CRV, the native token of Curve, a stablecoin decentralized trade (DEX), is below immense promoting strain. After the hack of July 2023, CRV has by no means been the identical once more. Nonetheless, the painful liquidations of Michael Erogov’s loans have worsened the state of affairs for holders.

Curve Founder Compelled To Promote $677,000 Of CRV, Token Falling

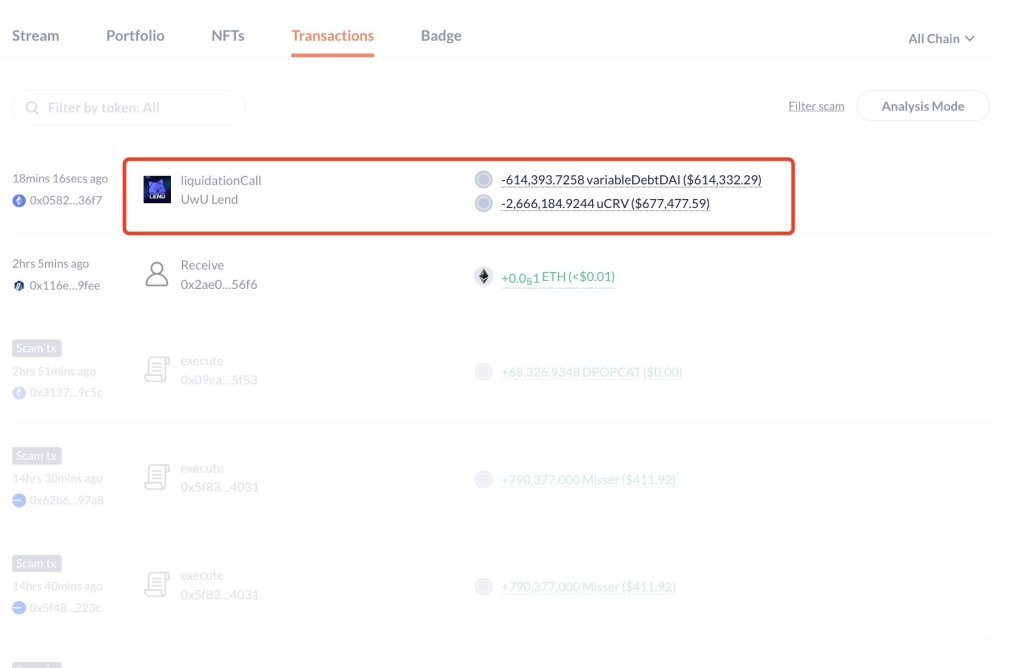

After the compelled liquidation in mid-June, which pushed costs under $0.30, knowledge confirmed that the founder was additionally compelled to promote CRV out there to repay a part of his mortgage. Yesterday, on July 25, Lookonchain knowledge confirmed that Erogov was liquidated for $677,000 price of CRV.

Presently, CRV continues to print, discouraging decrease lows. Despite the fact that the dump has not been as speedy as in June, the token is weak and will plunge under essential help ranges. For now, this degree is on the double backside at $0.21. On the higher finish, resistance lies at $0.30.

Curiously, this resistance degree served as help in June when costs slammed via the ground, accelerated by Erogov’s loans being liquidated. Then, as a result of quantity within the image, there was worry throughout the crypto board that the founder’s loans would additional destabilize the protocol, negatively impacting CRV holders.

On-chain knowledge reveals that Erogov had borrowed roughly $100 million in stablecoins utilizing $140 million in CRV as collateral. Some declare the founder purchased prime actual property with this mortgage.

Nonetheless, what’s recognized is that the collection of compelled liquidations and the scramble by the founder to dump CRV, which allowed him to be liquidated after the hack, compelled costs even decrease.

Hopes On Spot Ethereum ETFs And Neighborhood Initiatives

For the reason that hack on July 30, CRV has cratered by over 50%. Holders are going through it tough now that crypto costs are additionally sliding, retracing from their March 2024 peaks.

Promoting strain has since eased after many of the CRV collateral posted by Erogov was reclaimed by lending protocols—together with Frax and Aave. Nonetheless, the token remains to be struggling for momentum.

This weak point is a priority, particularly contemplating the constructive developments this week. As an Ethereum-based DEX, the approval and buying and selling of spot Ethereum ETFs would profit the protocol in the long term.

Past the by-product product opening up establishments to Ethereum, Curve can also be rising in power. Just lately, the neighborhood okayed a proposal to additional enhance CRV liquidity by bridging the hole between Solana and Ethereum through USDT.

By way of this initiative floated by Picasso Community, a pool of USDT on Solana and USDT on Ethereum was launched. The objective is to encourage cross-chain exercise and supply much more incentives for liquidity suppliers.