The worldwide financial market has now to this point proven rising indicators of instability which seems to have impacted the general crypto funding sector negatively. Latest knowledge from CoinShares has revealed a reversal within the move of funds, with crypto funding merchandise experiencing important weekly outflows.

As reported by CoinShares, this outflow marks the primary time in over a month that the web steadiness has tipped from “accumulation to liquidation,” highlighting investor nervousness amid recession fears in america.

Deciphering The Crypto Fund Flows: Was There Any Inexperienced?

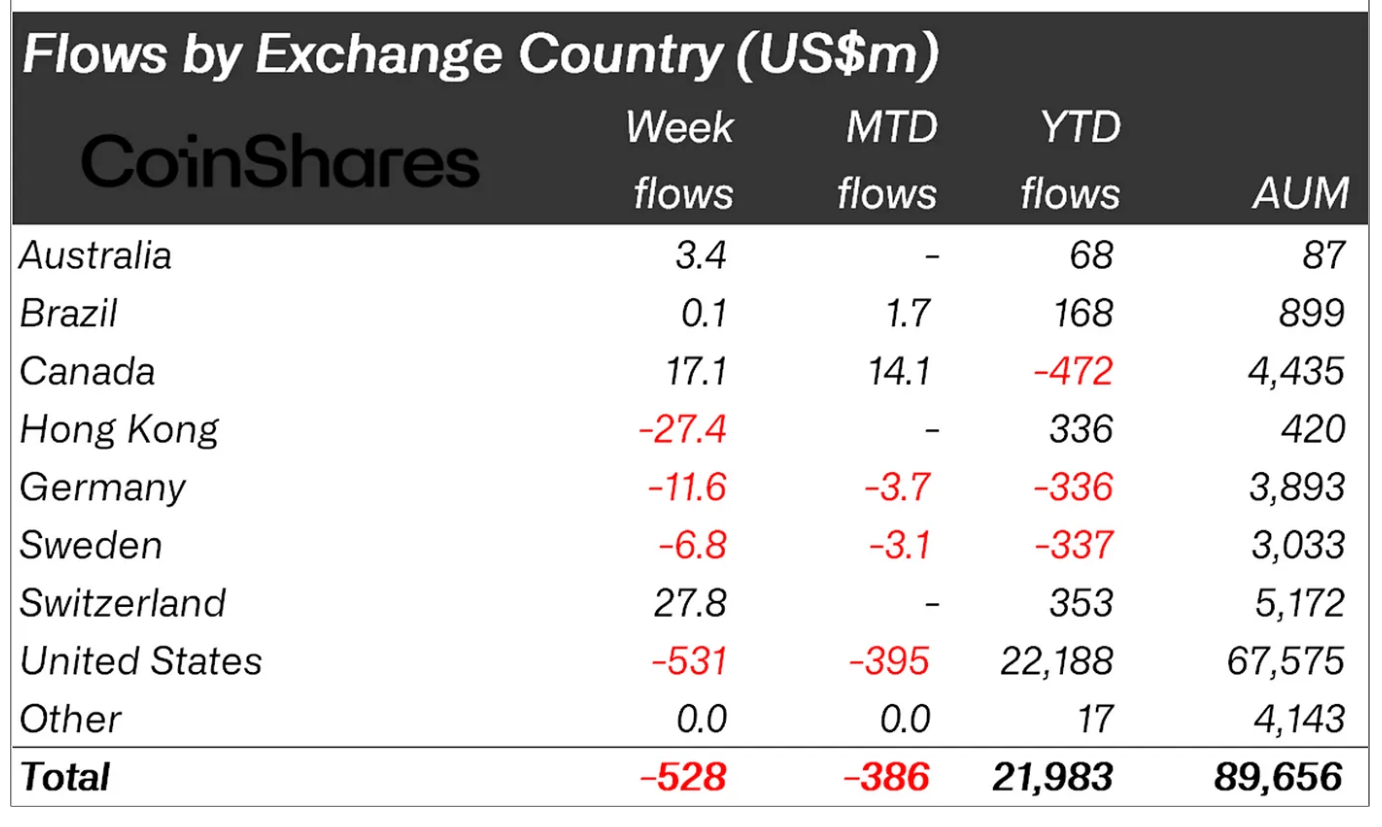

Analyzing the geographical distribution of those outflows presents a nuanced view of the present market stance. The report from CoinShares revealed that US-based funds had been the toughest hit, recording web outflows of $531 million.

Associated Studying: Bitcoin’s Value Potential: Analyst Maps Path To $700,000 And Past

This determine was closely influenced by a important sell-off on Friday, the place web outflows totalled $237.4 million, overshadowing any inflows earlier within the week.

