Onchain Highlights

DEFINITION: The Change Payment Dominance metric is outlined because the % quantity of complete charges paid in transactions associated to on-chain alternate exercise.

- Deposits: Transactions that embrace an alternate handle because the receiver of funds.

- Withdrawals: Transactions that embrace an alternate handle because the sender of funds.

- In-Home: Transactions that embrace addresses of a single alternate as each the sender and receiver of funds.

- Inter-Change: Transactions that embrace addresses of (distinct) exchanges as each the sender and receiver of funds.

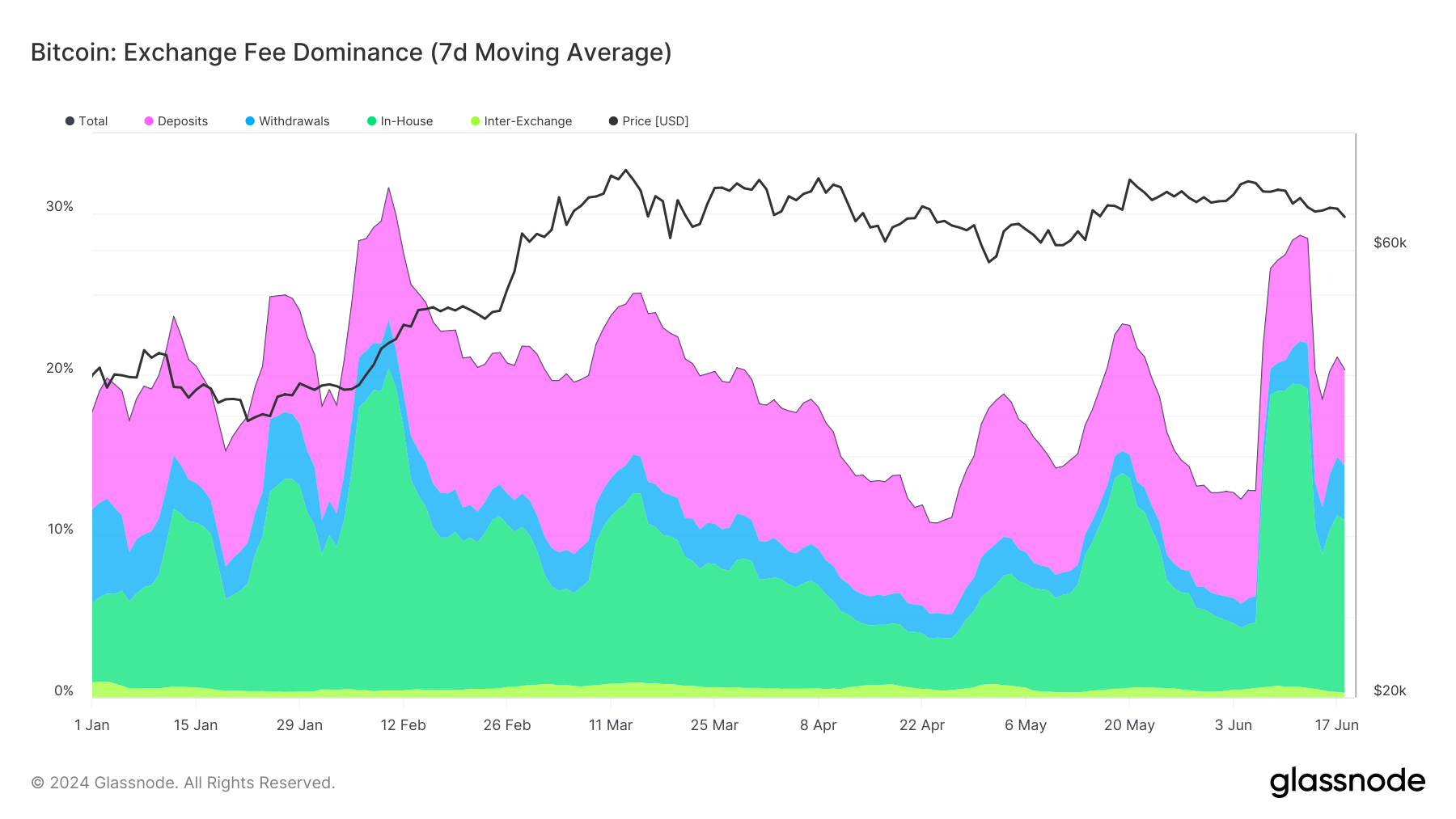

Bitcoin’s alternate charge dominance, represented as a 7-day shifting common, has proven vital fluctuations because the starting of 2024. Notably, the dominance of charges related to deposits, withdrawals, in-house transfers, and inter-exchange transactions has skilled durations of sharp improve and decline.

