The crypto trade is on the verge of a doubtlessly important growth as key figures within the sector trace on the imminent approval of a spot Ethereum ETF in the USA, presumably triggering a notable worth rally for ETH.

Nate Geraci, president of The ETF Retailer, shared insights into the anticipated timeline for the launch of the primary spot Ethereum ETF.

In line with Geraci, present forecasts by Bloomberg predict a mid-July launch. He detailed the procedural timeline through X, stating, “Wen spot eth ETF? BBG sticking w/ mid-July. Amended S-1s due July eighth. Potential ultimate S-1s by July twelfth. Would theoretically imply launch week of July fifteenth.”

In parallel, Steve Kurz, head of asset administration at Galaxy Digital, confirmed to Bloomberg on July 2 that the U.S. Securities and Change Fee (SEC) may greenlight a spot Ethereum ETF earlier than the month’s finish.

Associated Studying

Kurz emphasised the in depth groundwork laid in collaboration with the SEC, drawing parallels between the proposed Ethereum ETF and Galaxy’s current spot Bitcoin ETF (BTCO), created with Invesco. Kurz expressed confidence of their preparedness, remarking, “We all know the plumbing, we all know the method… The SEC is engaged.”

Bloomberg ETF analyst Eric Balchunas additionally chimed in, aligning with the mid-July expectations. He highlighted the SEC’s current directions to Ethereum ETF issuers for amending their S-1 registration varieties by July 8, suggesting attainable additional amendments. Notably, the SEC authorized rule adjustments below 19-b4 in Could, facilitating the itemizing and buying and selling of such funds, although the issuance of funds remained pending ultimate approvals.

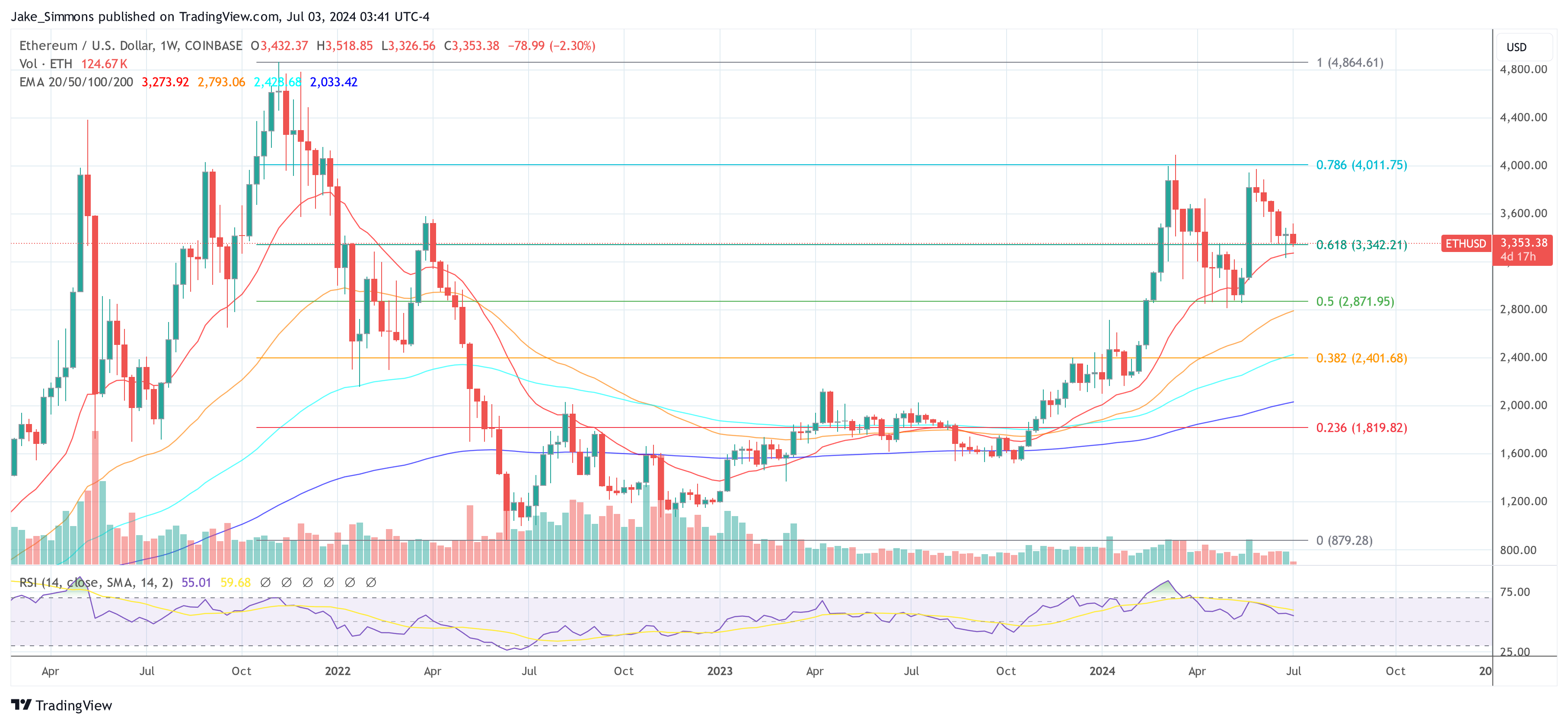

Ethereum Value Holds Above Key Assist

The anticipation of those approvals seems to be having a stabilizing impact on Ethereum costs. Crypto analyst IncomeSharks, commenting on Ethereum’s present worth trajectory through X, famous optimism for a near-term breakout, stating, “ETH – Trying extra optimistic for a Q3 breakout. Liking the possibilities of a run in direction of $4,000 this or subsequent month.” In line with the chart shared by him, ETH worth wants to carry the area of $3,300 to $3,350 as a way to rally to $4,000.

Supporting this sentiment, Chilly Blooded Shiller highlighted the essential want for Ethereum to exhibit momentum on the present worth ranges, particularly across the $3,400 mark, as a key indicator for a possible high-time-frame impulse.

Associated Studying

“ETH continues to be in a advantageous place but it surely actually wants to start out exhibiting some momentum quickly. LTF divergences round this $3400 low are in all probability the place I take one stab at attempting to seize any HTF impulse away from the consolidation,” he remarked through X.

Including historic perspective, analyst Jelle (@CryptoJelleNL) in contrast the present market section to Ethereum’s lengthy consolidation in 2016-2017 earlier than its huge rally, urging persistence and optimism: “In 2016-2017, ETH consolidated for 50+ weeks earlier than rallying practically 12000 p.c. At present, persons are giving up after lower than 20 weeks, with ETH ETFs proper across the nook. Follow the plan boys. One of the best is but to come back.”

At press time, ETH traded at $3,353.

Featured picture created with DALL·E, chart from TradingView.com