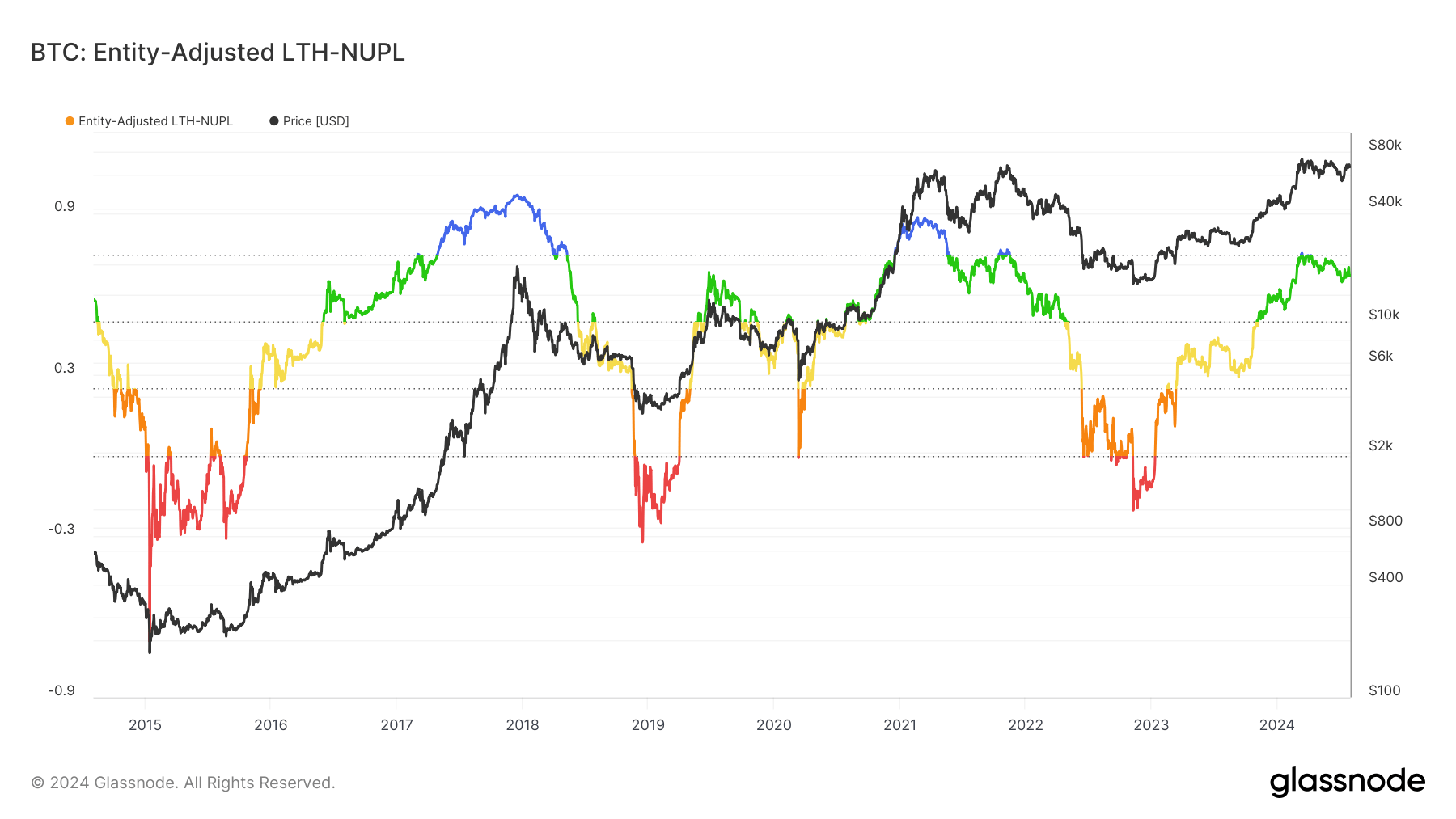

Entity-adjusted Bitcoin metrics present a refined view of market sentiment by filtering out non-economic transactions. That is particularly vital when analyzing internet unrealized revenue and loss, such because the LTH-NUPL and STH-NUPL.

