KEY

TAKEAWAYS

- S&P 500 and Nasdaq Composite shut at report highs

- Equities, valuable metals, and bonds all rise, however Bitcoin reveals weak point

- Regulate the Equal Weighted S&P 500 and Nasdaq breadth to get early perception into inventory market course.

For those who have been taking break day from the inventory market, because it wasn’t doing a lot within the final week or so, you are in for a pleasant shock.

July is taken into account a superb month for shares, and the primary buying and selling week of the month, albeit quick, did not point out in any other case. It might have been a brief buying and selling week, however rather a lot occurred—ECB discussion board, Fed minutes, PMI information, a brand new UK Prime Minister, and the June jobs report—to assist push the fairness market out of its doldrums.

The S&P 500 ($SPX) and Nasdaq Composite ($COMPQ) have damaged out of their sideways transfer and present directional bias towards the upside. Valuable metals, i.e. gold ($GOLD) and silver ($SILVER), are shifting greater after a pullback. Crude oil costs are consolidating after rising for a couple of month. The US Greenback Index ($USD) has pulled again and is buying and selling near a help stage.

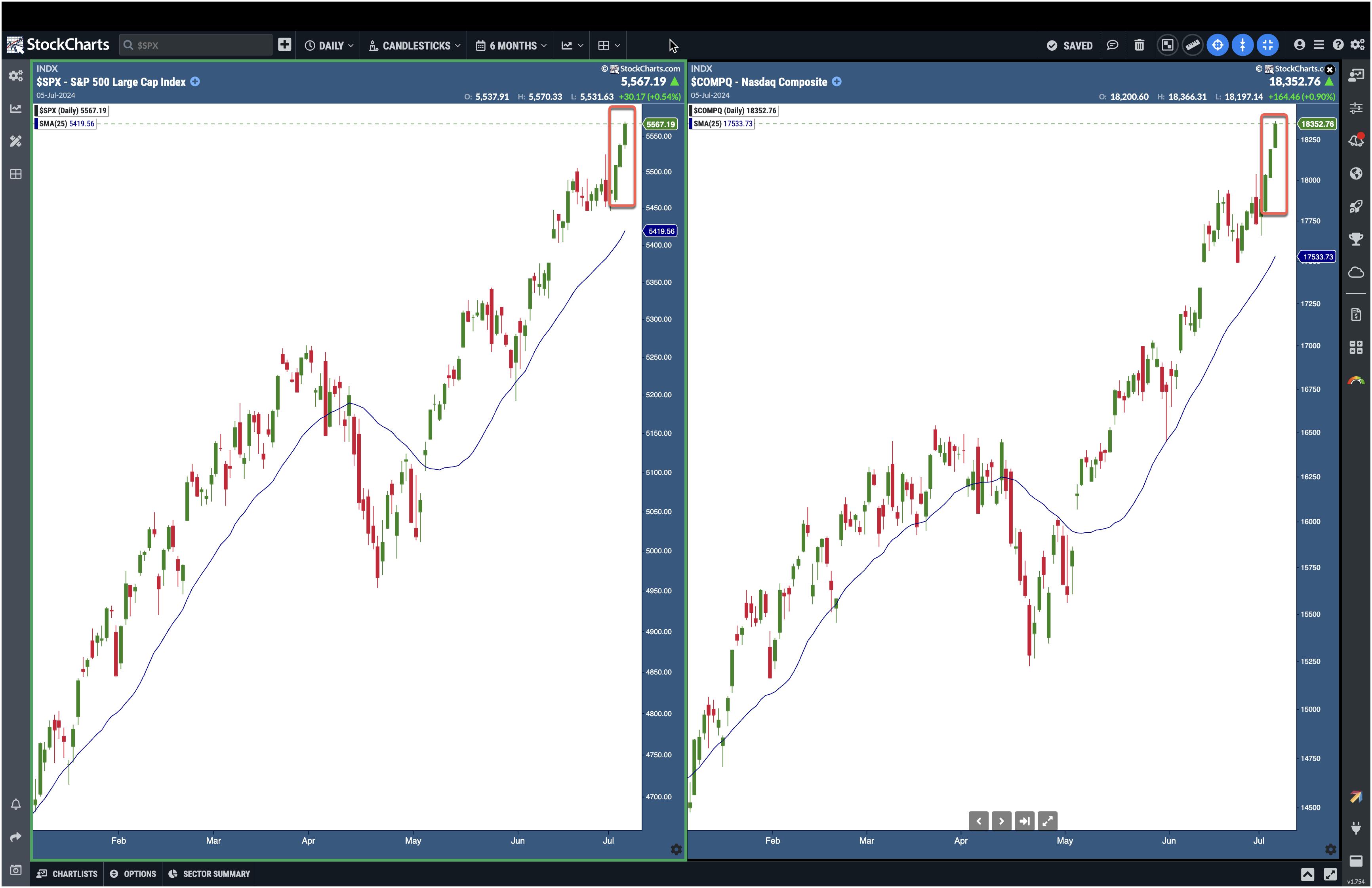

Trying on the each day chart of the S&P 500 and Nasdaq Composite beneath, you see a candlestick sample resembling the three white troopers. This is a sign that purchasing stress stays robust.