In early 2024, a pronounced surge in exchange-related charges occurred, peaking round early February. This spike was primarily pushed by heightened exercise in deposits and in-house transactions. Because the 12 months progressed, alternate charge dominance displayed a cyclical sample with notable peaks in mid-Could and mid-June, coinciding with elevated market exercise and potential strategic repositioning by traders.

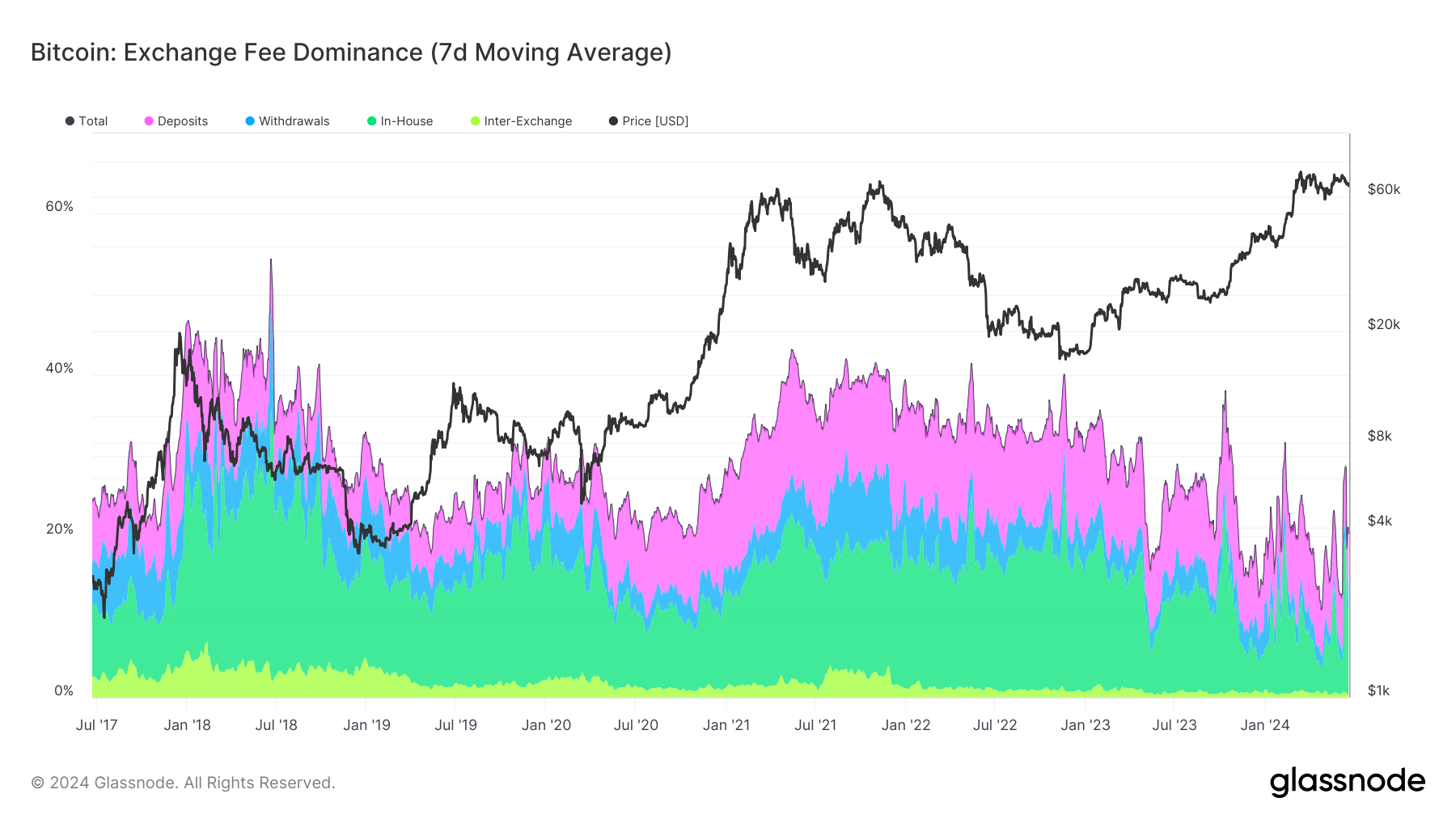

Comparatively, long-term information since 2017 reveal a broader pattern of alternate charge dominance aligning carefully with main market actions. Important spikes in exchange-related charges corresponded with important value milestones, such because the bull runs of late 2017 and early 2021. These durations had been marked by substantial market volatility, reflecting elevated buying and selling quantity and better on-chain alternate exercise.

Latest information recommend that Bitcoin’s post-halving value and alternate charge dominance principally correlate, reflecting broader market circumstances and investor habits. This ongoing interaction emphasizes the importance of exchange-related actions within the Bitcoin ecosystem, influencing transaction prices and general market liquidity.