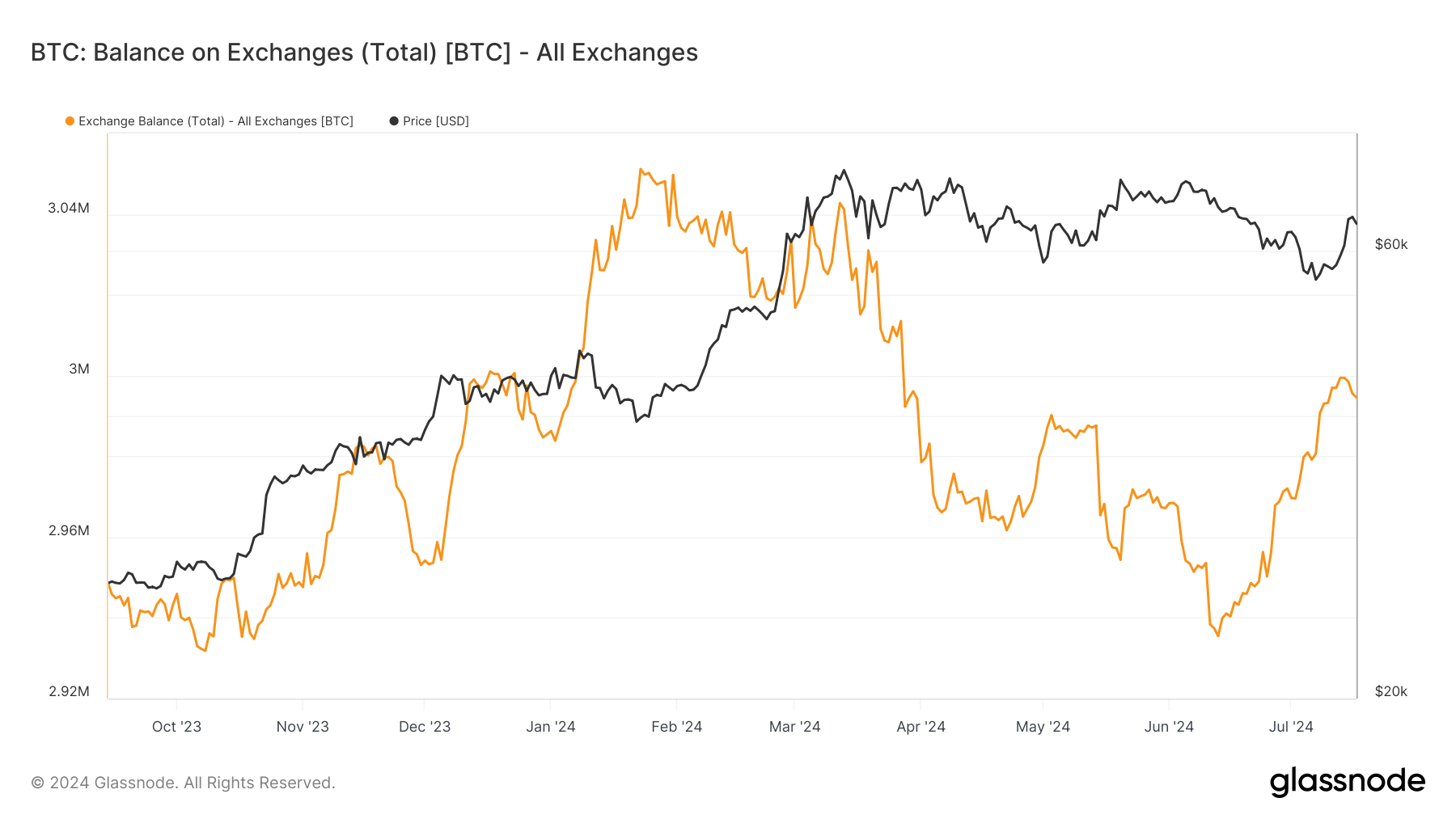

Bitcoin, at the moment valued at $64,900, has skilled vital actions in alternate balances over latest months, surging by 64,000 BTC, roughly $4.1 billion, within the final 30 days, in line with Glassnode information. This follows a interval of marked decline in exchange-held Bitcoin that started in early 2024 after the launch of the spot Bitcoin ETFs within the US and intensified post-halving in April 2024.

Analyzing the chart, Bitcoin alternate balances elevated all through the top of 2023, peaking round late January 2024, coinciding with a neighborhood worth low after the ‘promote the information‘ narrative of Bitcoin ETFs light. This rise was seemingly pushed by merchants shifting Bitcoin onto exchanges to capitalize on the value rally since October.

Nevertheless, as costs fluctuated and peaked once more round March and Might 2024, there was a notable outflow of Bitcoin from exchanges, suggesting a shift in direction of holding belongings in private wallets as a long-term funding technique.

The latest reversal, with vital inflows again to exchanges, suggests merchants are promoting into the slight market decline or taking benefit of the present worth actions to reposition their holdings. This motion of Bitcoin onto exchanges can usually precede elevated buying and selling exercise, both for profit-taking or in anticipation of market shifts.

Since July 14, roughly 1,000 BTC have left exchanges in a latest slight reversal of the development.