Onchain Highlights

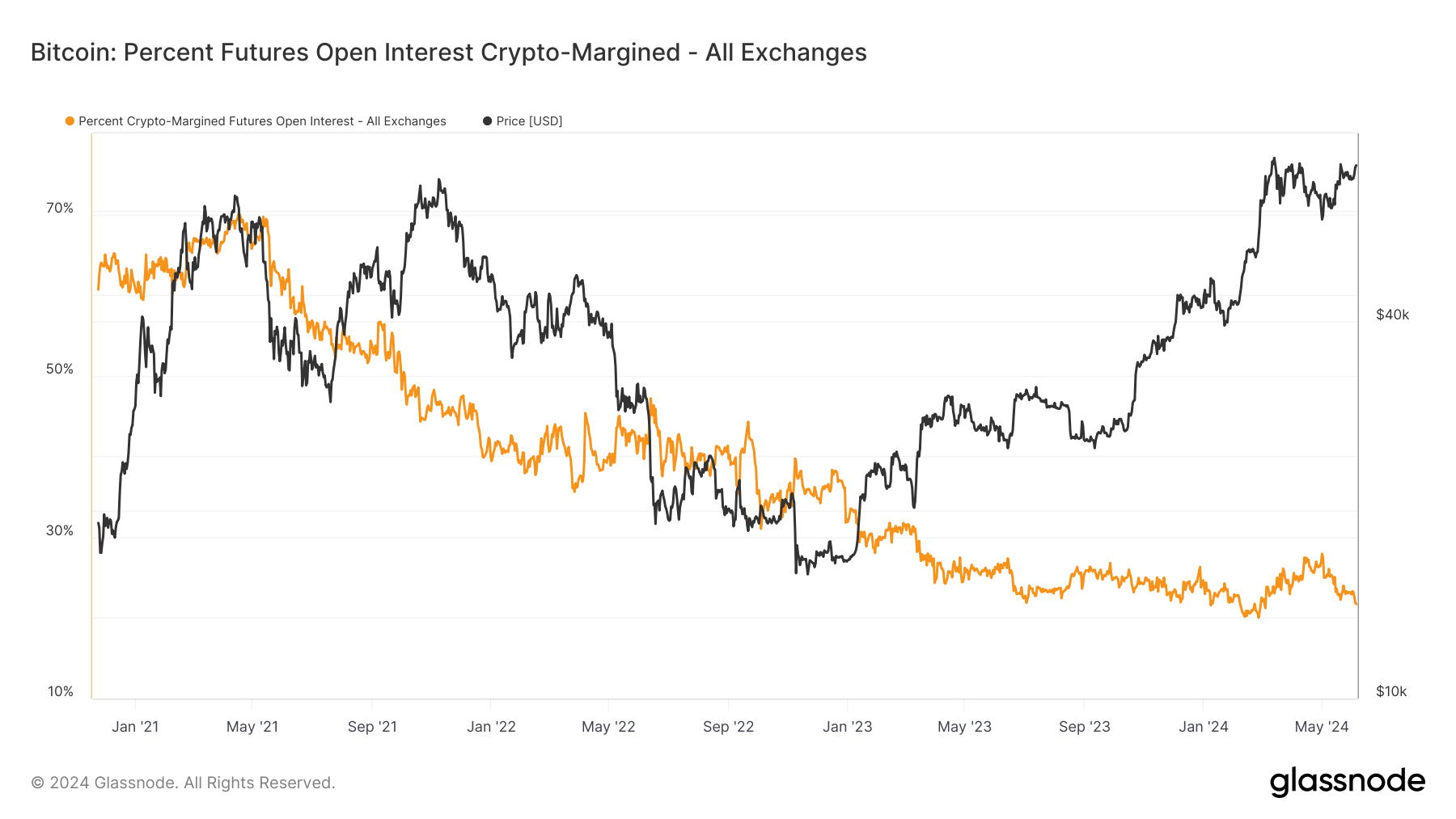

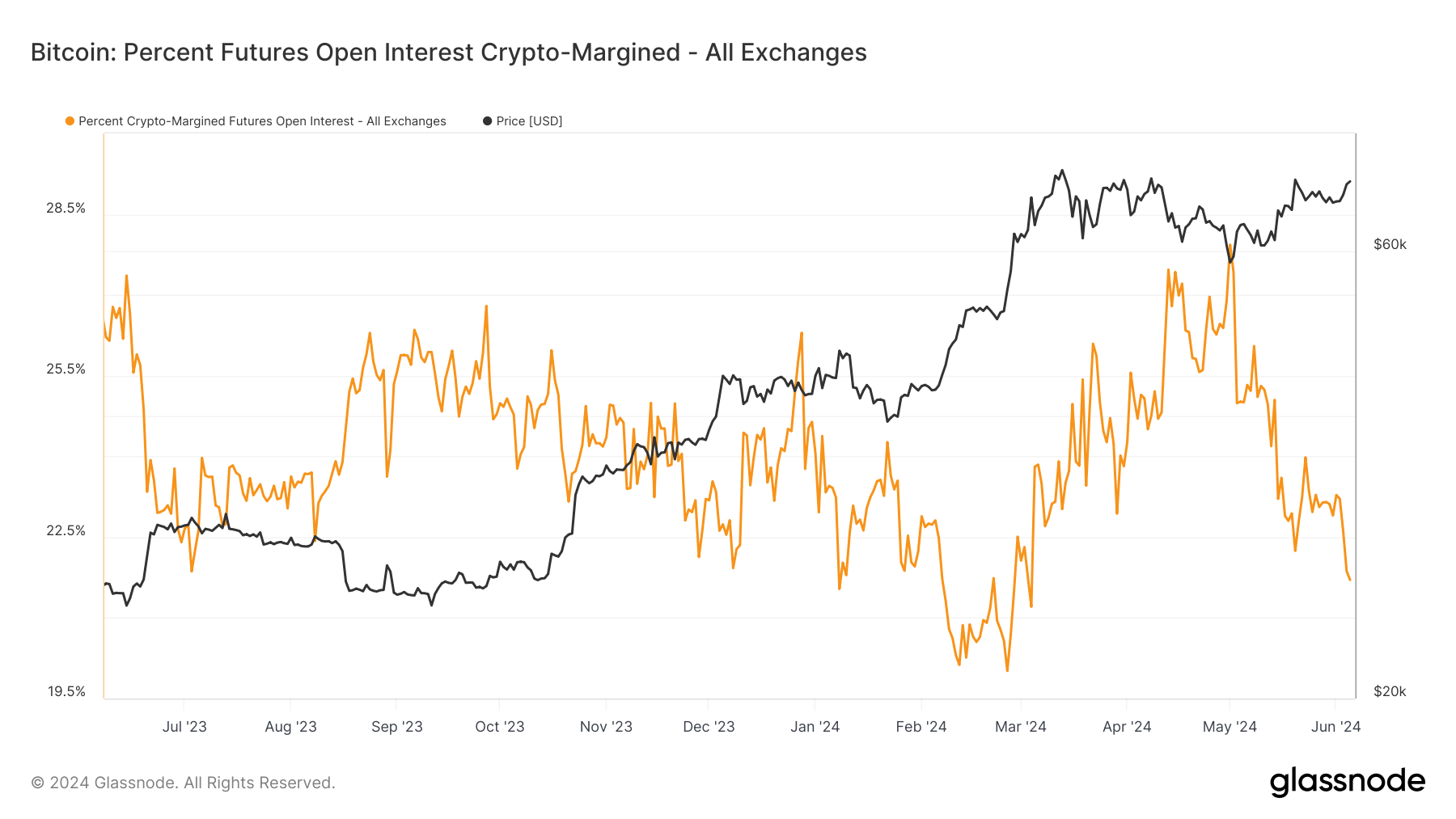

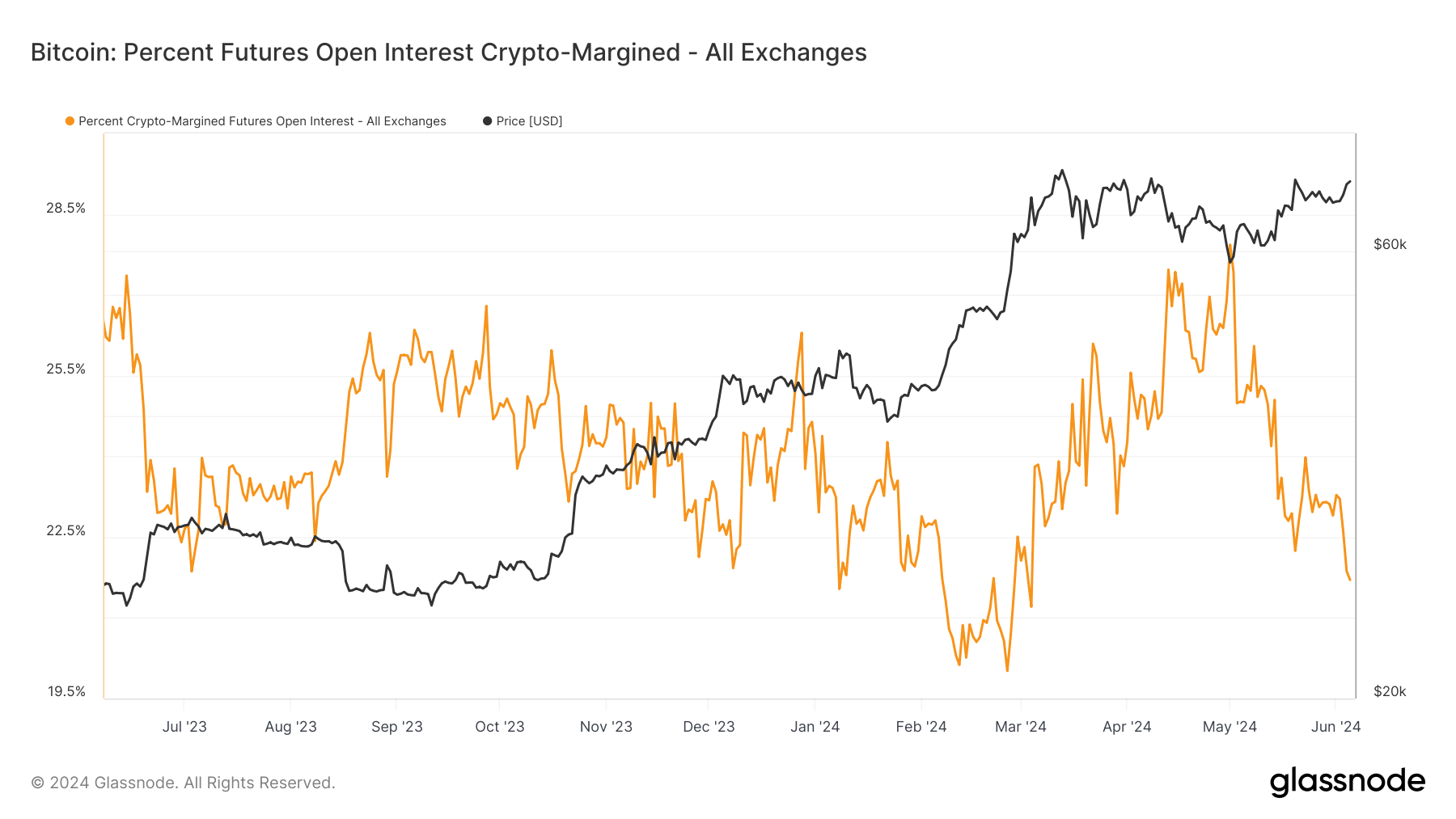

DEFINITION: The share of futures contracts open curiosity that’s margined within the native coin (e.g., BTC) and never in USD or a USD-pegged stablecoin.

Bitcoin’s futures market is present process a notable shift, as mirrored within the declining proportion of crypto-margined futures open curiosity throughout all exchanges. Knowledge from Glassnode highlights a big drop in the usage of Bitcoin as collateral for futures contracts, falling from 70% in early 2021 to lower than 20% by mid-2024.

This pattern suggests a rising choice for extra secure types of collateral, similar to USD or stablecoins, over Bitcoin itself. The rationale behind this shift is to mitigate the compounded dangers related to the volatility of Bitcoin costs, which may result in elevated liquidations throughout market swings. This transfer in direction of stability and danger mitigation indicators a maturation of the market, the place merchants are adopting methods to handle volatility extra successfully.

Moreover, the futures market’s response to Bitcoin’s value stabilization round $70,000 signifies an evolving panorama the place open curiosity is starting to get better. This restoration in open curiosity, coupled with the continued shift in direction of secure collateral, highlights altering dealer behaviors and market forces.