Bitcoin is regular when writing, floating above speedy assist ranges and inches away from reclaiming the all-important native liquidation line at round $66,000. Even because the broader crypto neighborhood expects patrons to step in and push costs greater, there are thrilling developments that buttress this outlook.

Billions Price Of BTC Pulled From Exchanges

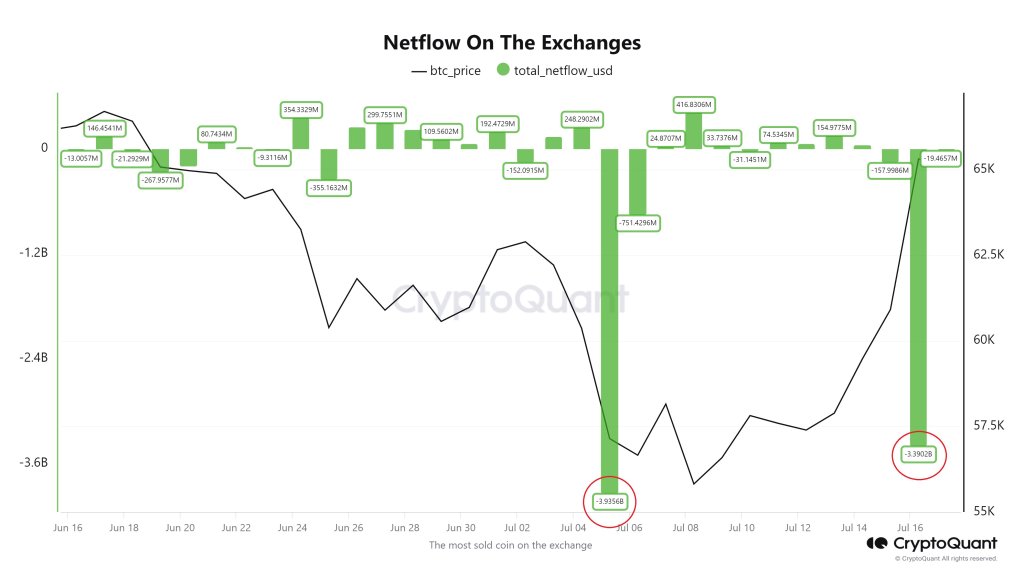

In response to change knowledge shared by one analyst on X, BTC holders more and more pull their cash from exchanges.

On July 5, when costs tanked, pushing the world’s most beneficial coin near $50,000, a staggering $3.8 billion BTC was moved from exchanges.

As soon as this occurred, costs quickly bounced again, rising from as little as $53,500 to $65,000 recorded earlier this week. Although costs have been shifting horizontally above $62,500 just lately, extra BTC is being withdrawn. On July 16, BTC house owners pulled one other $3.4 billion of the coin.

Associated Studying

Regardless that there isn’t any clear impression on costs, if previous efficiency guides, it’s seemingly that costs will edge greater like they did after the collapse to $53,500.

Often, analysts interpret change outflows as optimistic for worth. At any time when coin holders transfer property to non-custodial wallets, they wish to take management of their cash. As such, they is perhaps unwilling to promote.

Their resolution helps assist costs since they received’t promote on demand in the event that they want to, like in the event that they held them on crypto platforms like Binance or Coinbase. Furthermore, with fewer BTC available on exchanges, bulls have a tendency to learn attributable to elevated shortage.

Is Bitcoin Getting ready For One other Leg Up Above $72,000?

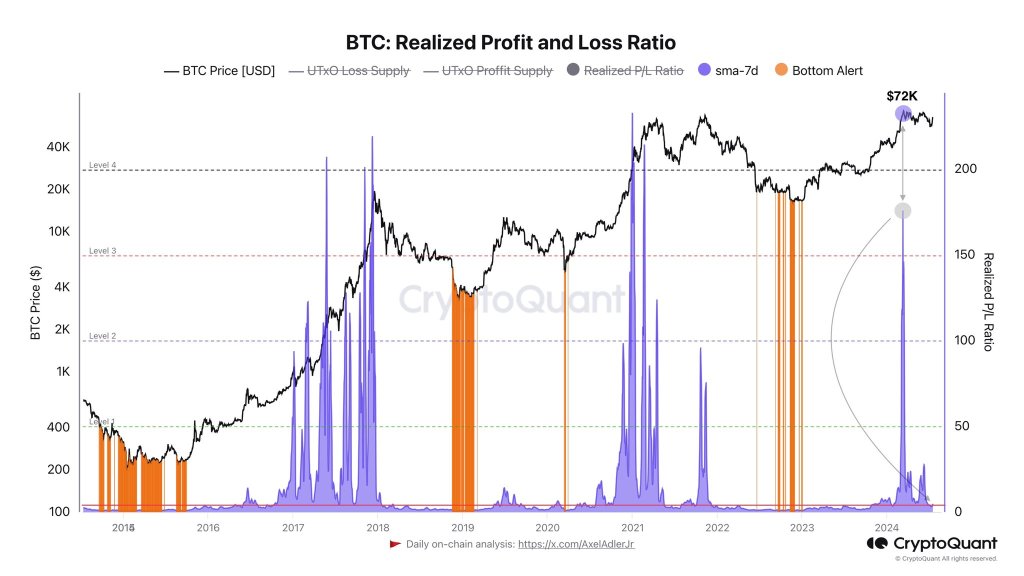

Past this improvement, one other analyst notes that the Realized Revenue and Loss Ratio metric has fallen and stands at multi-month lows. The metric is used to gauge market sentiment, primarily influenced by revenue and loss at any cut-off date.

This lower means that traders who wished to exit at highs have already taken revenue. For now, merchants should look ahead to these metrics to rise, maybe to multi-month highs, ideally above $72,000 and $74,000, earlier than profit-taking resumes.

Associated Studying

Bitcoin has additionally reclaimed its common value foundation of short-term holders (STHs) as costs get better above $62,000. Those that purchased throughout the final 155 days at the moment are within the cash. They’re seemingly holding and anticipating extra good points within the coming classes earlier than realizing earnings.

Prior to now, each time the typical value foundation is surpassed, CryptoQuant analysts say costs are inclined to rise by over 30%.

Function picture from DALLE, chart from TradingView