In a latest submitting with the US Securities and Change Fee (SEC), the BlackRock World Allocation Fund disclosed its possession of 43,000 shares of the asset supervisor’s Bitcoin ETF, iShares Bitcoin Belief, as of April 30.

This announcement follows two earlier filings by BlackRock on Might 28, which disclosed the fund’s publicity to Bitcoin in its Strategic World Bond Fund and Strategic Earnings Alternatives Portfolio.

BlackRock Bitcoin ETF Funding Plan

The funding big’s transfer in the direction of Bitcoin integration turned evident in March when it submitted a submitting to the SEC, expressing its intention to incorporate Bitcoin ETFs in its World Allocation Fund.

BlackRock’s goal is to put money into Bitcoin ETFs that straight maintain BTC, aiming to reflect the efficiency of the digital foreign money market.

The corporate’s submitting specified that the World Allocation Fund might purchase shares in exchange-traded merchandise (ETPs) that search to replicate the value of Bitcoin by straight holding the cryptocurrency. Nevertheless, it clarified that investments in Bitcoin ETPs shall be restricted to these listed and traded on acknowledged nationwide securities exchanges.

Associated Studying

This initiative aligns with BlackRock’s broader funding technique for its World Allocation Fund, a mutual fund designed to diversify traders by a variety of belongings, together with equities, bonds, and doubtlessly Bitcoin ETPs.

With $17.8 billion in belongings beneath administration (AUM) and a year-to-date return of 4.61% as of March 2024, the fund goals to capitalize on world funding alternatives whereas successfully managing danger and pursuing long-term capital development and earnings.

This marks the third inner BlackRock fund to put money into Bitcoin by the iShares Bitcoin Belief (IBIT) ETF. The Strategic World Bond Fund, Strategic Earnings Alternatives Portfolio, and now the World Allocation Fund have all acknowledged the potential of Bitcoin as an funding asset.

Bitcoin Value Evaluation

Up to now 24 hours, Bitcoin has proven resilience by reclaiming the $61,780 stage after experiencing a dip to as little as $58,000 on Monday. This restoration means that the main cryptocurrency is withstanding the promoting strain it has encountered over the previous week, indicating a possible continuation of its halted uptrend.

In accordance to technical analyst Ali Martinez, Bitcoin is forming an Adam & Eve bottoming sample, which may result in a projected 6% improve in the direction of $66,000 if BTC maintains a candlestick shut above the $62,200 stage.

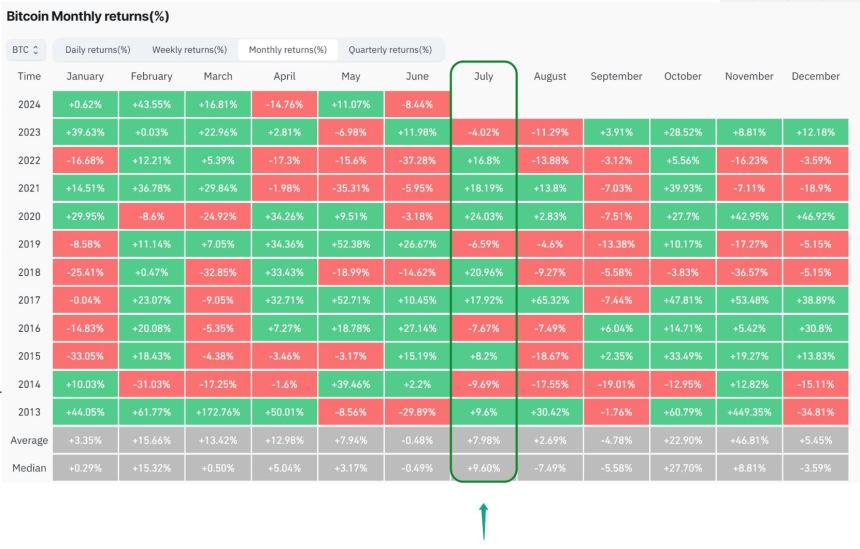

Moreover, historic information signifies that July has traditionally been favorable for Bitcoin’s value development, significantly in years of Halving.

Analyzing the picture above, 7 out of the earlier 11 July months resulted in optimistic positive factors. The inexperienced months, particularly, generated a formidable upside of 16.52%, whereas the purple months skilled a draw back of 6.99%.

Analyzing the efficiency of Bitcoin within the third quarter (Q3), the info presents a extra balanced image. Out of the earlier 11 Q3 durations, 5 have been optimistic. Inexperienced Q3s, on common, produced a big upside of 33.52%, whereas purple Q3s generated a median draw back of 16.023%.

Associated Studying

Whether or not historic value efficiency will repeat itself, main to cost positive factors for BTC, stays to be answered. If historical past have been to repeat on this situation, it may doubtlessly lead to Bitcoin retesting its all-time excessive, which reached $73,700 in March, doubtlessly even surpassing it.

Featured picture from DALL-E, chart from TradingView.com