An Ethereum whale has brought about panic amongst neighborhood members following a latest transaction suggesting they is perhaps trying to offload their holdings. This comes amid a latest prediction by analysis agency Matrixport that Ethereum’s worth might considerably rebound from its present worth degree.

Ethereum Whales Transfers 11,215 ETH

Onchain knowledge reveals that the Ethereum whale transferred 11,215 ETH ($34.3 million) to the crypto trade Coinbase. A dealer normally makes such a transfer when promoting these tokens, and contemplating the quantity of tokens concerned, such a sale might considerably influence ETH’s worth. Nonetheless, knowledge from the market intelligence platform IntoTheBlock reveals that there is perhaps a requirement for these tokens if, certainly, this whale is trying to offload their tokens.

Associated Studying

There was a rise of 132% within the massive holders’ netflow to trade netflow ratio within the final seven days, which means that Ethereum whales are actively accumulating extra ETH. The move metrics additionally paint an accumulation development amongst Ethereum holders, with influx quantity into exchanges down by over 11% within the final seven days.

Throughout this era, the outflow quantity from these exchanges has elevated by 3%, additional confirming that Ethereum buyers need to maintain their positions and accumulate extra ETH at this level. That is undoubtedly a optimistic growth for Ethereum’s worth, which might witness a big rebound because of this wave of accumulation.

Analysis agency Matrixport additionally predicted that ETH’s worth would rebound from its present worth degree because of the Spot Ethereum ETFs, which they claimed might launch as early as this week.

Whereas that continues to be unsure, market specialists like Bloomberg analyst James Seyffart have recommended that it shouldn’t be lengthy earlier than these Spot Ethereum ETFs start buying and selling. It’s because fund issuers have applied a lot of the feedback that the Securities and Change Fee (SEC) had on their S-1 filings.

ETH Is Primed For A Rally

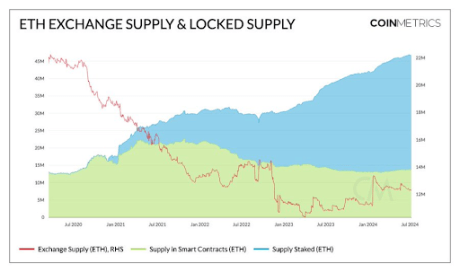

Crypto analyst Leon Waidmann talked about in an X (previously Twitter) put up that Ethereum is primed for a rally. He made this assertion primarily based on Ethereum’s dwindling provide. He famous that 40% of Ethereum’s provide is locked up, with 28% staked and the opposite 12% in good contracts and bridges.

Moreover, Waidmann expects this provide to proceed to scale back as soon as the Spot Ethereum ETFs start buying and selling, with institutional buyers taking an enormous chunk of the availability off exchanges. Based mostly on this, Ethereum might rally on the again of the availability and demand dynamics since demand is certain to outpace provide sooner or later.

Associated Studying

Crypto analyst Follis talked about that Ethereum’s chart seems an identical to Bitcoin’s simply earlier than it pumped over 200% final yr. He recommended that the Spot Ethereum ETFs could possibly be the catalyst that sparks an identical rally for ETH.

Featured picture created with Dall.E, chart from Tradingview.com