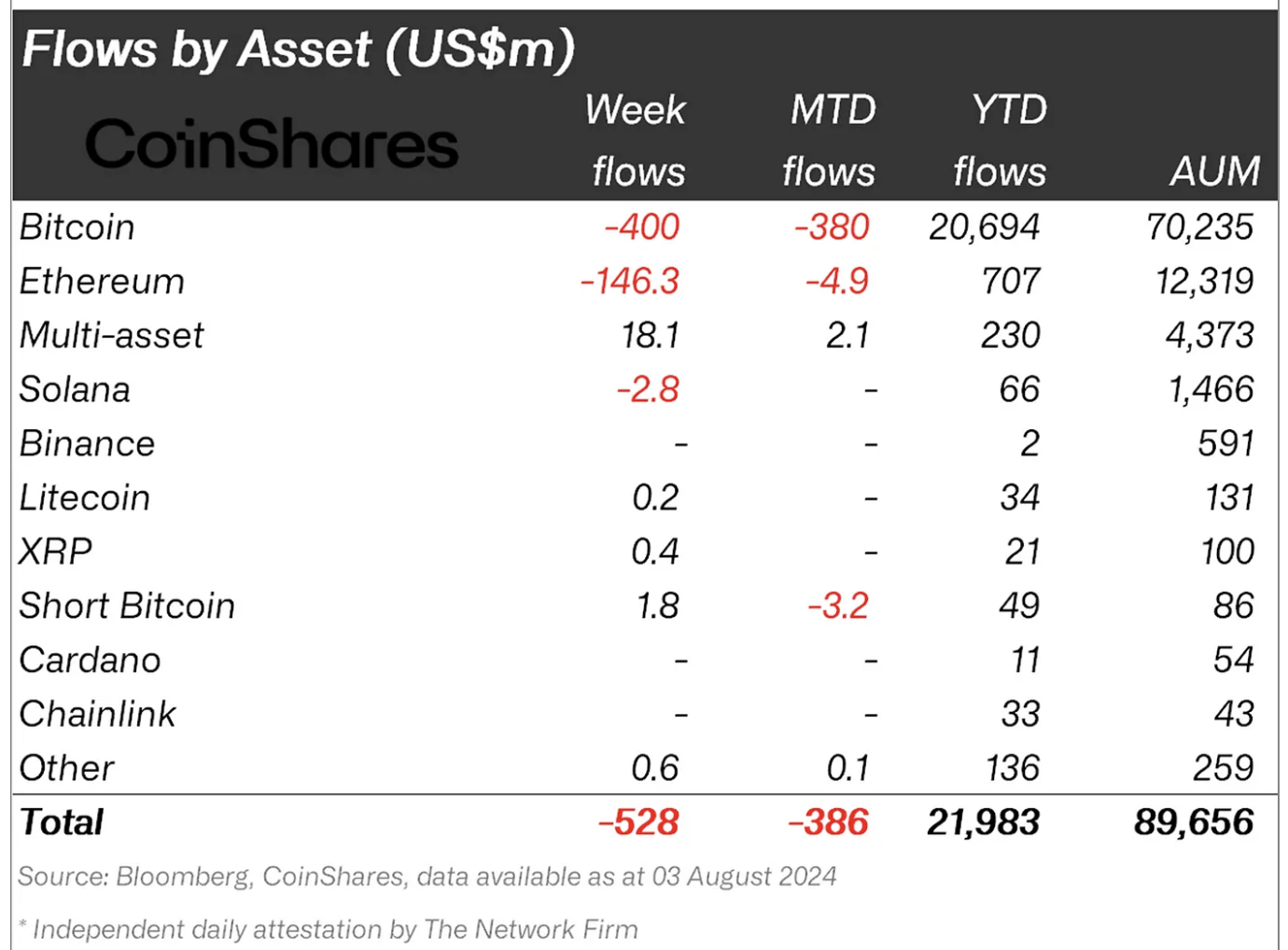

The majority of those withdrawals had been from Bitcoin-based merchandise, which noticed a $400 million exit, ending 5 weeks of consecutive web inflows. Notably, there was a slight uptick in investments into Brief Bitcoin funds, which garnered $1.8 million, marking their first important inflows since June.

Conversely, sure areas displayed resilience and even optimism amidst the downturn. Swiss and Canadian markets bucked the development by registering web inflows of $28 million and $17 million, respectively.

This implies that some traders are viewing the value declines as shopping for alternatives, probably anticipating a market restoration. Ethereum-specific merchandise additionally mirrored this risky development. Globally, Ethereum funding automobiles reported web outflows of $146 million.

The US spot Ethereum ETFs had been significantly affected, with $169.4 million leaving these funds. Nevertheless, this was half of a bigger narrative the place new Ethereum ETFs noticed roughly about $433.6 million in web inflows, solely to be overshadowed by $603 million in web outflows from Grayscale’s ETHE fund.

Behind The Outflows

The entire of $528 million withdrawn from numerous crypto asset funding merchandise final week alone comes on the heels of a number of notable financial pressures.

James Butterfill, the Head of Analysis at CoinShares, significantly attributed this exodus to mounting issues over what they consider to be “a response to fears of a recession within the US, geopolitical issues and consequent broader market liquidations throughout most asset courses.”

This mass withdrawal, based on Butterfill additionally coincided with a pointy market correction that erased roughly $10 billion from the full Alternate Traded Merchandise (ETP) Belongings Underneath Administration (AUM) on the week’s shut.

Associated Studying

No matter this, to this point, each Bitcoin and Ethereum seems to presently be seeing a slight rebound of their respective worth. At the moment, Bitcoin trades at $54,633 greater than 2% from its lowest level of $49,221 seen earlier right this moment.

Ethereum however has additionally reclaimed its value above $2,400 buying and selling at $2,448, on the time of writing. The present buying and selling value marks a rise from its 24-hour low of $2,171.

Featured picture created with DALL-E, Chart from TradingView