At spot charges, Bitcoin is agency, however merchants doubt the uptrend following the surprising dump on June 11. At the moment, Bitcoin is steady, trending above $67,000 and down regardless of features on June 12.

Nonetheless, even at this degree, there are issues as a result of the coin, regardless of all the boldness throughout the board, stays beneath $72,000. This response line is rising as a key liquidation space. If damaged, BTC might unleash a wave of quick liquidation, accelerating the lift-off to $74,000 and past.

Will Bitcoin Demand Soar In Spot Markets?

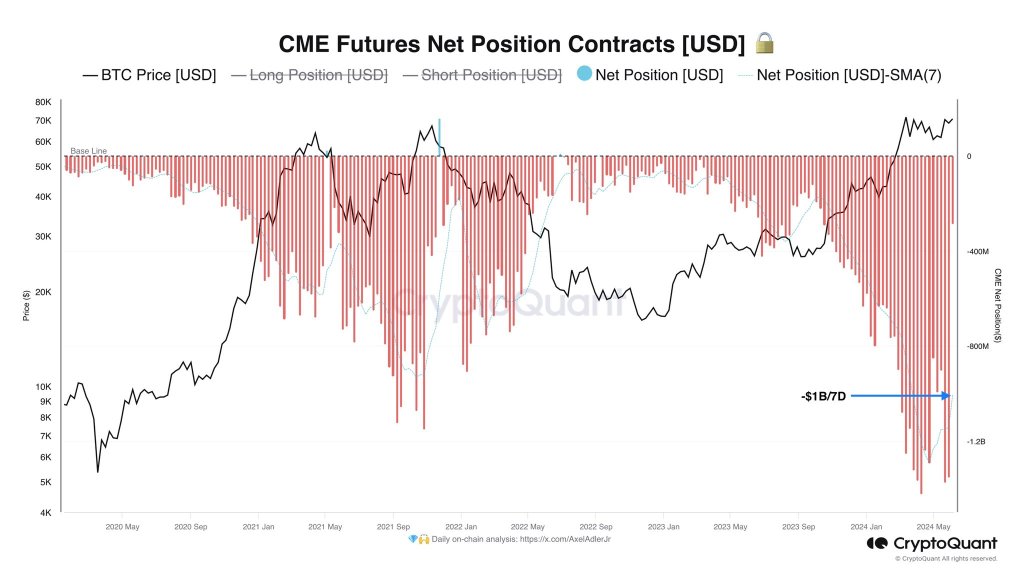

Taking to X, one on-chain analyst mentioned that Bitcoin is stagnating at spot ranges beneath $72,000 as a result of hedge funds are quick on futures.

Associated Studying: Solana On-Chain Indicators Suggests A Return Of Bullish Sentiment, Is It Time To Purchase SOL?

Although this has been a recognized improvement for some time, hedge funds have stacked their BTC shorts through the Chicago Mercantile Trade (CME) by over $1 billion within the final week alone.

Subsequently, the analyst says two issues should occur to reverse this impact and help costs. Though the BTC shorting on CME shouldn’t be essentially a bearish sign, hedge funds are hedging by taking part in a classy arbitrate technique, and coin holders should take a look at fundamentals.

Hedge funds are concurrently shorting BTC futures on CME and shopping for on the spot market. Subsequently, for the coin to interrupt $72,000 and pierce $74,000, the analyst mentioned customers should purchase no less than 2X the quantity of BTC futures shorted within the spot market.

BTC Costs Should Fall For Quick Sellers To Exit

If there isn’t any incentive to elevate spot costs larger, then Bitcoin costs should fall. Falling costs will encourage quick sellers, on this case, the hedge funds, to exit their positions lest they proceed paying funding charges. In a bearish market, and when futures costs start to fall, quick sellers should pay longs for the index to not deviate.

Whether or not there might be a spike in demand within the spot market stays to be seen. Nevertheless, what’s evident is that institutional curiosity in Bitcoin is there, solely that hedge funds, as seen from their arbitrage commerce utilizing CME, need to revenue, no matter value actions.

Associated Studying

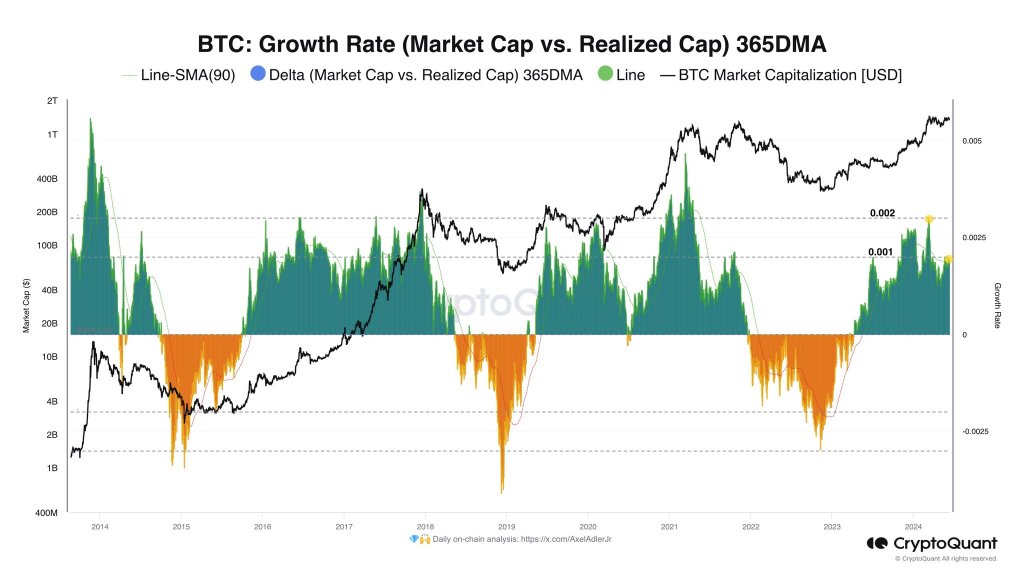

The analyst additionally shared one other chart to solidify the bullish outlook. The dealer used the “Progress Fee” metric to match adjustments in Bitcoin’s market and realized cap.

At the moment, the metric is at round 0.001, approach beneath 0.002, which means the market is extremely seemingly overheated. Bulls is likely to be making ready to make a comeback.

Function picture from DALLE, chart from TradingView