An analyst who precisely referred to as Bitcoin’s pre-halving pullback this 12 months is mapping out what he believes could possibly be essentially the most bearish worth path for BTC.

In a video replace, pseudonymous analyst Rekt Capital tells his 86,100 YouTube subscribers that Bitcoin traditionally goes via a four-year cycle primarily based on the halving – when BTC miner rewards get slashed in half.

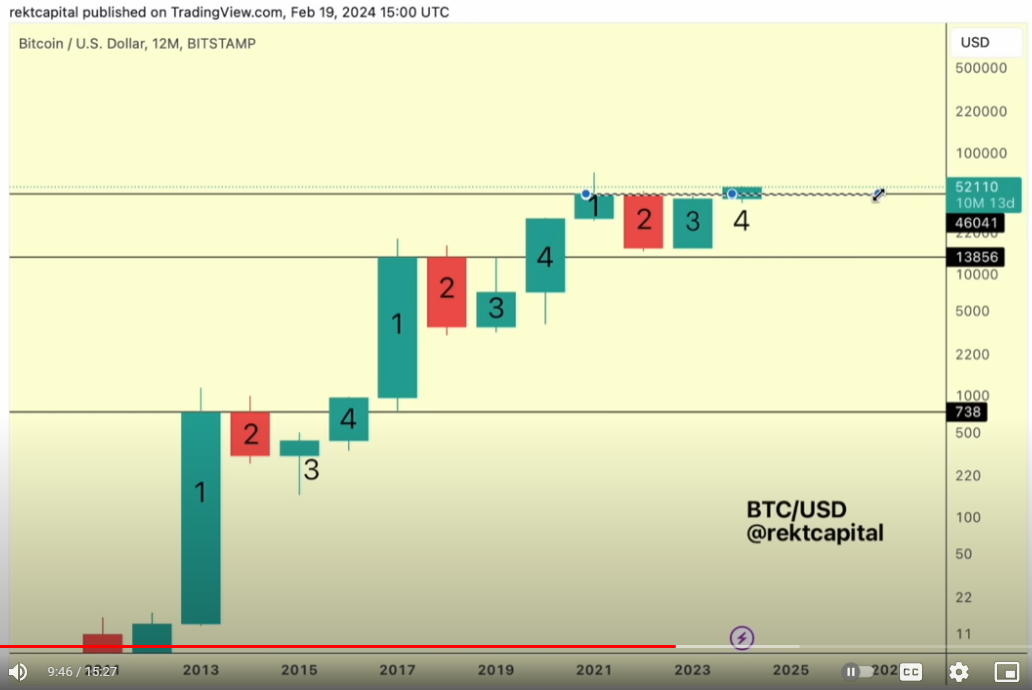

Trying nearer, Rekt says Bitcoin needed to take care of a “three-year resistance” degree in each four-year cycle – relationship again to as early as 2013.

In line with the analyst, Bitcoin needed to breach its three-year resistance at round $700 in 2017 and $13,856 in the course of the 2021 cycle earlier than printing a market prime.

For this cycle, Rekt says the three-year resistance degree stood at $46,000, which BTC has already taken out.

However the dealer notes that Bitcoin could revisit the world to retest it as assist earlier than sparking the following leg up.

“If we take a look at the dynamics of how this transition happens, candle 4 tends to arrange potential retests of this three-year resistance into new assist to propel worth to new all-time highs and past…

If we deal with candle 4 and the halving 12 months candle, there may be at all times scope for the retest in the course of the 12 months of that three-year resistance, from resistance into new assist… And it seems to be like there may be potential scope for a retest of this degree into new assist. That will imply that we have to drop into $46,000 for that retest. That will imply that we have to drop 19% this month.”

Whereas the dealer thinks {that a} drop to BTC $46,000 this month is throughout the realm of risk, he highlights that it’s a low-probability occasion on condition that Bitcoin is in a halving 12 months, and never in a bear market.

At time of writing, Bitcoin is buying and selling at $54,197, up barely on the day.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on X, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses chances are you’ll incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: DALLE3