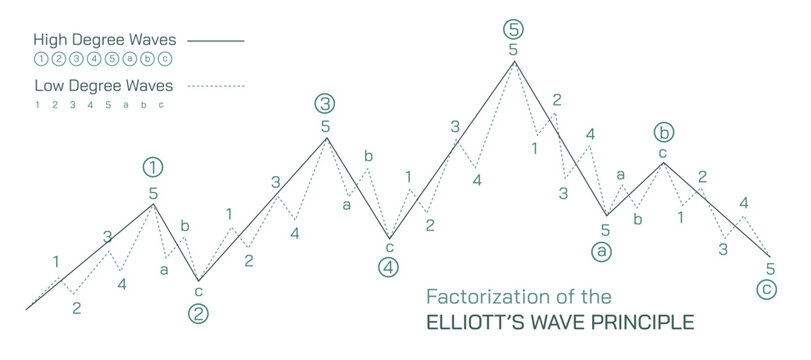

Goofy – Foreign currency trading advisor primarily based on Elliott wave principle together with the system – 7thlab – WAVE THEORY.

7thlab – WAVE THEORY is an automatic system that helps merchants analyze the market and make buying and selling choices with out private intervention. To do that, the advisor makes use of Elliott Wave Principle to find out entry and exit factors for trades, which lets you maximize the effectivity of market actions.

EA Goofy – https://www.mql5.com/en/market/product/81183?supply=Website+Profile+Vendor

Goofy technique advisor – 7thlab – WAVE THEORY – This isn’t only a buying and selling advisor. This can be a entire ecosystem related to the $GFC coin constructed on the TON blockchain.

$GFC – A coin that may mean you can accumulate passive revenue sooner or later. For all advisor homeowners. For every buy of a buying and selling advisor, from 10% to 50% of the revenue obtained from the sale of the advisor can be transferred into the liquidity of the coin. To extend liquidity. Rising liquidity will permit all coin homeowners to purchase and promote the coin as a full-fledged asset. Every Dealer who buys the Goofy advisor will obtain a free asset in his pockets within the quantity of $1000 GFC.

Coin monitoring is out there – Hyperlink 1 – Hyperlink 2

Key Characteristic

- Evaluation of Elliott Wave Principle:

The advisor analyzes market information utilizing Elliott Wave principle to find out the present part of the market and predict future value actions. This lets you extra precisely decide entry factors into the market. - Orders pending:

After figuring out the entry level, the advisor robotically creates a pending order for value correction. This permits the dealer to get most revenue from the sign, because the order can be executed at a extra favorable value. - Excessive volatility information filter:

The EA features a information filter that tracks micro- and macroeconomic occasions that may trigger excessive market volatility. This helps keep away from buying and selling during times of excessive uncertainty and reduces dangers. - Computerized lot system:

The advisor robotically calculates the lot measurement primarily based on the scale of the deposit and the danger degree set by the dealer. This optimizes capital administration and minimizes dangers. - Order grid:

The advisor makes use of a grid of orders to maximise income from value pullbacks. Which means if the value strikes in the wrong way, the advisor will open extra orders to take full benefit of market fluctuations. - Actual market entry:

Utilizing the Elliott wave principle means that you can decide extra correct entry factors into the market, rising the probability of profitable transactions. - Revenue maximization:

Creating pending orders and utilizing an order grid helps you maximize income from market actions, even when the value is quickly shifting in the wrong way. - Safety towards information dangers:

The Excessive Volatility Information Filter helps keep away from buying and selling during times of excessive volatility, decreasing danger and defending the dealer’s capital. - Automation and comfort:

The automated lot system and automated order administration permit the dealer to reduce handbook intervention and errors, making buying and selling extra handy and environment friendly.

