Macro investor Luke Gromen says that within the coming years, Bitcoin (BTC) and threat belongings will profit from a souring sentiment in US long-term bonds.

In a brand new video replace, Gromen says that on account of inflationary pressures, capital will doubtless rotate from the bond market into shares, gold and Bitcoin.

The investor says that due to these pressures, the iShares 20+ 12 months Treasury Bond exchange-traded fund (TLT) is signaling weak point towards threat belongings and inflation hedges.

“There’s a $130 trillion international bond market that might want to run right into a $65 trillion inventory market which I believe is going on. [There’s a] $14 trillion gold market and a $1.3 trillion Bitcoin marketplace for security from that inflation. And also you’re seeing that within the charts.

For those who have a look at the S&P 500 over the TLT – the lengthy bond ETF – it appears like a hockey stick. Nasdaq over TLT: hockey stick. Industrials over TLT: hockey stick. Gold over TLT, all collectively now: hockey stick. Bitcoin over TLT: hockey stick however very risky hockey stick.

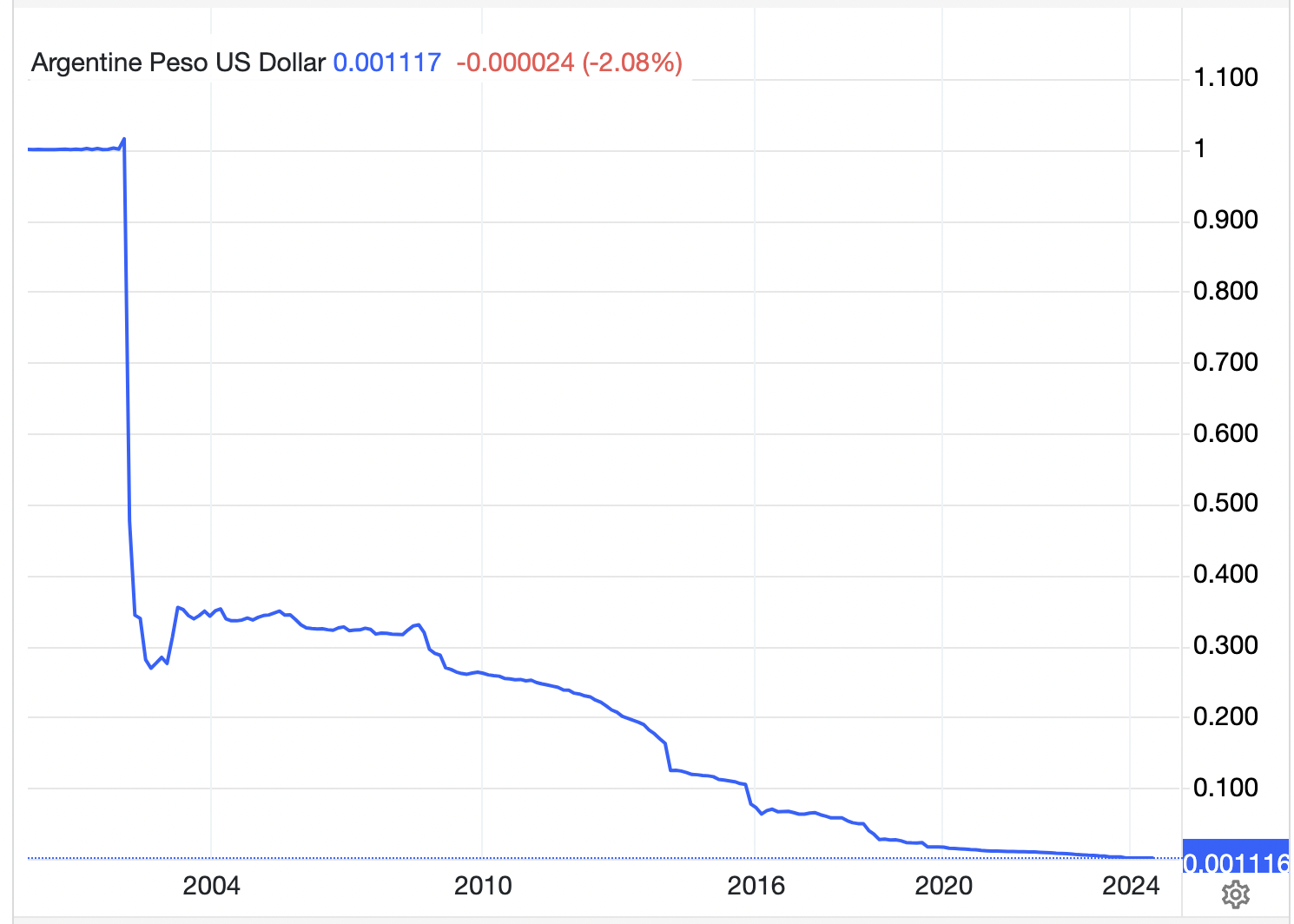

So my view is within the secular inflation that we’re within the early days of, you’ll see shares up in greenback phrases [but] down in gold and Bitcoin phrases. Principally Argentina with US traits.”

As a consequence of heavy inflation, the Argentinian inventory market index (MERVAL) has skyrocketed over 3,779% within the final twenty years, averaging greater than 188% returns annually.

Nonetheless, in greenback phrases, the Argentinian peso has primarily gone to zero in the identical timeframe.

At time of writing, Bitcoin is buying and selling at $64,689.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on X, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any losses you might incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in online marketing.

Generated Picture: DALLE3