Crypto analyst Astronomer (@astronomer_zero) posits a robust bullish outlook for Bitcoin within the fourth quarter of 2024. Leveraging historic information, Astronomer offers an evaluation by way of X, suggesting an 82% chance of an extremely bullish development based mostly on the efficiency of Bitcoin in September.

The crypto analyst opens his evaluation with an emphasis on the surprising optimistic efficiency of Bitcoin in September. “September is about to shut and to most of the people’s shock, it’s trying prefer it’s going to be inexperienced (by a protracted shot), with the prospect of setting the greenest September in 2024, supporting our breakout thesis we’ve been on for some time now,” he writes.

Delving into the sentiment of the market, Astronomer notes a big disconnect between public notion and precise market positions. “And though we’re not the one ones anymore which can be on the complete bull thesis, information is and stays information. And after thorough inspection, regardless of the speaking/evaluation posts, most will not be positioned but, took revenue too early or will cheer for dips and say they’re a present for the rationale of wanting one,” he defined.

Associated Studying

He additional elaborates on the sentiment inside closed circles: “This statement is not only coming from public posts or Twitter, but additionally from the array of paid teams partaken in to conduct these analyses. Not allowed to share names or particulars, however most teams certainly are lengthy and took revenue early, are searching for an entry, or are brief. So the market’s hand appears to be working.”

82% Likelihood Bitcoin Will Be Bullish

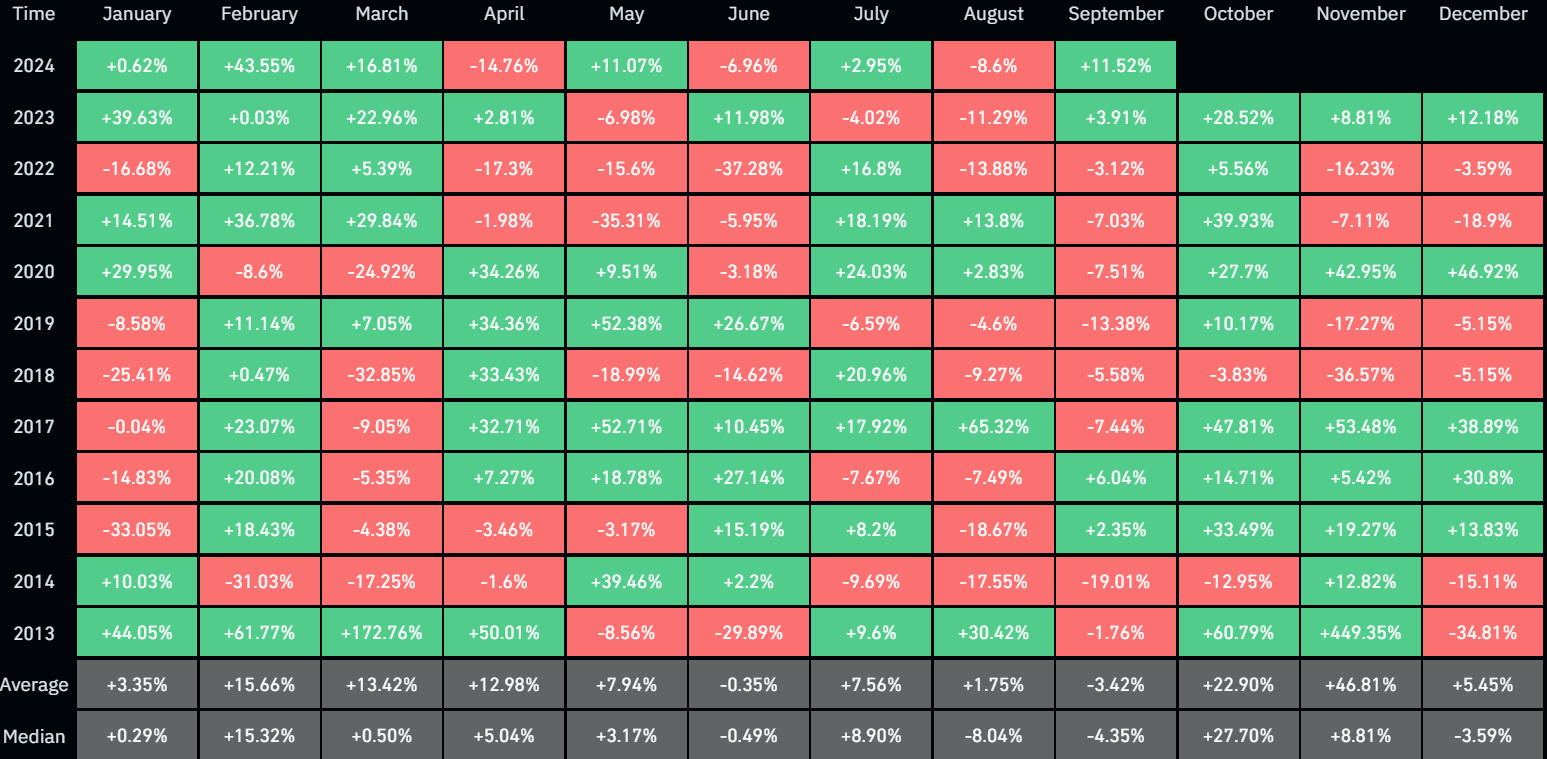

Astronomer’s bullish thesis leans on historic information, significantly the cyclical nature of the Bitcoin worth. “The information evaluation is pretty easy right here: every time BTC had a inexperienced September, it was adopted by at least three inexperienced months after, i.e., a inexperienced October, November, and December. And this has occurred 3/3 instances since BTC inception,” he asserts, signifying a robust seasonal sample.

Nevertheless, he’s fast to mood this with a critique of his methodology, admitting to the potential pitfalls of low information samples: “Now like I mentioned, I’m not the most important fan of seasonality and our evaluation solely has 3 information factors, which provides us solely a 67% confidence to make the declare that the following three months will certainly be inexperienced (low information fallacy). However so as to add significance, by the binary nature of bullish/bearish, there’s additionally exclusivity to the information: if September just isn’t inexperienced, 6 out of 8 instances, This fall has not been inexperienced every month.”

Associated Studying

He refines his thesis additional, “So, by together with the exclusivity, a extra normal and simpler to interpret declare, utilizing extra information factors is that: ‘The path of September has decided the overall path of This fall and if September is inexperienced and never purple, a bullish (not bearish) This fall has adopted 9 out of 11 instances. So if September closes above $59k, there’s an 82% probability This fall shall be bullish’.”

The prediction stirred dialogue throughout the neighborhood. A person @pieceofsheet99 commented skeptically, suggesting the potential for an surprising downturn: “If September turned out to be inexperienced to everybody’s shock, October may change into purple to everybody’s shock as properly.” Astronomer responded, reaffirming his reliance on historic developments, “Certainly, however that’s not what we’ve seen sometimes. So, I personally, as at all times, follow the information.”

Astronomer’s evaluation concludes on a notice of strategic optimism, emphasizing the significance of aligning with market dynamics and historic patterns reasonably than speculative impulses. “How bullish? We are going to see (time is extra essential than worth), but it surely’s not about planning for retirement and making quick cash. It’s about being on the fitting facet of the commerce, time after time after time, having fun with the market stress-free and never having too many regrets via shedding cash or being sidelined (having fun with the method). And this fashion, finally (reasonably quickly), you hit your objectives.”

At press time, BTC traded at $64,622.

Featured picture created with DALL.E, chart from TradingView.com