In opposition to Actuality

The latest surge in ROAR and GameStop presents a traditional risk-reward situation for buyers. Early contributors who purchased in at decrease costs stand to reap important earnings. Nonetheless, the inherent volatility of meme shares poses a big hazard of considerable losses.

Featured picture from HubPages, chart from TradingView