Monetary establishments are doubtless within the technique of positioning themselves for the launch of spot Ethereum (ETH) exchange-traded fund (ETF), in keeping with a VanEck analyst.

Matthew Sigel, head of digital property analysis at VanEck, says that hedge funds are front-running the approval of ETH ETFs within the US.

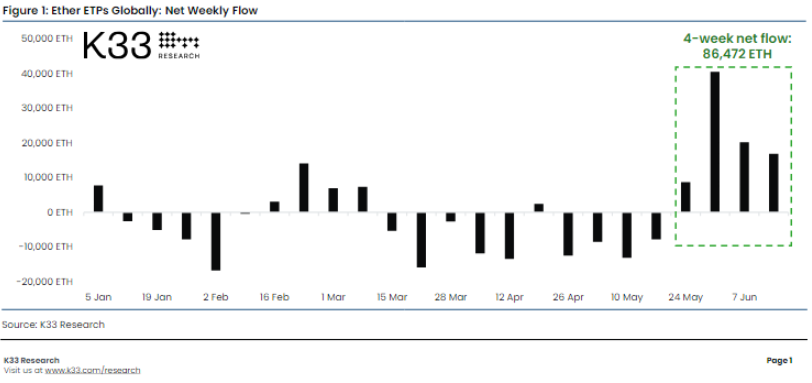

Sigel cites information from K33 Analysis displaying a big spike in inflows to Ether exchange-traded merchandise (ETPs) exterior of america markets.

“Hedge funds are front-running the ETH ETF approvals, ETH on exchanges is close to an all-time low, fundamentals are enhancing.

I could possibly be consuming BBQ HODL hat by July 4th.

And also you’re bearish?”

Sigel additionally shares a chart from blockchain analytics agency CryptoQuant displaying a downtrend of ETH provide on exchanges, suggesting an accumulation of Ethereum from massive gamers.

In a latest interview with the Bankless podcast, Sigel says that VanEck is viewing Ethereum as an “open supply App Retailer,” and in keeping with the analyst, it’s not utterly unlikely that sooner or later an ETH ETF might develop into extra profitable than the Bitcoin ETFs.

“Now that the SEC has at the very least theoretically accepted spot Ethereum ETFs to commerce it’s clearly necessary to clarify the funding case for this asset. General, there’s an even bigger marketplace for income-producing property than there are for inert property like Bitcoin (BTC). So it’s not inconceivable that in a decade, the marketplace for an Ethereum ETF could possibly be larger than Bitcoin, however within the meantime, we have now to teach conventional monetary market individuals as to why this asset issues.

There’s plenty of analogies which have been tried and the one which we’ve honed in on is the ‘open supply App Retailer.’

We predict that Ethereum is a productive asset that lets anybody open a storefront on this community, and so they can accomplish that at a decrease take fee than Large Tech presently fees. So it’s an open-source App Retailer with funds performance bundled in basically at no cost, and we needed to clarify the mechanics of how that works and put some numbers across the revenue and loss (OPNL) assertion of Ethereum.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Worth Motion

Observe us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate marketing online.

Generated Picture: DALLE3