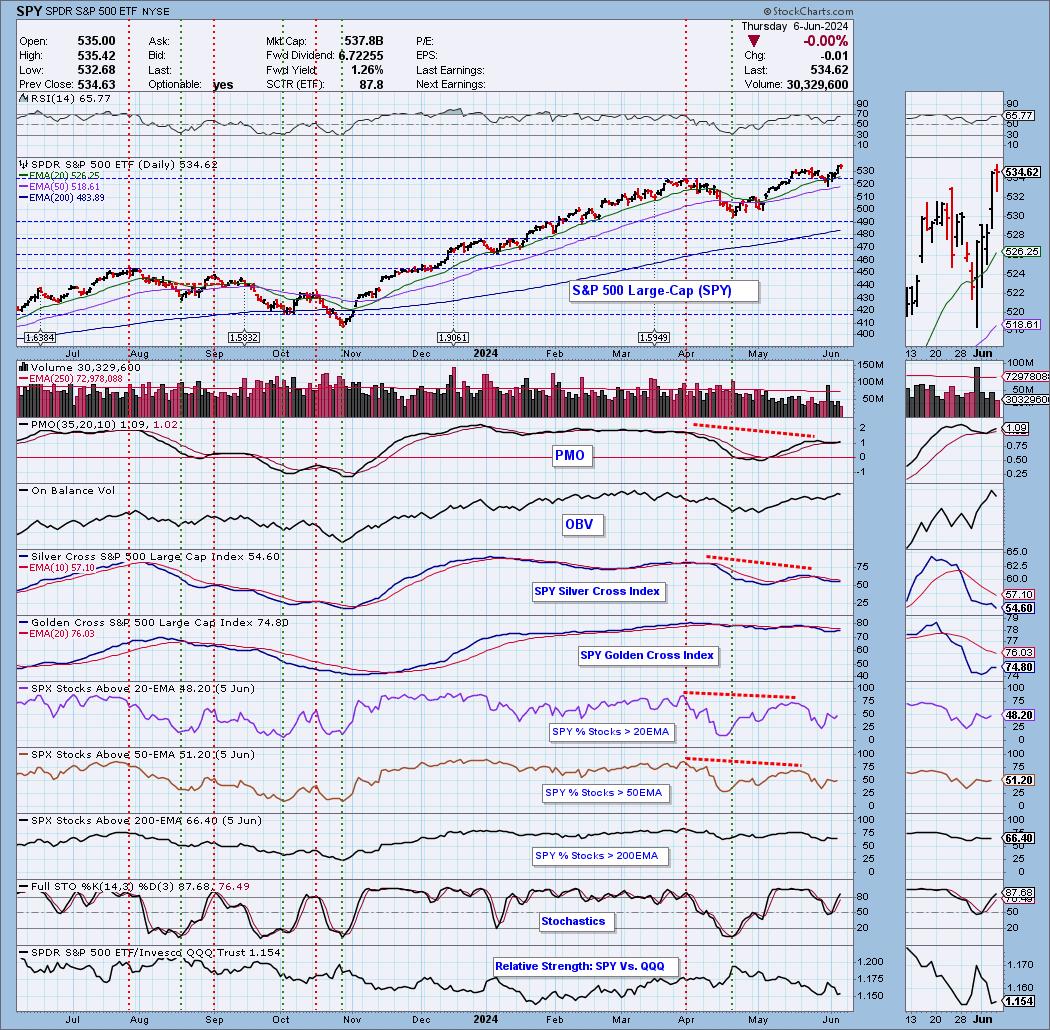

The Know-how Sector (XLK) continues to dominate and drive the rally, however fewer and fewer shares inside the sector are collaborating within the rally. We all know this as a result of our Silver Cross Index (SCI), which reveals the p.c of shares within the Know-how Sector with Silver Cross BUY Alerts (20-day EMA is above the 50-day EMA), is just at 54.60%. Virtually half of the shares are not on BUY Alerts.

Additional, trying on the seven years of information we have now on the SCI (chart beneath), we have been unable to seek out one other case the place XLK was making all-time highs with a Silver Cross Index studying so low that did not result in value weak point. In fact, we owe this dislocation to the magic of cap-weighting. Whereas fewer and fewer Know-how shares are collaborating within the rally, the mega-cap shares are those making new highs, and driving up the value of each value index of which they’re a element. The quite a few unfavourable divergences we will see are telling us that this in all probability will not proceed for lengthy.

Conclusion: Participation inside the Know-how Sector has been fading because the starting of the 12 months. Mega-cap shares are conserving costs elevated for now, however that in all probability will not final.

Be taught extra about DecisionPoint.com:

Watch the newest episode of the DecisionPointTrading Room on DP’s YouTube channel right here!

Strive us out for 2 weeks with a trial subscription!

Use coupon code: DPTRIAL2 at checkout!

Technical Evaluation is a windsock, not a crystal ball. –Carl Swenlin

(c) Copyright 2024 DecisionPoint.com

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and methods ought to by no means be used with out first assessing your individual private and monetary state of affairs, or with out consulting a monetary skilled. Any opinions expressed herein are solely these of the writer, and don’t in any manner symbolize the views or opinions of another particular person or entity.

DecisionPoint shouldn’t be a registered funding advisor. Funding and buying and selling choices are solely your duty. DecisionPoint newsletters, blogs or web site supplies ought to NOT be interpreted as a suggestion or solicitation to purchase or promote any safety or to take any particular motion.

Useful DecisionPoint Hyperlinks:

Worth Momentum Oscillator (PMO)

Swenlin Buying and selling Oscillators (STO-B and STO-V)

Carl Swenlin is a veteran technical analyst who has been actively engaged in market evaluation since 1981. A pioneer within the creation of on-line technical sources, he was president and founding father of DecisionPoint.com, one of many premier market timing and technical evaluation web sites on the net. DecisionPoint focuses on inventory market indicators and charting. Since DecisionPoint merged with StockCharts.com in 2013, Carl has served a consulting technical analyst and weblog contributor.

Be taught Extra