Onchain Highlights

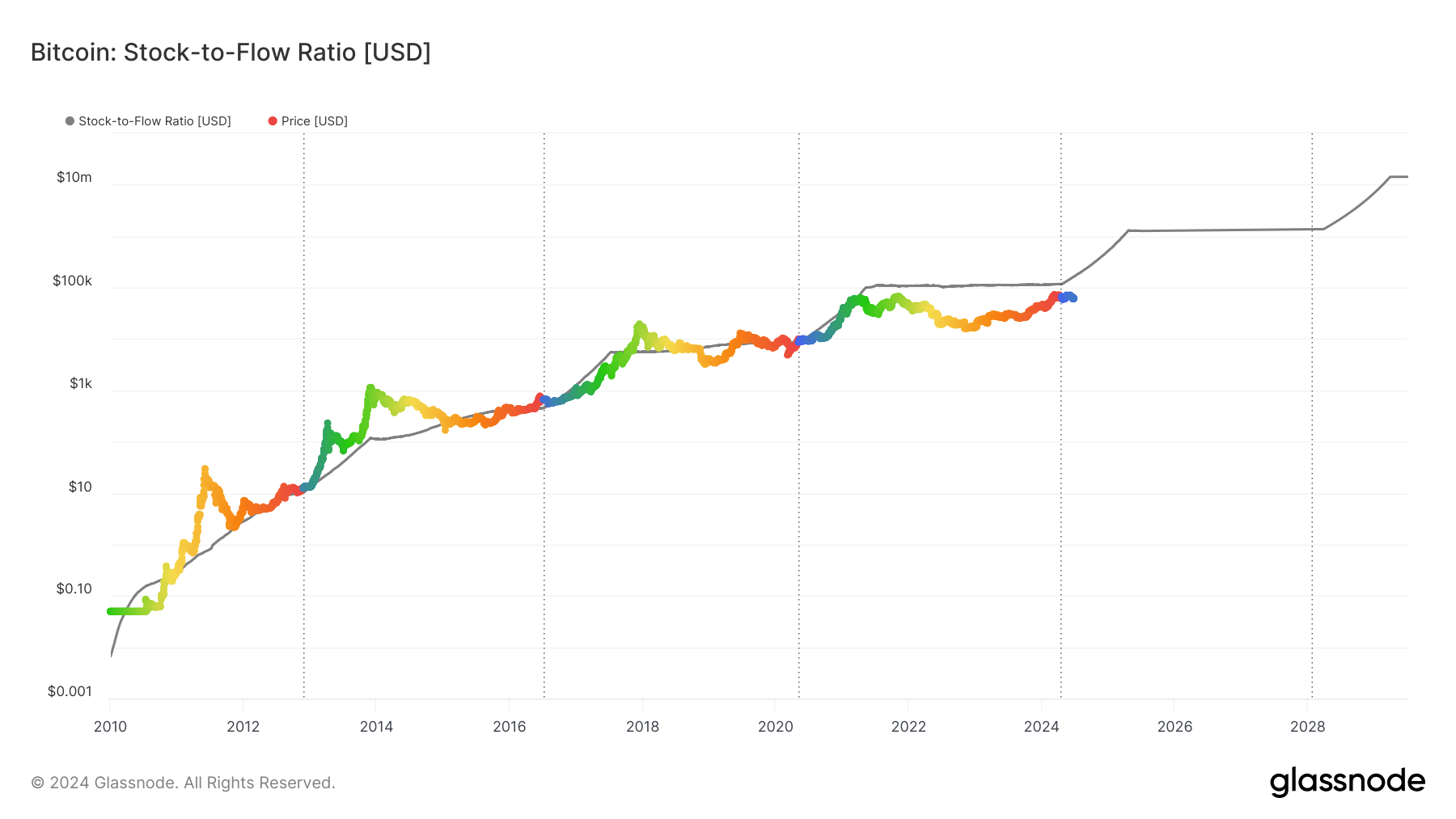

DEFINITION: The stock-to-flow (S/F) Ratio is a well-liked mannequin that assumes shortage drives worth. It’s outlined because the ratio of the present inventory of a commodity (e.g., the circulating Bitcoin provide) to the stream of latest manufacturing (e.g., newly mined bitcoins). Bitcoin’s worth has traditionally adopted the S/F Ratio, which is why it’s a preferred mannequin used to foretell future Bitcoin valuations.

