Solana began a gentle improve above the $155 zone. SOL worth is signaling an honest improve above the $162 and $165 resistance ranges.

- SOL worth began an honest upward transfer above the $155 resistance towards the US Greenback.

- The value is now buying and selling above $158 and the 100-hourly easy transferring common.

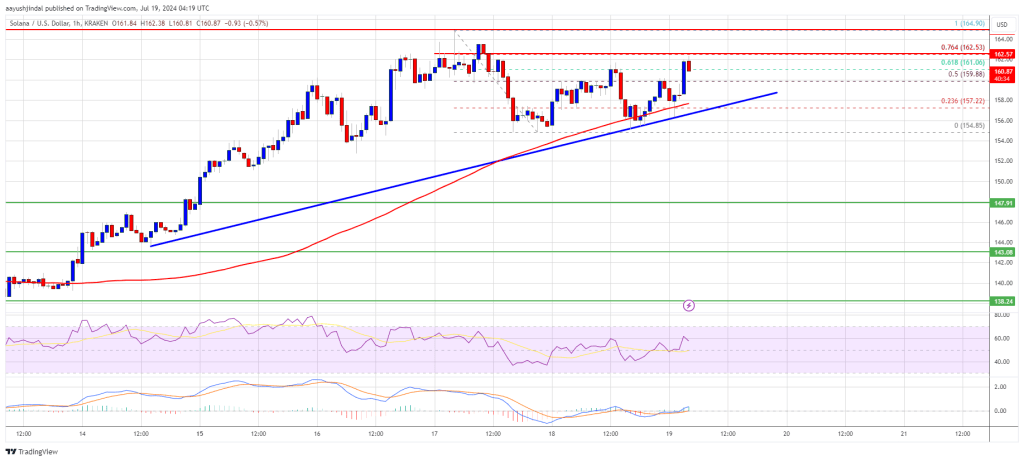

- There’s a key bullish development line forming with help at $159 on the hourly chart of the SOL/USD pair (knowledge supply from Kraken).

- The pair might goal for extra upsides if it clears the $162.50 resistance stage.

Solana Worth Stays In Uptrend

Solana worth remained in a optimistic zone above $145 and prolonged its improve above $150. SOL is forming a base and eyeing extra upsides, whereas Bitcoin and Ethereum are correcting features.

There was a transfer above the $158 stage. The value surpassed the 50% Fib retracement stage of the current decline from the $164.90 swing excessive to the $154.85 low. There may be additionally a key bullish development line forming with help at $159 on the hourly chart of the SOL/USD pair.

Solana is now buying and selling above the $158 stage and the 100-hourly easy transferring common. On the upside, the value may face resistance close to the $162.50 stage. It’s near the 76.4% Fib retracement stage of the current decline from the $164.90 swing excessive to the $154.85 low.

The subsequent main resistance is close to the $165 stage. A profitable shut above the $165 resistance might set the tempo for an additional regular improve. The subsequent key resistance is close to $172. Any extra features may ship the value towards the $180 stage.

Are Dips Supported in SOL?

If SOL fails to rise above the $162.50 resistance, it might begin a draw back correction. Preliminary help on the draw back is close to the $160 stage. The primary main help is close to the $158 stage and the development line.

A break beneath the $158 stage may ship the value towards $155. If there’s a shut beneath the $155 help, the value might decline towards the $150 help within the close to time period.

Technical Indicators

Hourly MACD – The MACD for SOL/USD is gaining tempo within the bullish zone.

Hourly Hours RSI (Relative Energy Index) – The RSI for SOL/USD is above the 50 stage.

Main Assist Ranges – $158 and $155.

Main Resistance Ranges – $162.50 and $165.