Demystifying Shifting Averages:

A Information for Foreign exchange Merchants

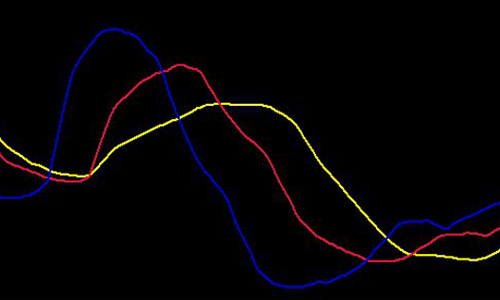

Shifting averages (MAs) are a cornerstone of technical evaluation within the foreign exchange market. By smoothing out value fluctuations, they assist merchants determine tendencies, gauge assist and resistance ranges, and make knowledgeable buying and selling choices.

Why are Shifting Averages Essential?

Think about watching a dwell foreign exchange chart – the worth motion may be erratic and tough to interpret. Shifting averages deal with this by making a always up to date common value over a selected interval. This smoothed line cuts via the noise, revealing the underlying development and potential turning factors out there.

- Development Identification: MAs act as a development filter, highlighting the underlying course (uptrend, downtrend, or sideways) by slicing via short-term value noise.

- Assist and Resistance: A rising MA can point out potential assist, whereas a falling MA can sign resistance. Costs usually discover non permanent pauses or reversals round these shifting averages.

- Buying and selling Indicators: Crossovers between totally different MAs or the worth itself can generate purchase and promote alerts. For instance, a shorter MA crossing above an extended MA would possibly counsel a bullish development.

Forms of Shifting Averages and Their Functions:

There are a number of kinds of shifting averages, every with its personal calculation technique and buying and selling functions:

1.Easy Shifting Common (SMA): The SMA is probably the most fundamental sort. It merely calculates the common value of a foreign money pair over an outlined look-back interval (e.g., 50 days).

SMA = (Price1 + Price2 + … + PriceN) / N

Right here, Value represents the closing value and N represents the variety of durations within the look-back window.

- Software: The SMA is an efficient place to begin for figuring out tendencies. A rising SMA suggests an uptrend, whereas a falling SMA signifies a downtrend. SMAs are sometimes used along side different technical indicators for affirmation.

2.Exponential Shifting Common (EMA): The EMA provides extra weight to current costs, making it extra responsive to cost adjustments than the SMA. This permits merchants to determine development adjustments faster.

EMA (at the moment) = (α * PriceToday) + [(1 – α) * EMA (yesterday)]

α = 2 / (n + 1)

Right here, α (alpha) is a smoothing issue (usually between 0.02 and 0.33) that determines the burden given to the present value. The next alpha ends in a extra responsive EMA.

- Software: EMAs are most well-liked by many merchants attributable to their quicker response to cost actions. They’re helpful for recognizing development reversals and producing buying and selling alerts.

3.Weighted Shifting Common (WMA): Just like the EMA, the WMA assigns weights to costs inside the look-back interval. Nevertheless, not like the EMA’s exponential weighting, the WMA assigns a user-defined weight to every value, with newer costs usually receiving increased weights.

WMA = (Weight1 * Price1 + Weight2 * Price2 + … + WeightN * PriceN) / (Weight1 + Weight2 + … + WeightN)

- Software: WMAs permit merchants to customise the emphasis on particular durations inside the look-back window. As an illustration, a WMA with increased weights for current costs can be utilized to determine short-term tendencies.

Superior kinds of shifting averages:

Along with the elemental kinds of shifting averages coated earlier, listed here are some lesser-known however worthwhile MAs utilized by foreign exchange merchants:

1.Smoothed Shifting Common (SMMA):Just like the SMA, the SMMA calculates the common value over a interval. Nevertheless, it applies a two-step averaging course of for a smoother outcome.

Calculate a easy shifting common (SMA1) for the chosen interval (n).

Calculate one other SMA (SMA2) utilizing the values from SMA1.

The ultimate SMMA is commonly SMA2, offering a extra refined development view in comparison with the usual SMA.