Non-entity-adjusted metrics can present skewed, unclear, or incorrect information as a result of they embody all transactions, even inner transfers throughout the identical entity. These “in-house” transactions don’t symbolize actual financial exercise however can artificially inflate or deflate the obvious degree of unrealized revenue or loss.

As an illustration, massive inner transfers would possibly create the phantasm of elevated market exercise or profit-taking, leading to false interpretations of market tops or bottoms and in the end inflicting inaccurate market predictions.

Entity-adjusted LTH-NUPL is a complicated metric that considers the precise financial exercise of long-term holders by excluding these “in-house” transactions. This helps filter out exercise from massive institutional gamers which have develop into ubiquitous within the trade because the launch of spot Bitcoin ETFs.

Traditionally, LTH-NUPL has been a dependable indicator of market sentiment, notably in figuring out market tops and bottoms. When the LTH-NUPL crosses above 0.7, it sometimes indicators the start of a euphoria or greed section out there. This section typically correlates with market tops as long-term holders notice important unrealized earnings. Conversely, values between 0.5 and 0.7 point out a perception or denial section, relying on the value route.

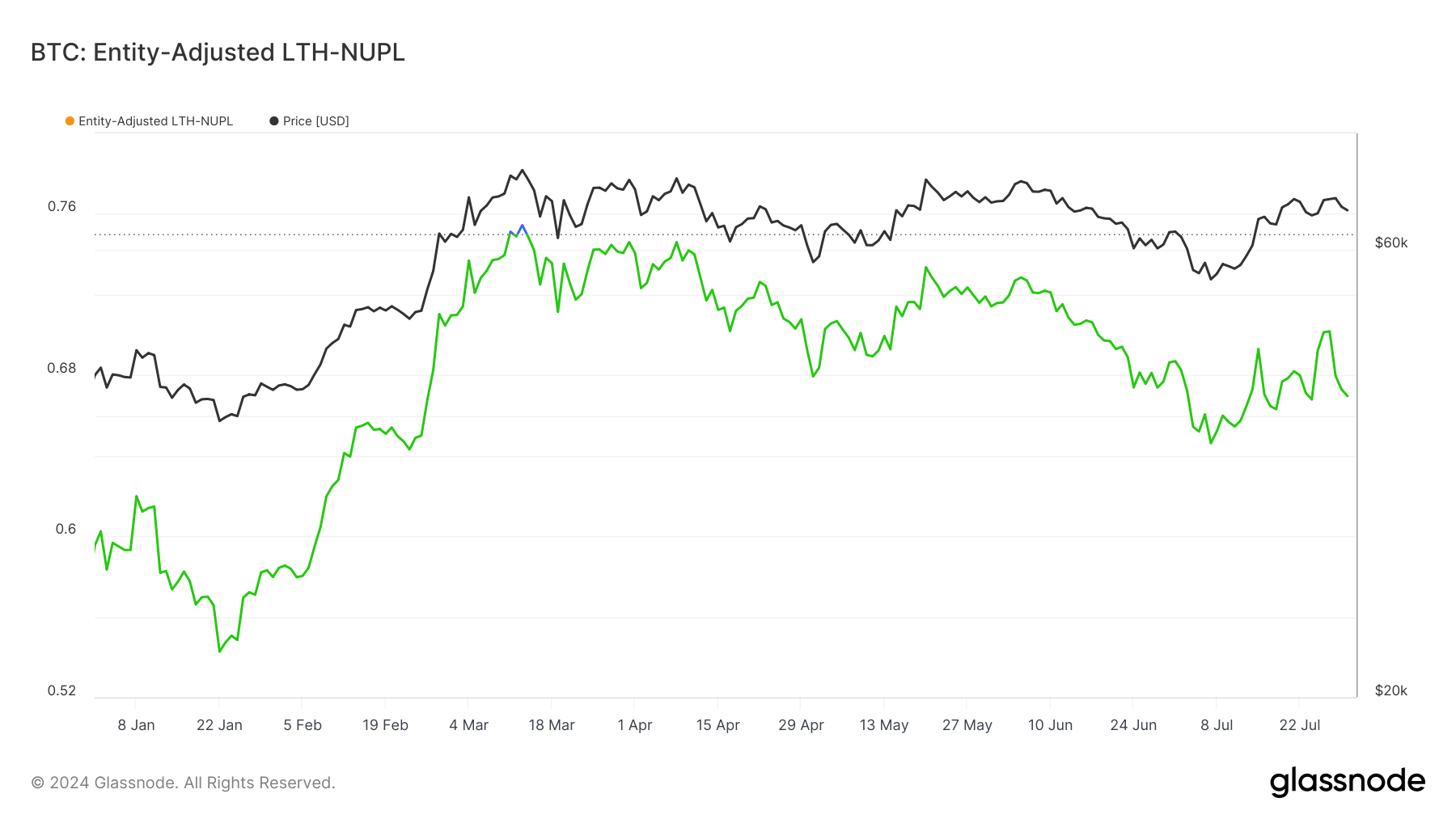

In 2024, LTH-NUPL has persistently remained above 0.5, suggesting a robust perception out there’s upward development amongst long-term holders. The metric briefly crossed into the greed section from Could 11 to Could 13, displaying a short-lived euphoria as Bitcoin reached its new all-time excessive.

Since July, LTH-NUPL has been trending upwards with important volatility, reaching 0.70 on July 27 earlier than barely reducing to 0.66 by July 31.

This upward development in LTH-NUPL displays the arrogance of long-term holders within the ongoing market rally regardless of the occasional volatility. The metric’s resilience above 0.5 all year long reveals the cohort’s sustained perception.

