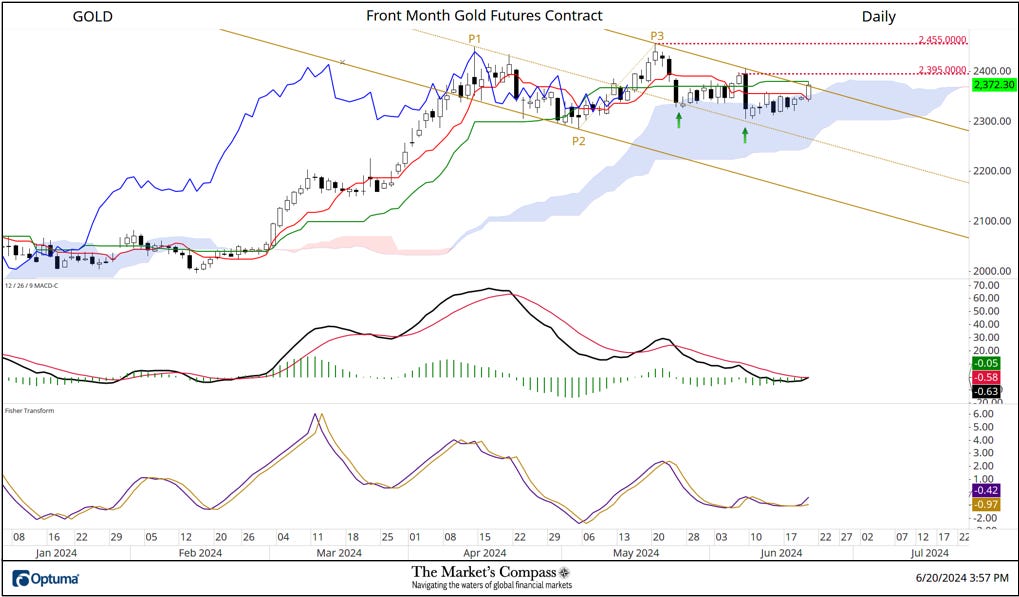

When the entrance month gold futures contract fell off from the Could 20th increased excessive (gold P3) I utilized a Normal Pitchfork (gold P1 by way of P3) to the chart. What tells me that this was the right variation of the pitchfork that I used is that costs held assist on the Median Line (gold dotted line notated with inexperienced arrows) since I drew it. Additionally previous to the value pivot at P2 costs revered assist on the Decrease Parallel (strong gold line). The proper vector or angle of the pitchfork recognized each down legs of the corrective section (gold P1 by way of P2 and P3 by way of at the moment).

That stated, for the second time in ten days the Higher Parallel (higher strong gold line) has capped inter-downtrend rallies on a closing foundation and on an intra-day foundation resistance on the Kijun Plot (strong inexperienced line) got here into play. Draw back momentum is slowing as witnessed by MACD which is now strolling the lifeless impartial tight rope and is hinting at a hook increased. That is in live performance with a flip within the Fisher Remodel above its sign line. A observe by way of to yesterday’s rally that overtakes the Kijun Plot and value resistance at $2,395 would goal the Could highs which might be $50 increased at $2455. Yosemite Sam thought there was gold in them thar hills and I’m in his camp.

For readers who’re unfamiliar with the technical phrases or instruments referred to within the feedback on the technical situation of Gold can avail themselves of a quick tutorial titled, Instruments of Technical Evaluation that’s posted on The Markets Compass web site…

https://themarketscompass.com

Charts are courtesy of Optuma.

To obtain a 30-day trial of Optuma charting software program go to…