Ought to I Cease Loss Manually or Wait For Knowledgeable Advisor?

One of many largest benefits of skilled advisors is that they function with out feelings. That is significantly true for retail merchants who virtually all the time assume and commerce with feelings till they devour all of their capital.

However markets are usually not like this. Markets function with skilled merchants {and professional} buying and selling algorithms. They by no means commerce with feelings and so they cease loss when they should and not using a slightest hesitation.

There are particular instances in monetary markets, when the frequent ideas of market contributors are readable from the charts and due to this fact we will perceive the anticipated route of the value motion.

In such conditions, if our skilled advisor opens a counter development place , we don’t want to attend until martingale or loss grows and sweep our margins.

Right this moment I wish to discuss this straightforward technique that may simply be outlined from the charts. That is the ‘V’ form value motion.

When the value reaches a sure stage, it both accepts it or it strongly rejects it.

This image right here is taken from SP500 index futures. As you may see, after leaving the consolidation zone value strikes to a sure stage with a minimal pullback on the first cease which is the second field.

This exhibits a typical state of affairs for an acceptance. Value then continues to advance. On this case, when our skilled advisor locations a brief place across the second field area, the place might doubtlessly create bother for us. The chances for a nasty commerce may be very excessive. On this state of affairs you need to think about a handbook cease loss or exit as early as potential if patrons can clear the latest high.

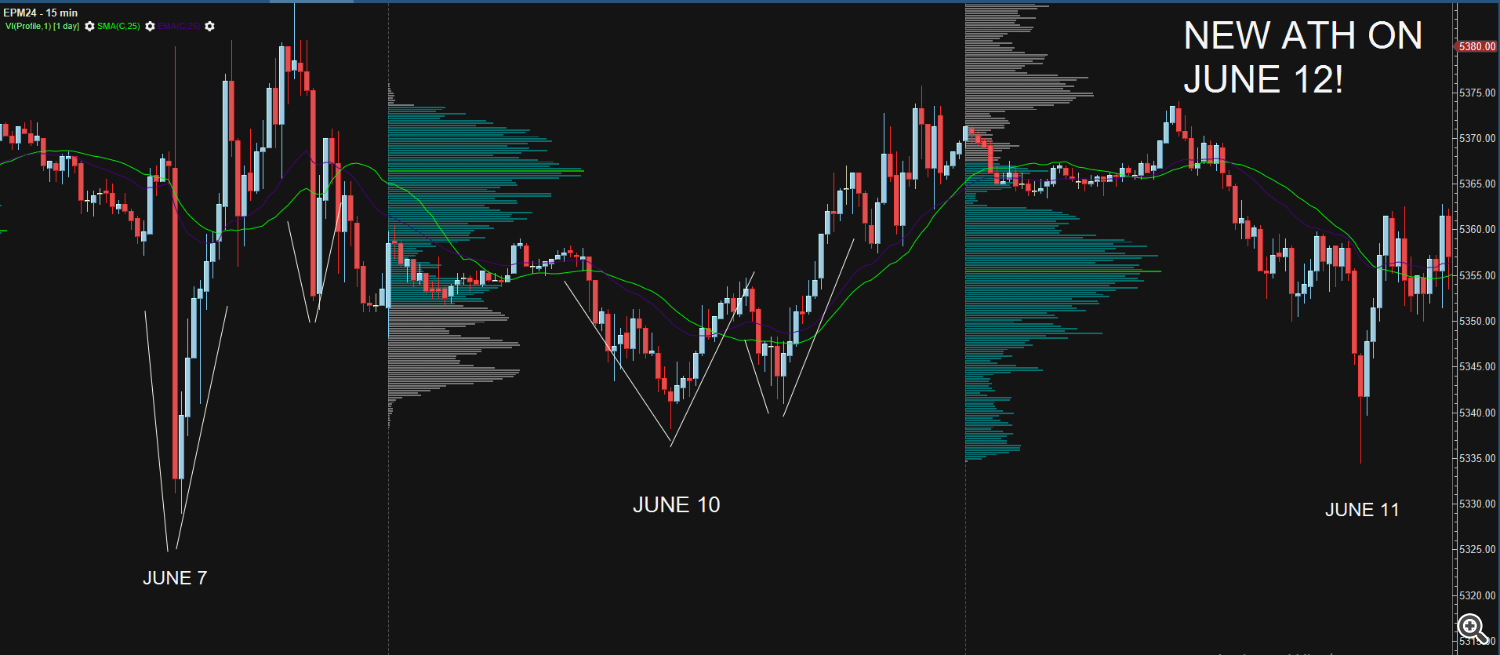

Now let’s give an instance for the rejection situation. On this instance, between June 7 and June 11, we see 3 vendor assaults however each assault has been defended and dips have been strongly purchased with “V” sort value actions.

It’s obvious that markets wish to go up and we must always not quick in such conditions. After 3 dip makes an attempt, we see a brand new all time excessive on June 12. In such conditions, if our skilled locations a brief place round these dips, it might create large bother for us. We must always considerably think about cease loss or exit when potential.

On this quick article, I’ve demonstrated a quite simple but highly effective idea of buying and selling. It isn’t magic or it’s not an area science. It’s only a easy rule of buying and selling. Understanding this V form value actions on M15 charts can save us from big troubles.

Thanks for studying and I sit up for seeing you in my subsequent article.

Finest needs,

Evren Çağlar