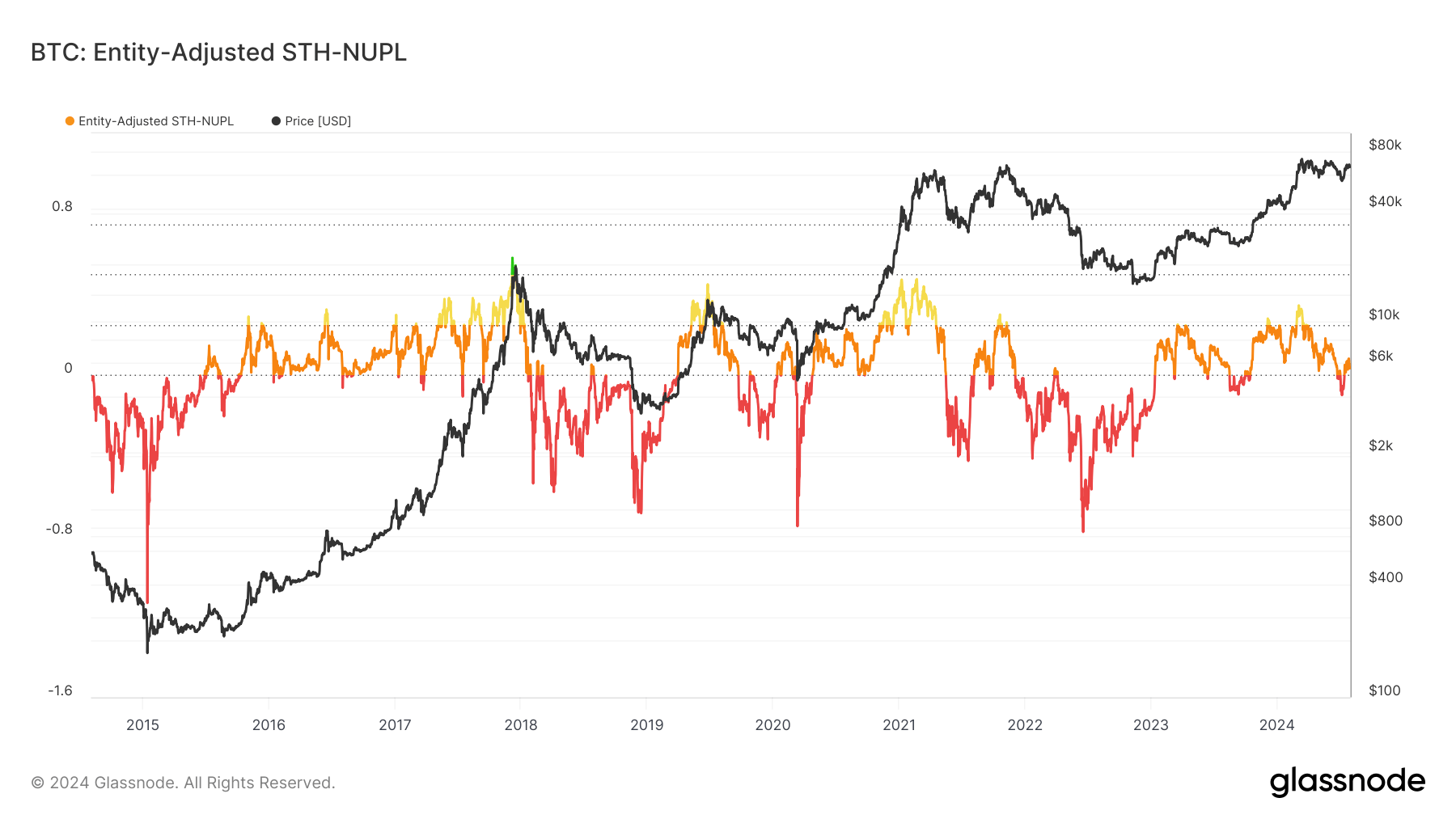

Entity-adjusted STH-NUPL, however, measures the web unrealized revenue or lack of short-term holders, outlined as entities holding Bitcoin for lower than 155 days. Traditionally, STH-NUPL has been much less efficient in predicting market tops and bottoms than LTH-NUPL.

Throughout Bitcoin’s bull run in December 2017, STH-NUPL briefly entered the assumption/denial section. Nonetheless, it has principally ranged between 0 and 0.24, indicating a state of hope or concern amongst short-term holders, with excessive volatility corresponding to cost actions.