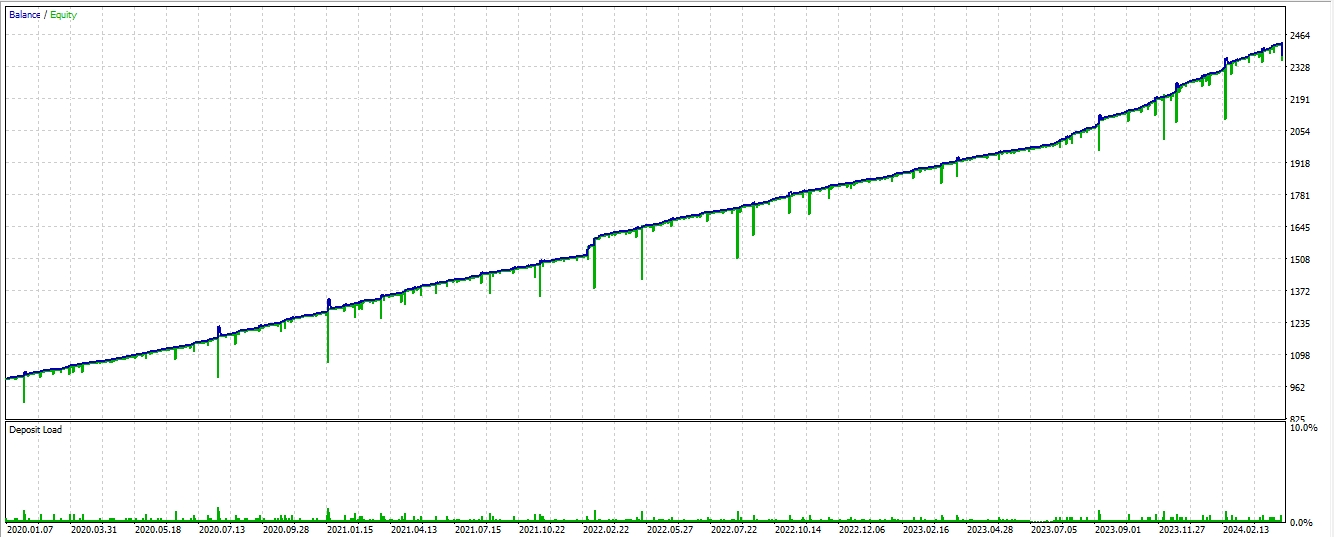

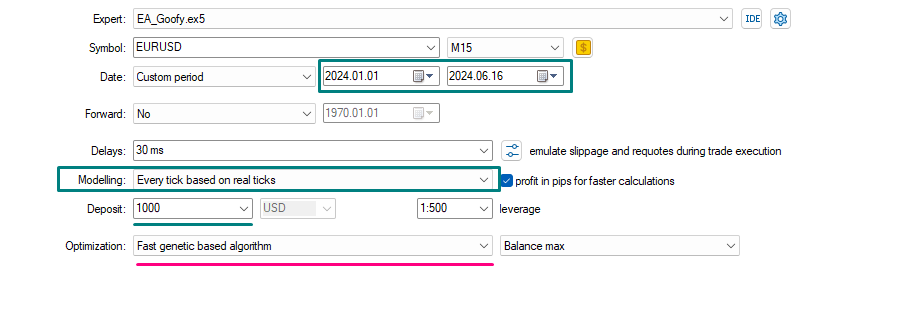

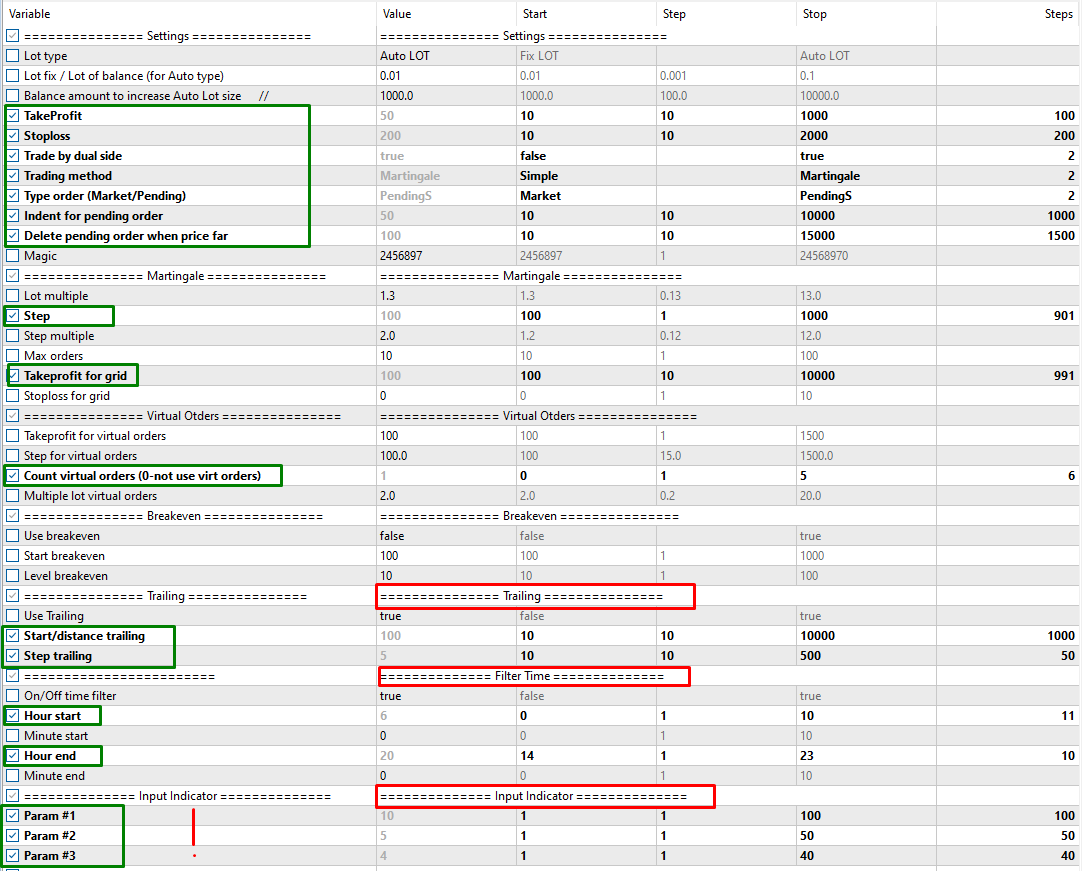

Earlier than you begin utilizing the advisor, it have to be optimized for the market circumstances of your dealer along with your account kind.