CHART 1. BULLISH CHART PATTERN IN THE S&P 500 AND NASDAQ COMPOSITE. The indexes broke out of their sideways transfer and continued rising. A follow-through subsequent week would imply additional upside.Chart supply: StockChartsACP. For instructional functions.

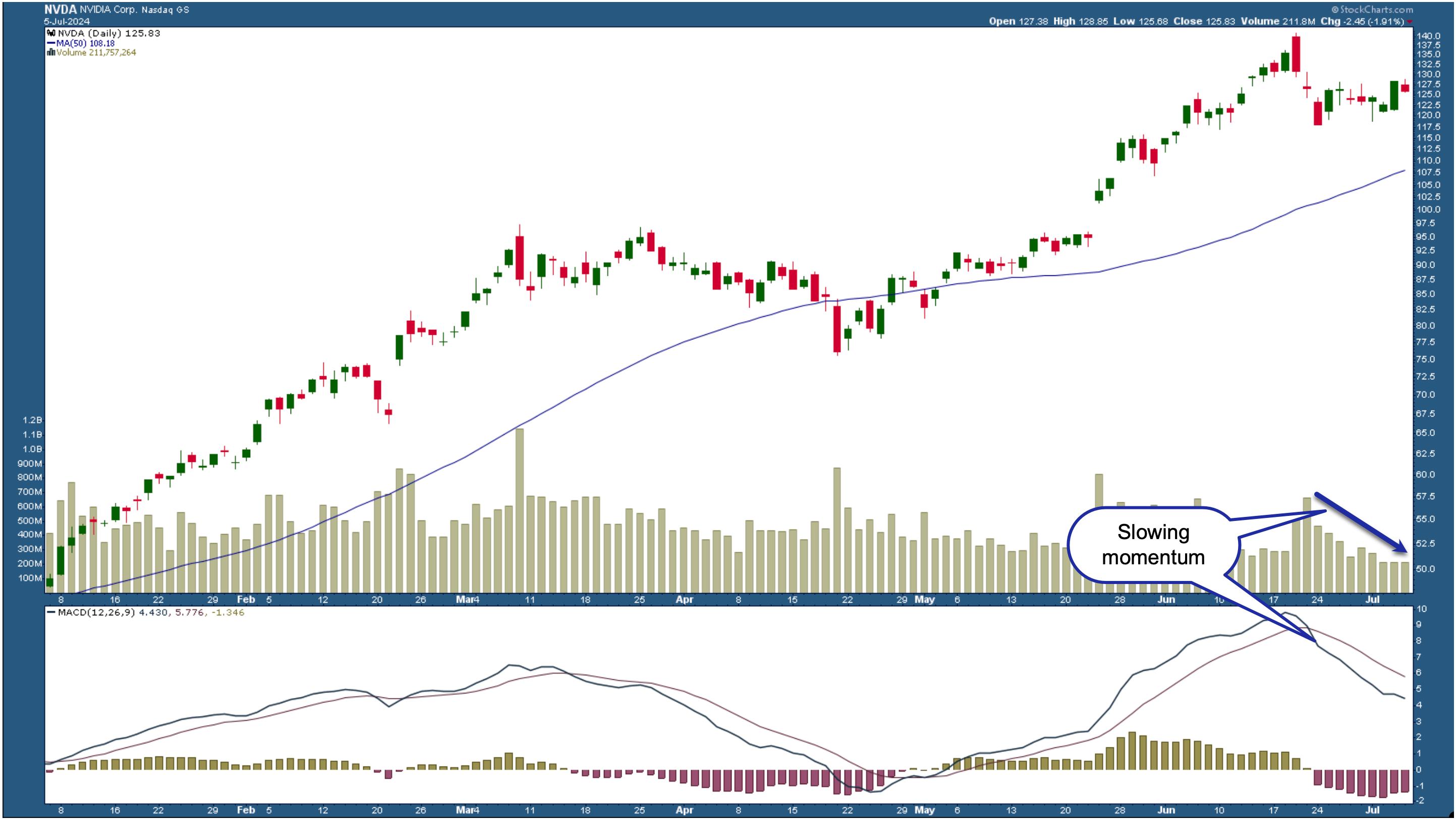

NVDA Nonetheless Sturdy

There was some concern that the broader market, particularly know-how shares, would pull again after NVDIA’s inventory value. However should you have a look at the each day chart of NVDA inventory beneath, it is buying and selling nicely above its 50-day easy shifting common (SMA).

