Beercoin, the bubbling Solana-based meme coin that promised a style of monetary freedom, is experiencing a hangover of epic proportions. After a meteoric rise in worth earlier this month, Beercoin has come crashing down, plummeting by practically 70% in a matter of days. This dramatic decline displays a confluence of things, together with a broader crypto market correction, a hawkish Federal Reserve stance, and a regarding pattern of insider promoting.

Associated Studying

Fed Tightens The Faucets

The Federal Reserve’s current resolution to undertake a extra hawkish financial coverage, prioritizing inflation management over financial stimulus, has solid a darkish cloud over the whole cryptocurrency market. Bitcoin, the bellwether of the business, dipped beneath $66,000 this week, dragging most altcoins down with it.

This shift in central financial institution coverage is especially detrimental to extremely speculative property like meme cash, which thrive on straightforward cash and investor exuberance. Meme cash, usually missing real-world utility or established fundamentals, are seen as the primary to be dumped when danger aversion creeps into the market.

Whales Leap Ship

Including gas to the fireplace of Beercoin’s descent is a troubling pattern of insider promoting. Onchain evaluation by LookOnChain revealed that a number of people with important holdings, doubtless early traders who acquired Beercoin at a reduction throughout pre-sales, have not too long ago cashed out in massive portions.

One other pockets associated to the #beercoin workforce bought 5.43B $BEER for $1.13M!

Though it has been transferred many instances, we traced that the pockets acquired $BEER instantly from the #beercoin workforce pockets “7yfvQX…o9v394” and “8VY4LF…fDd5G2”.https://t.co/vElDToYi5C pic.twitter.com/oYp41d3Naz

— Lookonchain (@lookonchain) June 16, 2024

This mass exodus by insiders, who presumably possess a deeper understanding of Beercoin’s potential or limitations, raises critical purple flags for retail traders. Their actions will be interpreted as a lack of confidence within the undertaking, doubtlessly signaling that Beercoin is probably not the golden ticket to riches it was initially touted to be.

Technical Indicators: Frothy Future

Technical evaluation, the examine of worth charts and historic knowledge to foretell future market actions, paints a equally grim image for Beercoin. The token has not solely fallen beneath a key help degree, nevertheless it additionally continues to commerce beneath essential transferring averages, technical indicators used to gauge momentum and establish potential pattern reversals.

BEER Value Prediction

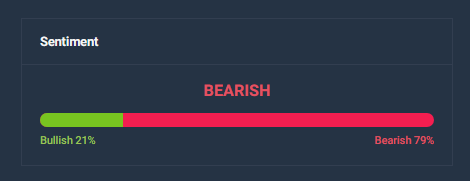

In the meantime, the present BEER worth prediction suggests a major upward trajectory, anticipating a 220% enhance to $0.0₁₀5119 by July 18, 2024. Regardless of this optimistic forecast, technical indicators present a bearish sentiment, indicating potential warning amongst traders.

The Worry & Greed Index is at 74, which denotes excessive ranges of greed out there, suggesting that the present bullish outlook could also be pushed by overenthusiastic sentiment quite than stable fundamentals.

Associated Studying

Over the previous 30 days, BEER has skilled an uncommon pattern, recording 100% inexperienced days with zero worth volatility, an anomaly in typical market conduct. This constant upward motion with none fluctuations might point out a extremely manipulated or illiquid market.

Featured picture from Well being | HowStuffWorks, chart from TradingView