Bitcoin, the enigmatic digital forex, is again within the highlight because the US banking system grapples with mounting stress. Whereas some predict a stratospheric rise to $1 million per coin, fueled by financial woes, others stay skeptical.

Associated Studying

Banking On Bitcoin’s Rise?

Bitcoin advocates see it as a beacon of stability in a storm. In contrast to conventional property tied to the well being of establishments, Bitcoin boasts a finite provide and decentralized nature. This, they argue, positions it completely to learn from a “flight to security” state of affairs, the place buyers search refuge from a doubtlessly collapsing banking system.

The current historical past appears to help this narrative. In March 2023, the failures of distinguished establishments like Silicon Valley Financial institution coincided with a 40% surge in Bitcoin’s value inside every week. Business figures level to this as proof of Bitcoin’s function as an “uncorrelated asset class” – a hedge towards conventional monetary turmoil.

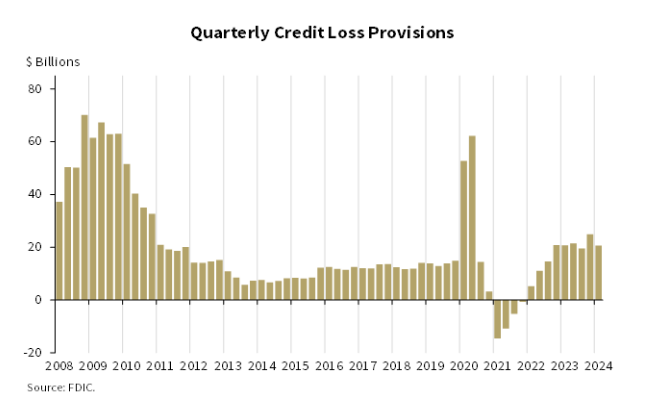

Additional bolstering this argument is the newest report by the Federal Deposit Insurance coverage Company (FDIC). The report paints a regarding image, highlighting a worrying pattern of unrealized losses on securities held by US banks.

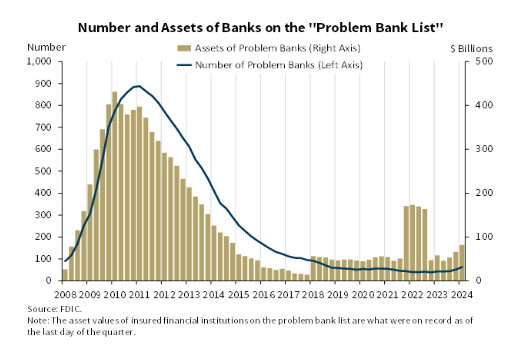

These losses, pushed by rising rates of interest, have ballooned to over $500 billion. Moreover, the variety of banks on the FDIC’s “Drawback Financial institution Checklist” has grown from 52 to 63 in only one quarter, elevating fears concerning the total well being of the sector.

Million-Greenback Dream Or Flight Of Fancy?

Whereas the potential for Bitcoin to realize worth appears simple, the bold value goal of $1 million faces robust headwinds. Consultants warn that such a dramatic surge may come at the price of a full-blown financial meltdown, a state of affairs that wouldn’t essentially profit Bitcoin in the long term.

Moreover, Bitcoin’s historic correlation with different property isn’t static. Whereas intervals of weak correlation exist, there have additionally been cases of robust correlation, significantly throughout broader market downturns. This casts doubt on Bitcoin’s capability to fully decouple itself from a struggling conventional monetary system.

Associated Studying

One other issue to think about is the current uptick within the M2 cash provide, a metric representing the whole cash circulating within the economic system. Traditionally, intervals of M2 enlargement have coincided with Bitcoin value will increase. Nonetheless, the interaction between cash provide and Bitcoin in an atmosphere with a doubtlessly shaky banking system stays an open query.

The Street Forward For Bitcoin

Bitcoin’s future is a little bit of a guessing recreation proper now. Banks within the US are having some issues, and that might make Bitcoin extra precious. But when the entire economic system goes downhill, even Bitcoin may undergo. So, all of it is determined by how dangerous issues get with the banks and the economic system usually.

Featured picture from Pngtree, chart from TradingView