Fast Take

We are actually 33 days into the present miner capitulation, with the common length being 41 days. This means that some miners are nonetheless dealing with vital monetary strain because of the earlier halving, which has rendered their operations unprofitable. The hash charge has dropped over 12% from its peak on Could 26, with the subsequent problem adjustment scheduled for June 20 anticipated to be barely optimistic, in keeping with Newhedge.

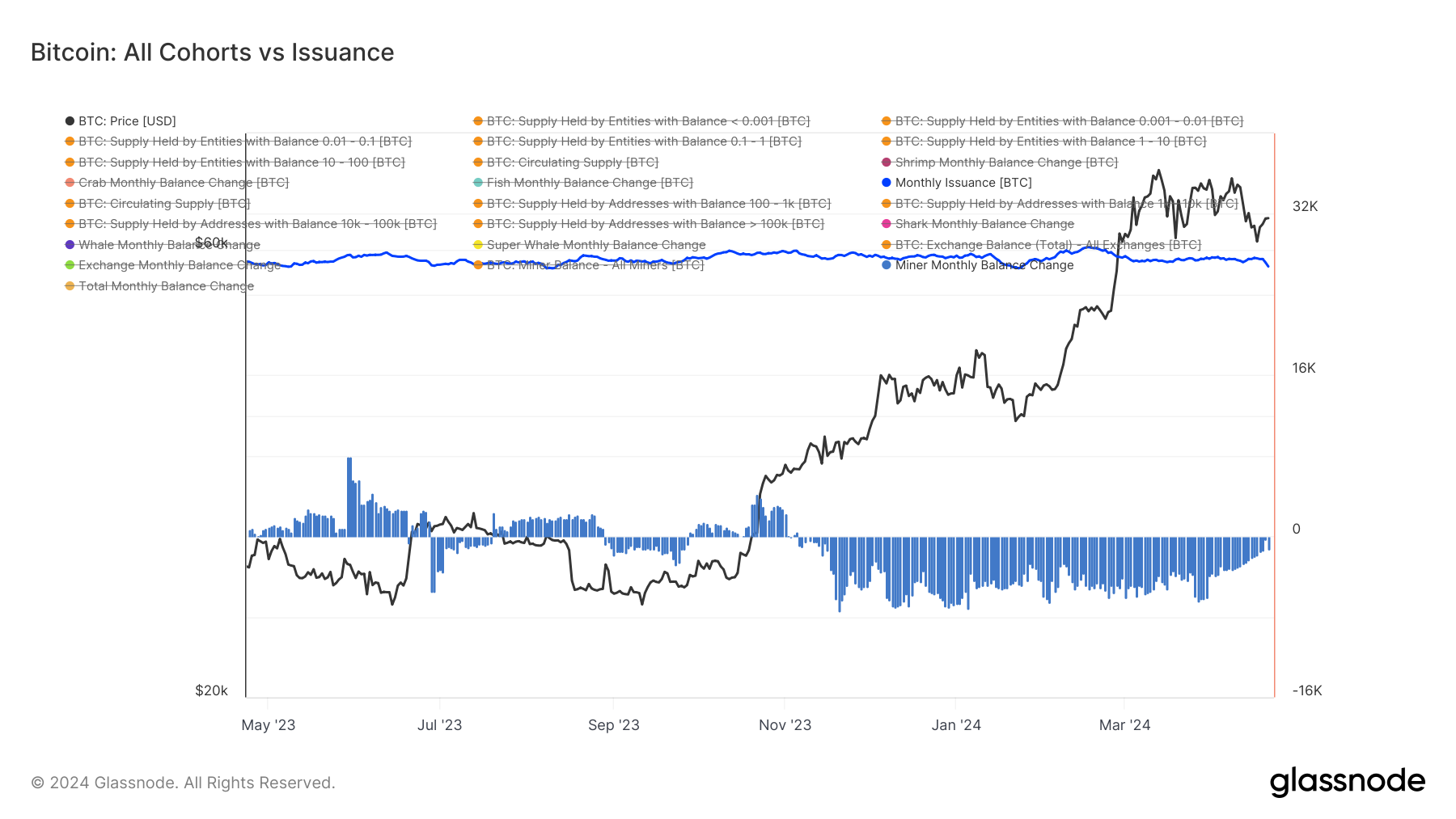