- Software: Preferrred for scalpers and short-term merchants who need to decrease value noise and concentrate on very short-term tendencies.

2.Linear Weighted Shifting Common (LWMA): The LWMA assigns weights to costs inside the interval, with newer costs receiving increased weights. This creates a smoother transition between value actions in comparison with the WMA.

LWMA (n) = [(Price(t) * 1) + (Price(t-1) * (n-1)) + … + (Price(t-n+1) * n)] / n

Value(t) = value on the present time (t)

- Software: LWMA is appropriate for swing merchants who need to seize tendencies whereas decreasing the choppiness of shorter-term MAs.

3.Quantity-Weighted Shifting Common (VWMA): Not like price-based MAs, the VWMA incorporates buying and selling quantity into its calculation. Intervals with increased buying and selling quantity have a better influence on the common.

VWMA (n) = Σ (Quantity(i) * Value(t-i+1)) / Σ Quantity(i)

Quantity(i) = buying and selling quantity at time t-i+1

- Software: The VWMA is useful for figuring out tendencies supported by excessive buying and selling quantity, probably indicating stronger market conviction.

4.Kaufman Adaptive Shifting Common (KAMA): The KAMA is a extra complicated sort of shifting common that adapts its weighting scheme primarily based on market volatility. It assigns increased weights to costs throughout risky durations and decrease weights throughout calmer instances.

- Calculation:(The calculation for KAMA is kind of intricate and entails a number of steps. It is beneficial to make use of software program with built-in KAMA capabilities.)

- Software: The KAMA excels at figuring out tendencies in risky markets the place conventional MAs may be much less efficient attributable to extreme whipsaws.

5.Hull Shifting Common (HMA): The HMA is a double-smoothed model of the WMA. It applies a selected weighting scheme that emphasizes each current and previous costs.

- Calculation:(The HMA calculation entails a number of steps and intermediate calculations. It is best suited to use with buying and selling software program.)

- Software: The HMA gives a transparent development view with minimal lag, making it worthwhile for figuring out development course and potential entry/exit factors.

6.Double Exponential Shifting Common (DEMA): The DEMA is basically an EMA utilized twice. This double smoothing creates a fair smoother line in comparison with the usual EMA.

EMA1 (at the moment) = [α * Price(today)] + [(1 – α) * EMA1(yesterday)]

DEMA (at the moment) = [α * EMA1(today)] + [(1 – α) * DEMA(yesterday)]

- Software: The DEMA is beneficial for figuring out very long-term tendencies and filtering out much more short-term volatility. It is useful for long-term foreign exchange merchants with a positional strategy.

7.Triple Exponential Shifting Common (TEMA): Just like the DEMA, the TEMA applies a three-step EMA calculation, leading to an exceptionally clean line.

- Calculation System (confer with DEMA formulation for calculation steps)

- Software: The TEMA is greatest suited to figuring out very long-term tendencies with minimal noise. It may be instrument for gauging general market sentiment over prolonged durations.

8.Adaptive Shifting Common (AMA): The AMA is a dynamic shifting common that adjusts its smoothing issue primarily based on market volatility. Throughout risky durations, the AMA emphasizes current costs, whereas in calmer markets, it behaves extra like a normal SMA.

- Calculation: The AMA calculation is comparatively complicated and entails a number of steps. Software program platforms usually deal with the calculations for merchants.

- Software: The AMA is useful for merchants who need an adaptable shifting common that reacts to altering market situations.

Bear in mind, these are only a few examples, and there are various variations and combos of shifting averages. Experimenting and backtesting with totally different MAs will allow you to decide which of them fit your buying and selling fashion and market situations.

Selecting the Proper Shifting Common:

The very best shifting common for you relies on your buying and selling fashion and targets. Here is a common guideline:

- Brief-term merchants: Shorter-lookback interval EMAs or WMAs with a concentrate on current costs may be useful.

- Lengthy-term merchants: Longer-lookback interval SMAs or EMAs with a smoother response can be utilized.