Bitcoin is agency at press time. In line with CoinMarketCap knowledge, the world’s most precious coin is altering palms above $63,500, regular on the final day and up a good 7% over the earlier week of buying and selling. Technically, the uptrend stays so long as costs keep above the help zone at round $58,000 and $60,000.

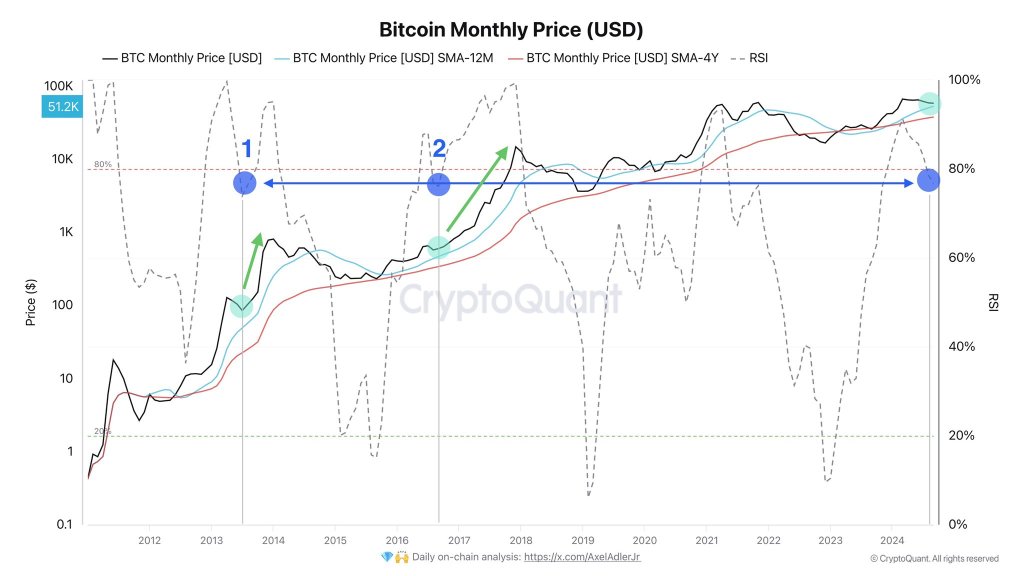

Bitcoin Up 30% From August Lows, RSI Dips Beneath 80% Stage In The Month-to-month Chart

At press time, merchants are upbeat and optimistic, which might type the bottom of one other leg up. To date, because the dip in early August, Bitcoin is up 30% and retesting August highs at round $65,000. Nonetheless, there are excessive expectations that consumers will push costs above this stage, marking one other part for assured bulls, a improvement within the month-to-month chart is value noting.

Associated Studying

Taking to X, the analyst notes that as bulls wrestle to interrupt above $65,000 and print a recent 2-month excessive, the upside momentum appears to be fading. At press time, the Relative Power Index (RSI) within the month-to-month chart is falling, lately breaking beneath the 80%.

Usually, the zone between 80% and 100% marks the higher restrict of the oscillator, denoting that the coin is overvalued or within the overbought territory. With the RSI falling, it may be interpreted that the upside momentum is down, which is a internet adverse for bulls.

Since that is printed out within the month-to-month chart, it might have severe penalties within the each day and decrease time frames. It might trace that cracks are forming, and sellers could also be making ready to push decrease, particularly if bulls fail to interrupt above $65,000.

There Is Hope, BTC Will Doubtless Spike As soon as Costs Race Above $73,000

Bearish as this can be, there may be hope. The analyst observes that although the RSI is beneath the 80% mark, this isn’t the primary time. On a number of events, Bitcoin costs recuperate steadily when the RSI falls to this stage. Nonetheless, this doesn’t occur on a regular basis.

As it is a concern, merchants ought to intently monitor how worth motion pans out within the coming days. A drop towards the $60,000 mark will pour chilly water into the present momentum, signaling the beginning of a attainable correction.

Associated Studying

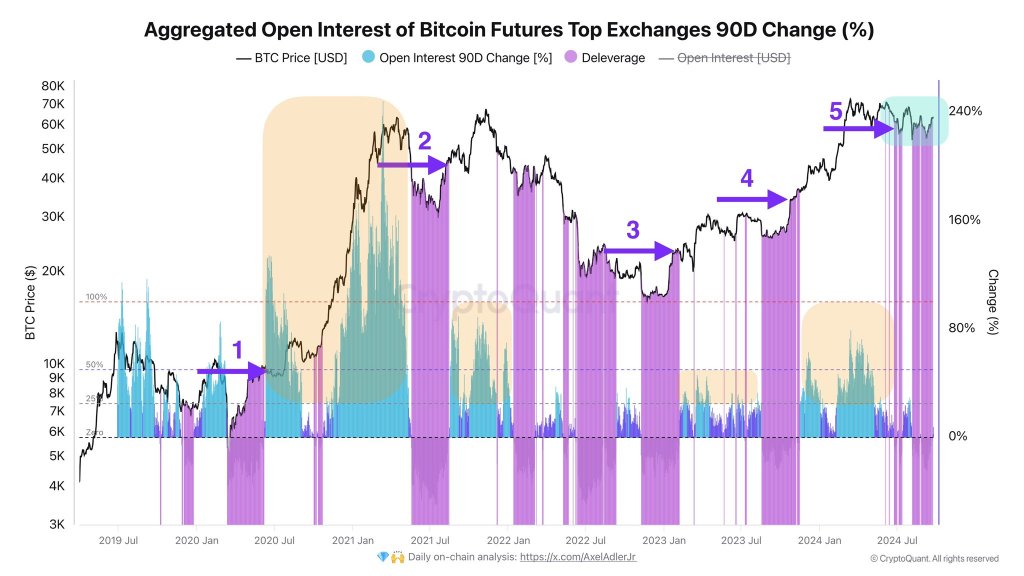

Even with this outlook, the analyst is bullish. In a separate publish, the analyst stated if Bitcoin shakes off weak point and climbs in direction of $73,000, the coin might rally strongly. When this occurs, the analyst expects a brand new inflow of recent liquidity, particularly within the futures market.

The influx, in flip, might drive costs to new ranges, even perhaps above all-time highs. All the identical, earlier than this occurs, BTC wants to assemble momentum. This surge will occur, particularly if there’s a decisive shut above the $65,000 resistance line.

Characteristic picture from DALLE, chart from TradingView