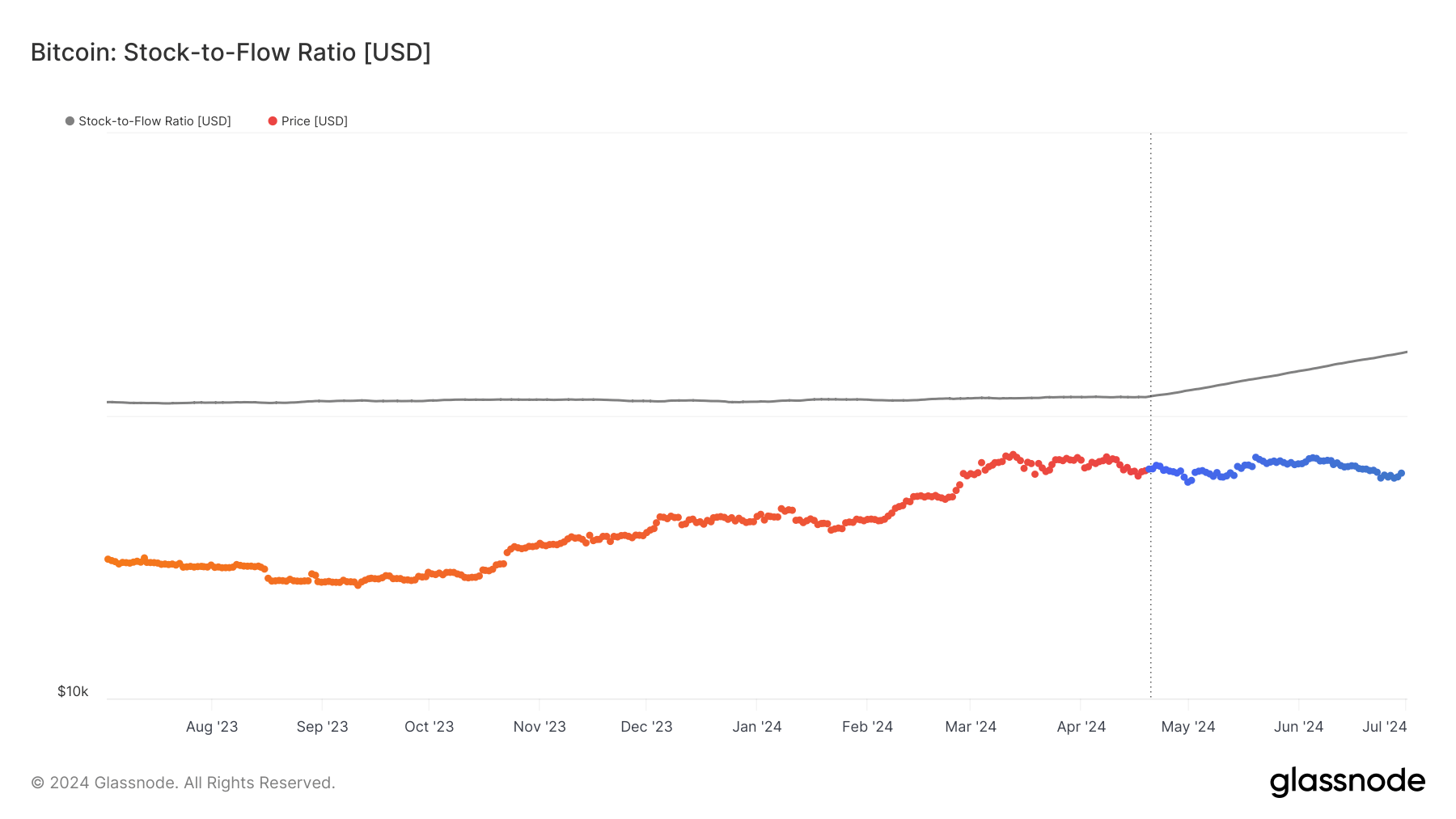

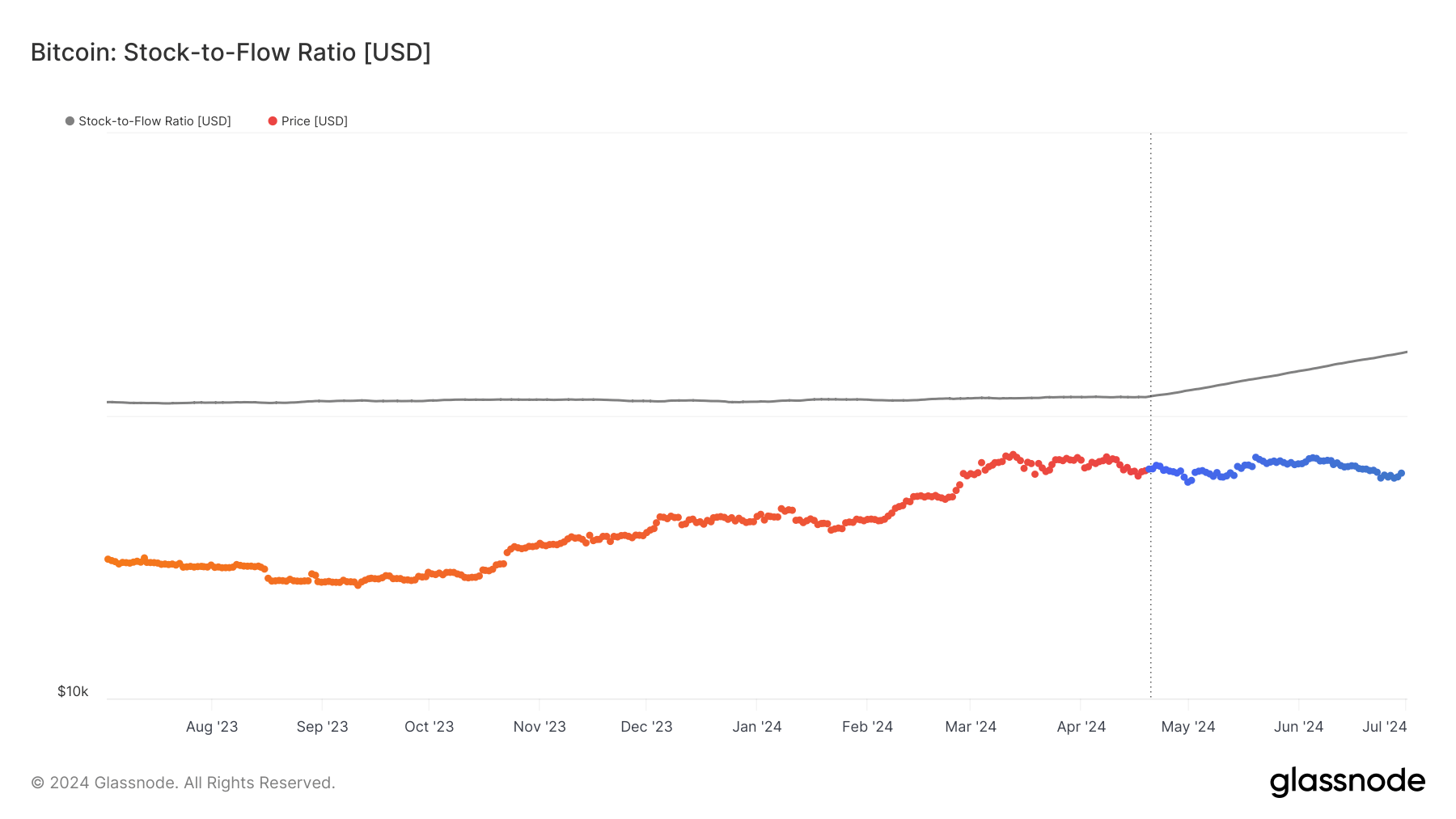

Bitcoin’s stock-to-flow ratio chart has to date illustrated a historic correlation between shortage and worth. Nonetheless, current information from Glassnode confirmed a deviation from this mannequin over the previous few years. Regardless of the April 2024 halving, which decreased the stream of latest Bitcoin and elevated shortage, Bitcoin’s worth has not aligned as carefully with the projected stock-to-flow values because it did in earlier cycles.

This deviation means that different market elements are influencing Bitcoin’s worth past the stock-to-flow mannequin’s shortage premise. Whereas halvings have traditionally boosted costs by highlighting Bitcoin’s restricted provide, present market situations replicate a extra advanced interaction of influences, together with regulatory developments and macroeconomic tendencies.

The current pattern emphasizes the need for traders to contemplate a broader vary of things when assessing Bitcoin’s future worth trajectory. The stock-to-flow ratio stays a worthwhile device, however its predictive energy has been tempered by the market’s maturity and complexity.