Use the usual MT5 optimization system for the final yr or yr and a half.

Predominant optimization timeframe from m1 – m5 – m15 – m30 – H1 – H4

Predominant parameters for optimization:

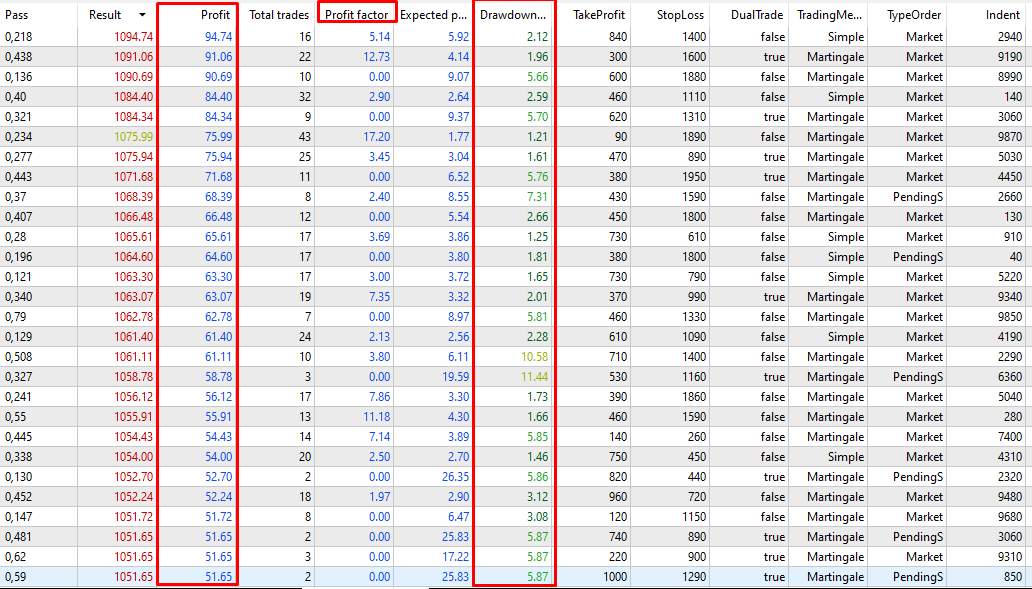

Key optimization indicators