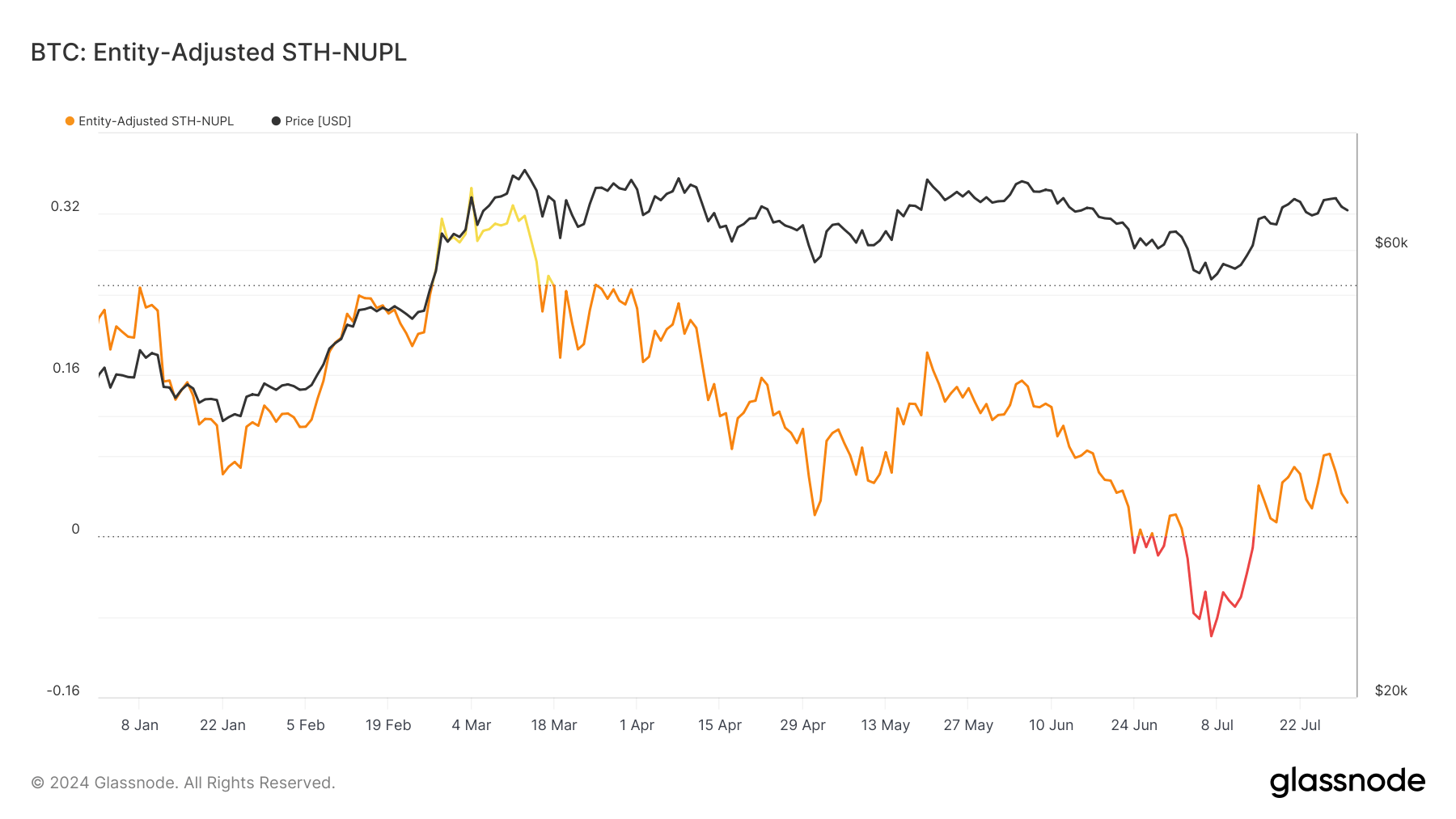

This 12 months, STH-NUPL noticed as a lot volatility as its LTH counterpart. The ratio entered the optimism class above 0.24 in March, solely to drop into capitulation territory beneath 0 in late June and mid-July. This drop displays the market’s extreme correction and the following panic amongst short-term holders.

Since July 7, STH-NUPL has been trending upwards, breaking above 0 and coming into the hope class on July 15. As of July 31, the metric stands at 0.033, a slight lower from a latest excessive of 0.081 on July 27. This upward development signifies a gradual restoration in market sentiment amongst short-term holders, although it stays cautious and unsure.

The disparity between LTH-NUPL and STH-NUPL highlights long-term and short-term holders’ contrasting behaviors and sentiments. LTH-NUPL’s increased and extra secure values recommend a stronger and extra constant perception out there’s long-term potential. Having held their property by way of varied market cycles, long-term holders exhibit larger resilience and confidence, contributing to the metric’s effectiveness in predicting market tops and bottoms.

In distinction, STH-NUPL’s decrease values and better volatility mirror the short-term holders’ sensitivity to market fluctuations. Brief-term holders usually tend to react to speedy worth actions, resulting in frequent shifts between hope, concern, and capitulation phases. This reactive habits makes STH-NUPL a much less dependable indicator of long-term market traits.

LTH-NUPL’s capability to sign market tops is rooted within the habits of long-term holders throughout euphoric phases. When LTH-NUPL exceeds 0.7, it signifies that long-term holders are sitting on substantial unrealized earnings. Traditionally, this has led to profit-taking actions, subsequently triggering market corrections or tops.

The submit NUPL ratio reveals why long-term holders are higher market prime indicators appeared first on CryptoSlate.