CHART 2. DAILY CHART OF NVDA STOCK. Despite the fact that NVDA’s inventory value pulled again, the general development continues to be up. Nonetheless, momentum is slowing. This might change subsequent week and is value watching. Chart supply: StockCharts.com. For instructional functions.

The general development is up, however that does not imply NVDA’s inventory value will hit new highs quickly. For those who have a look at the shifting common convergence/divergence (MACD) indicator, the MACD line has crossed beneath the sign line and is trending decrease. Quantity additionally has declined. Each these indicators counsel that momentum is slowing. This kind of value motion is typical of a vacation weekend and shortened buying and selling week, so it is probably not an correct illustration. If there’s continued follow-through subsequent week, it might be a extra confirming sign.

Bitcoin: The Weak Hyperlink

Whereas equities are trending greater, Bitcoin is going through headwinds. Traders are nonetheless coming to grips with Mt. Gox’s collapse and the information that it will repay its collectors $8.5 billion in crypto. This may imply those that obtain cash of their crypto wallets will most likely liquidate them, inflicting Bitcoin costs to fall additional.

the each day chart of Bitcoin to US Greenback ($BTCUSD), it is buying and selling at its February ranges. It is also bouncing off the 38.2% Fibonacci retracement stage (primarily based on the September 2023 lows to March 2024 excessive).

CHART 3. DAILY CHART OF BITCOIN TO US DOLLAR. Bitcoin is buying and selling at its February 2024 ranges. Value may fall decrease and hit the 50% and 61.8% Fibonacci retracement ranges.Chart supply: StockCharts.com. For instructional functions.

The MACD within the decrease panel reveals the cryptocurrency is shedding momentum. If the weak momentum continues, Bitcoin may go as little as its 50% and 61.8% Fibonacci retracement ranges. Regulate these ranges!

Bonds Costs On the Transfer

Treasury yields fell after a barely cooler June jobs report. This elevated bond costs (rates of interest and bond costs transfer in reverse instructions), a welcome reversal after the sharp July 1 decline. This value motion will be seen within the iShares 20+ 12 months Treasury Bond ETF (TLT).

The chart beneath reveals TLT coming near breaking beneath a powerful help stage. That TLT has bounced off this help stage and reversed, which is a sign of the excessive chance of a Fed rate of interest lower by this yr.

CHART 4. DAILY CHART OF ISHARES 20+ YEAR TREASURY BOND ETF (TLT). TLT held on to the help of the blue-dashed trendline and reversed.Chart supply: StockCharts.com. For instructional functions.

If subsequent week’s June CPI and PPI information counsel inflation continues to chill, rate of interest cuts change into extra seemingly. Treasury yields may fall additional, which suggests bond costs will rise.

In line with the CME FedWatch Software, the chance of a September rate of interest lower sits at round 70%, as of this writing.

Shares will seemingly get a lift from the elevated chance of an rate of interest lower within the September Fed assembly. Subsequent week’s inflation information and Fed Chairman Powell’s assertion may influence the inventory market’s course. There are some areas buyers ought to watch.

Add the next two charts to your StockCharts ChartLists.

One reveals the divergence between the worth motion within the Nasdaq Composite and its Advance-Decline line. The opposite reveals the S&P 500 Equal Weighted Index in a consolidation sample. The course of those charts may offer you a heads-up on the general inventory market course.

CHART 5. NASDAQ DIVERGES FROM ADVANCE-DECLINE ISSUES LINE.

CHART 6. THE S&P 500 EQUAL WEIGHTED INDEX IS CONSOLIDATING.

Finish-of-Week Wrap-Up

- S&P 500 closed up 1.95% for the week, at 5567.19; Dow Jones Industrial Common up 0.66% for the week at 39,375.87; Nasdaq Composite closed up 3.5% for the week at 18,352.76

- $VIX up 0.32% for the week closing at 12.48

- Finest performing sector for the week: Shopper Discretionary

- Worst performing sector for the week: Vitality

- High 5 Giant Cap SCTR shares: NVIDIA (NVDA); Tremendous Micro Laptop, Inc. (SMCI); Vistra Vitality (VST); Applovin Corp (APP); Taiwan Semiconductor Mfg. (TSM)

On the Radar Subsequent Week

- June CPI

- June PPI

- Fed Chair Powell Testimony

- Treasury Secretary Yellen Testimony

- Fed speeches from Barr, Powell, Goolsbee, and Bostic

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your individual private and monetary scenario, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Web site Content material at StockCharts.com. She spends her time developing with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Be taught Extra