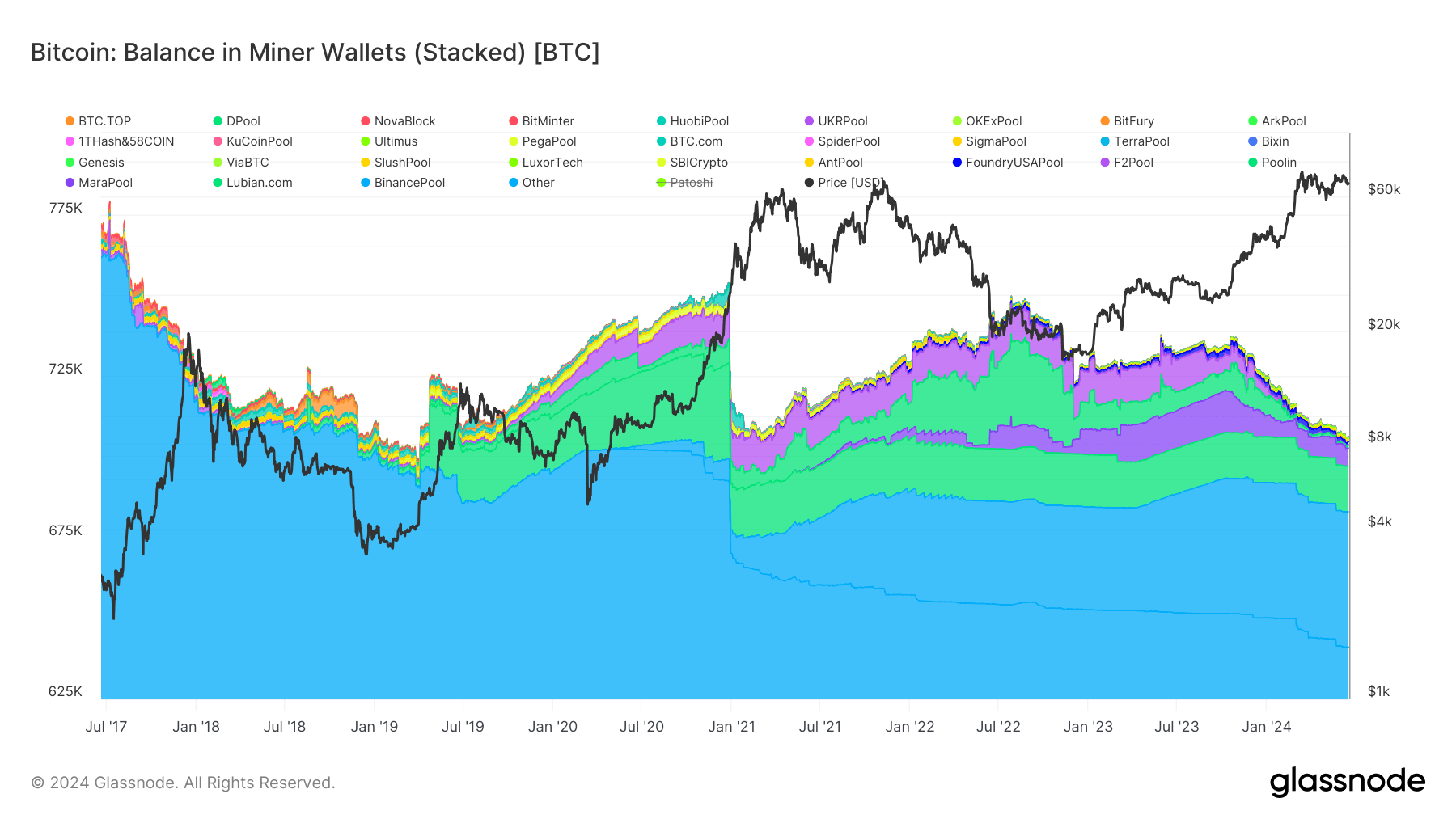

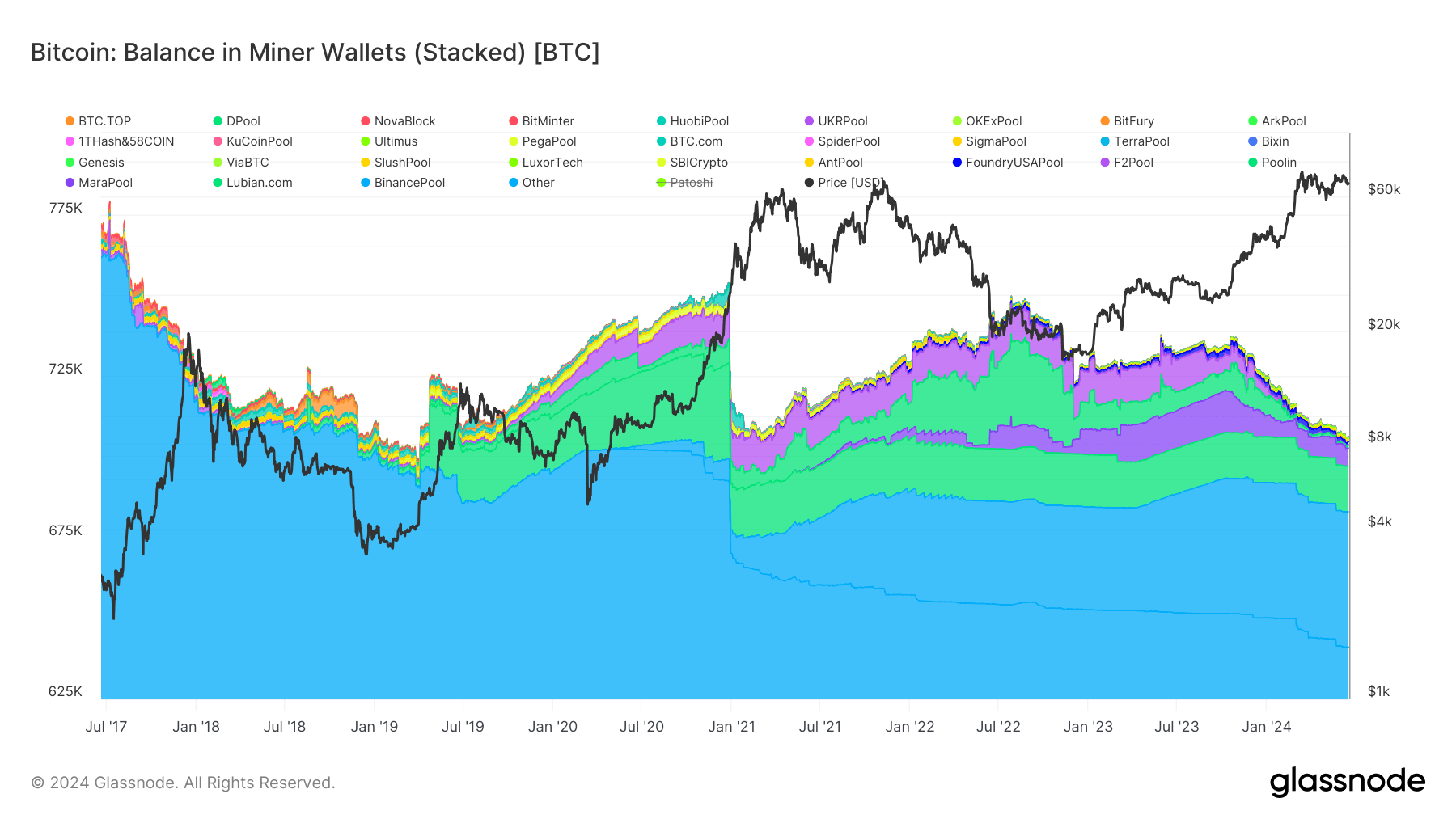

Nonetheless, the hash charge’s decline has not reached the anticipated 25% post-halving drop, demonstrating sudden resilience. This resilience might be attributed to 2 components: elevated transaction charges pushed by Runes and Inscriptions and miners’ strategic monetary planning. Miners have constructed up reserves and are offloading Bitcoin to maintain their operations. Over the previous 30 days, greater than 3,000 BTC has been distributed by miners, persevering with a development of serious distribution since December 2023, unmatched because the 2017-2018 interval, in keeping with Glassnode information.

Glassnode information exhibits that miner balances have decreased by roughly 30,000 BTC since October 2023, now standing at 1.8 million BTC.

This ongoing distribution poses a big headwind for Bitcoin, including promoting strain to the market and affecting its worth dynamics.