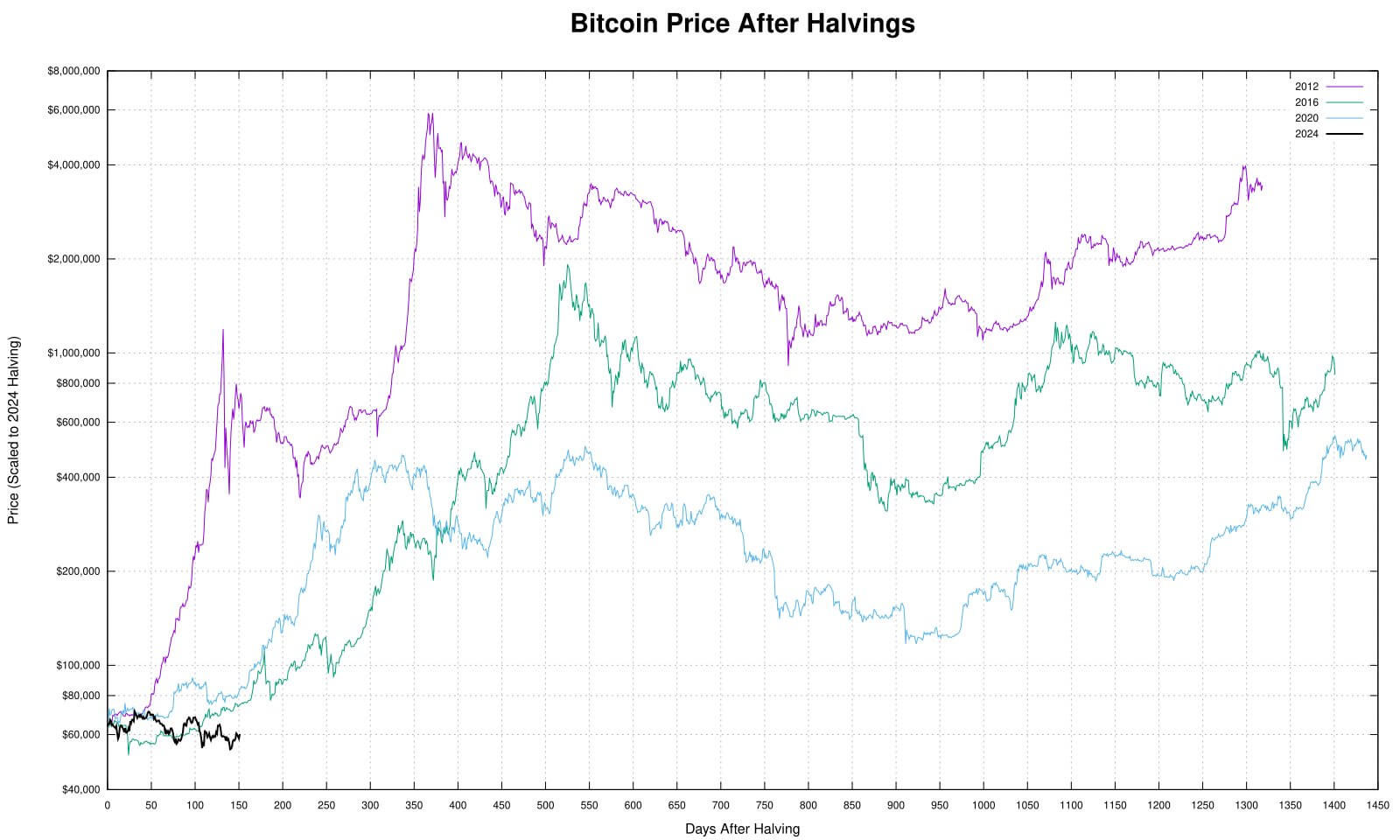

Bitcoin’s value is lagging behind earlier halving cycles, in accordance with latest information from Halving Tracker. At 151 days after the 2024 halving, Bitcoin stands round $59,800, considerably decrease than scaled costs from previous cycles.

Comparative figures present that on the identical level post-halving, the 2012 cycle would scale Bitcoin’s value to $696,090.64, the 2016 cycle to $74,818.97, and the 2020 cycle to $83,883.71. This underperformance has prompted business specialists to precise concern over Bitcoin’s valuation.

Pierre Rochard, VP of Analysis at Riot Platforms, described the present cycle because the worst to this point, suggesting that Bitcoin stays deeply undervalued. His remarks spotlight rising apprehension in regards to the crypto’s market trajectory this cycle.

Historic information signifies that earlier halving cycles skilled extra sturdy value surges throughout the first 151 days. Particularly, the 2012 and 2016 cycles confirmed important development, adopted by sharp pullbacks, reflecting greater volatility in earlier years.

Analysts counsel that whereas Bitcoin’s present efficiency is subdued, there may be potential for future development. The 2020 cycle demonstrated steadier development, and if the 2024 cycle follows an identical sample, a gradual enhance might happen within the coming months.

Exterior components resembling macroeconomic situations, regulatory developments, and investor sentiment will play essential roles in shaping Bitcoin’s value motion. Market maturity might result in decreased volatility in comparison with earlier cycles, depending on macro components resembling price cuts.